A New Gold ETF Product Could Be A Better Mousetrap

Plenty of choices when it comes to gold ETFs.

The Perth Mint rolls out its new product.

A competitive expense ratio.

Timing is everything.

Gold continues to shine.

Gold traded in a $331.30 range from 2014 through June 2019. After the June Fed meeting, the price broke out to the upside and was trading at over $1425 per ounce on Friday, July 19.

The Perth Mint opened in 1899 after the discovery of gold deposits in Coolgardie and Kalgoorlie, Australia. The Mint is Australia's official bullion mint and is wholly-owned by the Government of Western Australia. The mint still issues coins that are legal tender in Australia and has been an active participant in the international gold market. The Perth Mint refines 90% of Australia's gold production. Perth Mint gold is acceptable for delivery by the London Bullion Market Association, the COMEX division of the CME, the Shanghai Gold Exchange, the Tokyo Commodities Exchange, and the Dubai Multi Commodities Centre.

In January 2018, the Perth Mint announced it would produce a blockchain-based cryptocurrency backed by its bullion in the next 12 to 19 months. On August 15, 2018, the mint listed a physical gold ETF product (AAAU) that holds 100% of its net assets in gold bullion.

Plenty of choices when it comes to gold ETFs

Aside from AAAU, at least three other products hold 100% of nets assets in physical gold bullion and replicate the price action in the yellow metal. The most liquid is the SPDR Gold Shares product (GLD) that has been around since 2004. GLD is the most successful commodity ETF with $35.96 billion in net assets. GLD trades an average of over 8.3 million shares each day. Each share represents one-tenth of an ounce of gold.

The iShares Gold Trust (IAU) has net assets of $13.35 billion and trades almost 17 million shares each day as it reflects the price action of 1/100 of an ounce of the yellow metal. The Granite Shares Gold Trust (BAR) has $545.52 million in net assets, trades 192,455 shares on average and also represents 1/100 of an ounce of gold.

Other gold ETFs backed with the bullion include SGOL, GLDM, and CEF.

The gold ETF/ETN space also has a myriad of bullish and bearish products that offer leveraged and unleveraged returns based on the price action in the metal and gold mining shares on both the up and the downside. There are many choices for market participants when it comes to the precious metal.

The Perth Mint rolls out its new product

Last year, the Perth Mint rolled out its version of a physical gold ETF product, AAAU. The fund summary for AAAU states:

The investment seeks to provide investors with an opportunity to invest in gold through shares, and have the gold securely stored by the Custodial Sponsor; reflecting the performance of the price of gold less the expenses of the trust's operations is the secondary consideration. The trust holds London Bars and Physical Gold of other specifications without numismatic value. It receives gold deposited by Authorized Participants in exchange for the creation of Baskets and delivers gold to Authorized Participants in exchange for Baskets surrendered to it for redemption.

AAAU holds 100% of its assets in bullion, and each share reflects the price action in 1/100 of an ounce of gold. The Perth Mint product has net assets of $132.94 million and trades an average of 44,834 shares each day.

Last week, the Perth Mint traveled to the NYSE to promise its AAAU product and caught the attention of market participants with a one-ton gold coin.

Source: Yahoo/ETF Trends.com

The coin is one of the biggest in history. The Perth Mint has entered the competitive ETF market for gold. It is looking to attract assets by undercutting the fees of most of the other products available in the market today and offering a geopolitical twist.

A competitive expense ratio

AAAU charges an expense ratio of just 0.18%. The only less expensive products on the market are the Granite Shares gold Trust at 0.17% and the Aberdeen Standard Physical Swiss Gold Shares ETF (SGOL) at 0.17%. The heavyweights when it comes to net assets are GLD and IAU, which carry expense ratios of 0.40% and 0.25% respectively. CEF does not list its expense ratio.

Central banks are the world's largest holders of gold, and many manage the geopolitical risk of their holdings by keeping gold in various locations around the globe. London, New York, Zurich, and Australia are some of the most popular storage locations for the yellow metal. The Perth Mint offers a product that holds gold in its vaults in Western Australia. According to the website:

AAAU shares are backed by allocated gold secured within The Perth Mint's network of central bank grade vaults in Western Australia. The Perth Mint may, on rare occasions, store some gold in other highly secure vaults. All the gold held on behalf of AAAU is guaranteed by the Government of Western Australia.

