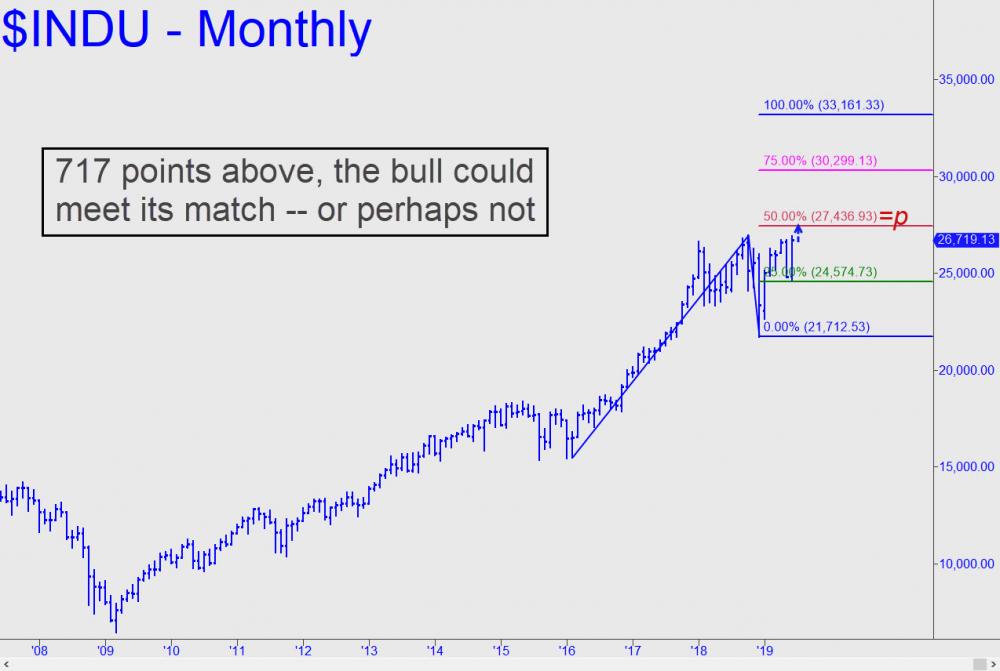

| Here are three numbers to jot down to get an accurate and potentially useful 'read' on the aging bull market: 27,436, 28,738 and 33,161. These are 'Hidden Pivot' resistance targets for the Dow Industrials, and any one of them could stop the bull in its tracks. Each is a good place to attempt getting short with a tight stop-loss, but if the stop gets pulped, assume that the next-higher target is in play. And if the Indoos should hit 29,000 (or so) and then plummet to the green line (24,5740), treat that not as a sign that the long-awaited bear has finally arrived, but as a great buying opportunity. Above 33,161, I have no additional targets to offer. That would be the bull's final charge, as far as I'm concerned, and the best opportunity to get short that we might see in a very long while.Why should you trust these numbers? For one, if you've followed Rick's Picks for any length of time, you'll know that the big-picture forecasts for T-Bonds, gold, the U.S. dollar, interest rates, inflation (or lack of, actually) and major stock averages have gotten it mostly right. (But not always, as those of you still waiting for crude to hit $28 a barrel would be ready to attest.) Another reason is that these sunny numbers come not from a hopped up permabull who thinks that decade-old rally will go on forever; rather, they are from someone who could give you a dozen good reasons why the Dow should be trading at 10,000 now, not heading toward 30,000 as would appear to be the case. |

|

|