A Popularity Reversal Is Needed For Gold

Gold rally has attracted far too many bulls for comfort.

Gold long positions have dramatically risen while shorts have declined.

A pullback or "pause that refreshes" is needed to cool the enthusiasm.

Gold has stolen the investment spotlight after a stellar rally which took the continuous contract price to a new 12-month high last week. Consequently, gold is receiving the front-page headline treatment in the financial press for the first time in months. But will gold's newfound publicity benefit the yellow metal price in the near term? In today's report, I'll explain that it needs a chance to cool off from its recent runaway move before moving higher. The surging dollar index, moreover, will likely keep a lid on gold prices in the immediate term while allowing some of the metal's popularity to dwindle. This will help improve gold's sentiment profile by taking gold out of the spotlight while weeding out weak-handed investors, in turn paving the way for higher prices later this summer.

Gold's reemergence as a top-performing asset amidst a background of economic uncertainty happened suddenly. A combination of factors, ranging from global trade fears to geopolitical risks, helped propel gold prices to yearly highs after a 3-month slump. The rapid nature of gold's reversal illustrates two important points, or potential risks, that investors should keep in mind right now. The first point is that while gold's "fear factor" remains strong enough to support prices around recent levels, fear is the most ephemeral of emotions and can disappear just as quickly as it appears.

The second point to remember is that while gold has recently experienced a surge in its popularity among retail investors, this popularity can be a double-edged sword. While increased money flows into gold tend to boost the metal's intermediate-term (3-6 month) price trend, too much investor optimism can also create an adverse price reaction for gold in the immediate-term (1- 4 week) time frame. I'm referring here to the well known contrarian principle which states that when too many participants crowd into the same trading position, the crowd's bullish expectations are frequently disappointed - at least temporarily.

In view of the dramatic increase in favorable publicity that the yellow metal has garnered in the last two weeks, it's not unreasonable to assume that gold faces a contrarian danger. With investor sentiment becoming very optimistic right now, gold is increasingly vulnerable to a pullback. For this reason, gold investors should consider holding off on making any additional purchases in the metal until the crowd's ardor for gold cools off.

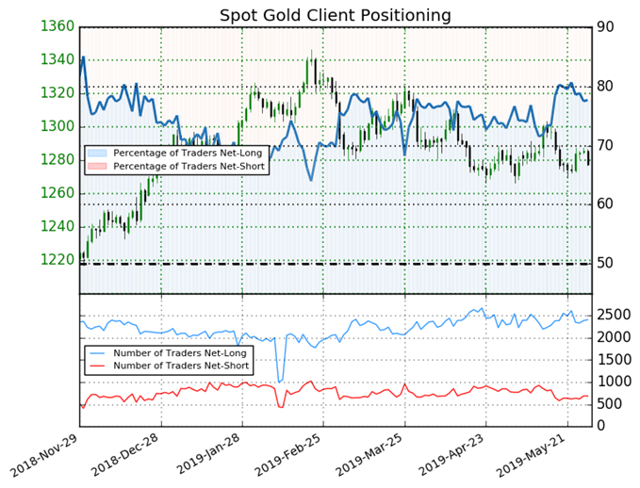

An example of how popular gold has become lately can be seen in the latest IG client positioning report from DailyFX. The following graph shows that 78% of retail traders are net long gold, with the ratio of traders long-to-short last seen at 3.5-to-1. This suggests that retail traders are becoming overexposed to the metal on a short-term basis. Accordingly, a brief pullback or else a "pause that refreshes" may be needed to wring some of this excess optimism from the market. This would have the beneficial impact of improving gold's short interest ratio, thereby making it easier for gold to kick off another sustained short-covering rally. Put another way, we should ideally see an increase in gold bears and a big decrease in gold bulls.

Source: DailyFX

Source: DailyFX

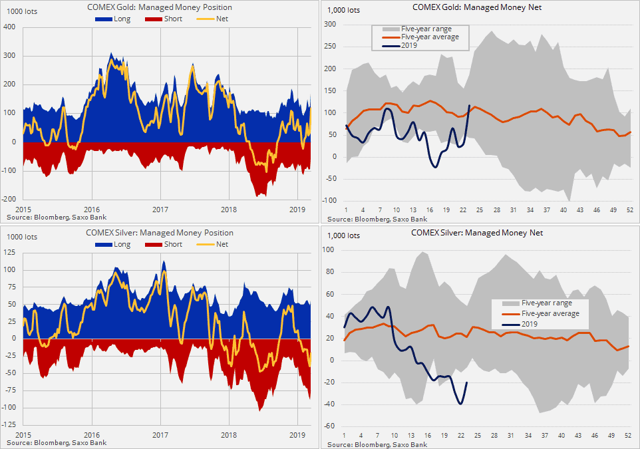

Further evidence that gold remains vulnerable to profit-taking in the wake of its rising popularity is seen in the latest Commitments of Traders (COT) reports published by Saxo Bank. According to Saxo Bank's Ole Hansen, "Hedge funds increased bets on rising commodity prices across 24 major futures contracts by 57% to 401k lots during the week to June 4". This includes an increase in net long positions for gold by a record 85,000 lots to 118,000 lots, the highest amount in 14-months. This should make contrarians very nervous in the near term as there are seemingly too many long positions for comfort in gold right now.