Timing is everything

The recent marketing trip by the Perth Mint to ring the closing bell on the NYSE came at a perfect time to raise awareness about its product. In June, the price of gold broke out to the upside.

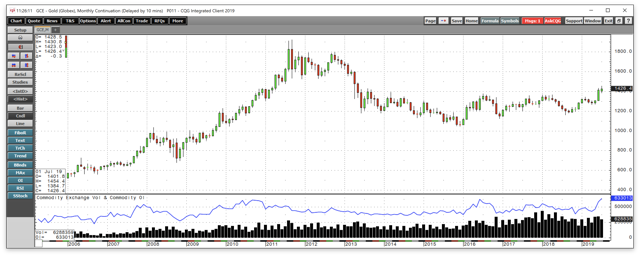

Source: CQG

As the monthly chart highlights, at over $1425 per ounce, the price of gold is at its highest level since 2014. Open interest, the total number of open long and short positions on the COMEX futures market at over 630,000 contracts is close to a record level. The inflow of funds into gold-related ETF and ETN products and gold mining shares is rising. At the same time, the prospects for the yellow metal are bullish with high-profile and legendary figures such as Paul Tudor Jones and Ray Dalio extolling the virtues of a long position in the precious metal. Central banks around the world continue to be net buyers of gold to add to their reserves.

Timing is everything in markets. If gold's recent break to the upside is a sign that the next leg in the bull market is underway, AAAU could begin to attract lots of interest given its potential to diversify some geopolitical risk away from Europe and the US to Australia.

Gold continues to shine

One of the most compelling arguments for the bull market in gold is its price performance in all of the leading world currencies. Gold broke to the upside in US dollar terms in June.

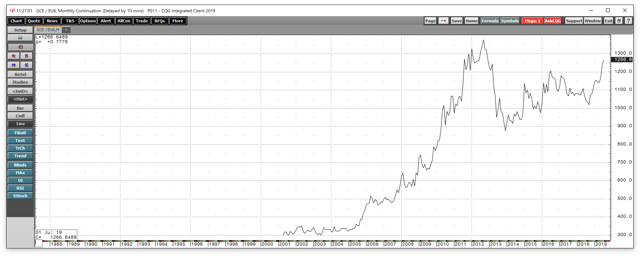

Source: CQG

In euro currency terms, gold has been in a bull market since the early 2000s and has made higher lows and higher highs since 2013.

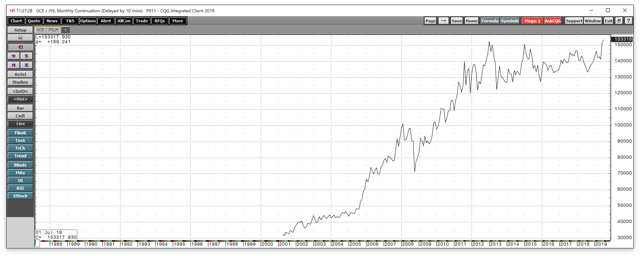

Source: CQG

The monthly chart illustrates the gold in Japanese yen terms just traded at a new all-time peak.

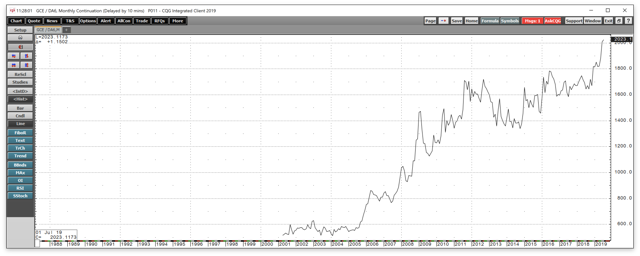

Source: CQG

In Australian dollar terms, gold is also at a record level as it is in many other world currencies.

The prospects for further gains in the price of gold in all currencies seems excellent. Since central banks around the world diversify their gold holdings in various locations, it could be the perfect time to consider socking away some individual holdings in the AAAU product. I continue to believe that the price of gold is heading higher and the Perth Mint offers what could be a better and more economical mousetrap.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. I just reworked the report to make it very actionable!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.The author is long gold

Follow Andrew Hecht and get email alerts