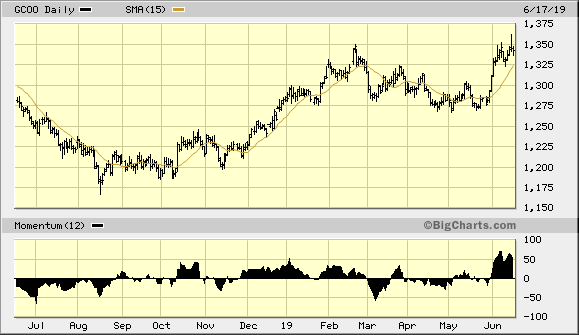

Yet despite the excess bullishness in the market, gold still has a couple of major factors in its favor. One is the aforementioned "fear factor" which will almost certainly continue in the coming weeks as the U.S.-China trade war is nowhere near a resolution. What's more, investors and economists are becoming increasingly worried about the prospect of a trade-related U.S. economic recession by later this year. This built-in fear factor alone should be sufficient to keep gold prices above the recent low of $1,275 (see chart below).

Source: BigCharts

Yet another positive factor which should support gold prices in the coming weeks is the revival of geopolitical risk in the Middle East. Last week's attack on two oil tankers near the Strait of Hormuz was sufficient to put a short-term bottom on the crude oil price, and it also inspired gold's latest move to yearly highs. This event also illustrates that the gold market remains sensitive to military threats and other types of unsettling news headlines.

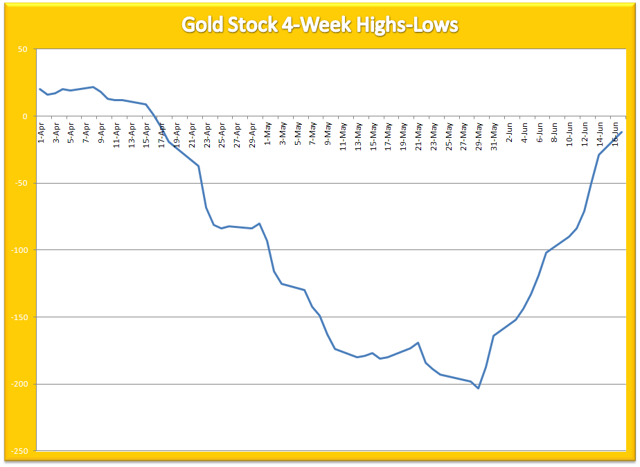

Let's now turn our attention to the gold mining stocks. While the companies which produce the metal obviously face some degree of risk in the near-term from a potential gold price pullback, the overall path of least resistance for the gold stocks remains up. That's the message of the 4-week rate of change (momentum) indicator of the new highs and lows for the 50 most actively traded gold stocks. As can be seen here, this indicator continues its impressively rising path as of Jun. 17. This provides a strong technical confirmation that the near-term demand for gold mining and exploration stocks is still strong enough to push prices higher despite the risks mentioned in this report.

Source: NYSE

As long as the above indicator is in a rising trend, I recommend that traders maintain long positions in outperforming individual gold stocks and gold mining ETFs. My favorite vehicle for participating in a gold stock rally is the VanEck Vectors Gold Miners ETF.

In conclusion, the gold price is currently vulnerable to a pullback in the immediate term due to a sharp spike in buying interest and a sharp decline in short interest. Gold must contend with the latest strengthening of the U.S. dollar, and this could put a short-term lid on prices until gold sentiment cools off. Meanwhile, gold mining shares still enjoy a strong tailwind in the form of rising internal momentum, which should allow the gold miners to continue rising in the immediate term.

On a strategic note, I'm currently long the VanEck Vectors Gold Miners ETF (GDX). After the recent rally to the March high in GDX, I recommend raising the stop-loss on this trading position to slightly under the 22.00 level on an intraday basis. This is where the technically significant 15-day moving average can be seen in the daily chart above. The latest weekly close under the 50-day moving average in the U.S. dollar index should help support the intermediate-term outlook for gold and gold stocks. Investors can also maintain longer-term investment positions in gold and gold ETFs.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts