A Short-Term Test Of Gold's Currency Component

Latest dollar rally threatens to undermine gold's currency component.

A temporary pullback in the gold price is overdue and probably needed.

Record central bank demand, however, will keep gold's recovery intact.

The last few months have been extremely rewarding for gold investors. The gold price gained 10% from its August 2018 lows and with hardly a pullback along the way. After this impressive performance, however, it's only natural to expect gold to give back at least a small portion of its recent gains. The latest rally in the U.S. dollar index served as a vivid reminder of this, and in light of this, we'll discuss the prospects for a gold price pullback in today's report.

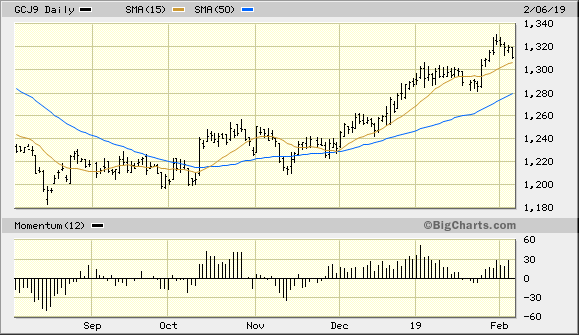

The gold price was down 0.66% on Wednesday, which wasn't bad considering that the U.S. dollar rallied and tested its benchmark 50-day moving average. The latest test of this widely watched benchmark trend line made many gold traders nervous, and rightly so, given gold's sensitivity to the dollar's dominant trend. While the April gold futures price (below) remains above both its 50-day and 15-day moving averages, which confirms the immediate-term (1-4 week) trend is still up, gold could come under increasing pressure in the coming days.

Source: BigCharts

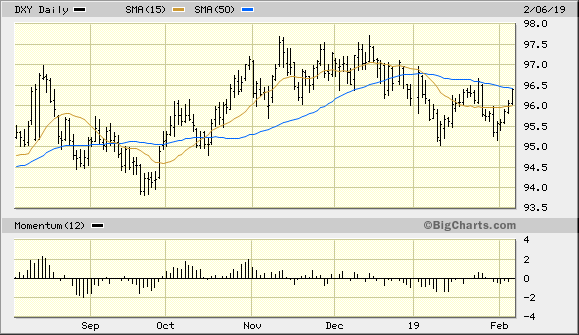

The dollar rose to a two-week high against a basket of currencies on Wednesday, which served as a "heads-up" that the greenback's neutral trend of the last three months may be coming to an end. Shown here is the U.S. dollar index (DXY) in relation to its 15-day and 50-day moving averages. As you can see here, DXY touched the technically important 50-day MA on Wednesday and came just shy of closing above it. I've emphasized in recent reports that if the dollar index finishes above the 50-day MA on a weekly closing basis, the dollar bulls will enjoy an advantage, and gold will likely come under pressure. As of Feb. 6, the dollar's trend remains neutral, but the next couple of days will serve as a critical test of its intermediate-term (3-9 month) trend, which the 50-day MA signifies.

Source: BigCharts

The dollar's latest attempt at an upside breakout can't be underestimated, for if the dollar continues to strengthen it will undermine gold's all-important currency component. The dollar's softness since December is what allowed the gold price to rally unimpeded and outperform other major assets, including equities, during the last two months. Even with other factors in gold's favor - including geopolitical uncertainty and ETF demand - a rising dollar index will serve as a serious obstacle for gold and would likely prevent any additional short-term gains.

If we do see continued strength in the dollar in the next few days, it won't necessarily end gold's intermediate-term recovery. But it would almost certainly result in a long-overdue pullback in the yellow metal's price, and likely a test of gold's important 50-day moving average. However, as long as the gold price remains above the rising 50-day MA on a weekly closing basis (see above chart), its intermediate-term recovery trend should still be considered to be technically intact.

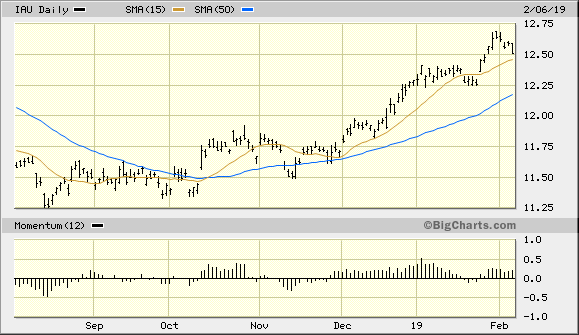

Turning our attention to the iShares Gold Trust (IAU), the gold trading vehicle used for this report, the ETF is still confirming that its immediate-term trend is up despite the recent dollar rally. IAU is above both its rising 15-day and 50-day trend lines as of Feb. 6 despite the recent erosion of gold's fear factor. As we've discussed in recent reports, gold investment demand remains strong in both the U.S. and Europe, which is helping to keep IAU's interim upward trend intact.

Also, the fact that investors have switched from higher-cost gold ETFs like the SPDR Gold Trust (GLD) and into lower-cost ETFs like IAU in recent months has been a positive factor for the latter ETF. I, therefore, continue to recommend a stop-loss slightly under the $12.35 level on our open trading position in IAU. I'll maintain my immediate-term bullish posture on IAU as long as this level remains inviolate.

Source: BigCharts

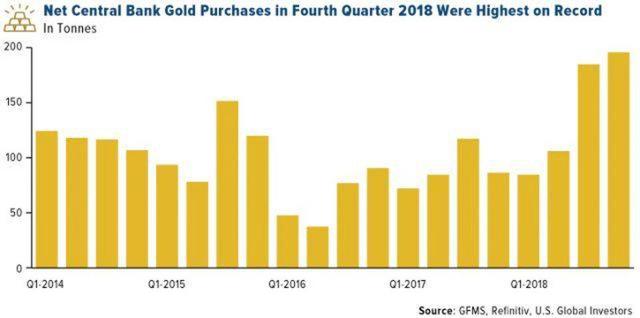

Serving as a counterweight to the recent rally attempt in the dollar, however, is strong central bank demand for the yellow metal. According to the World Gold Council, central banks in 2018 added 651.5 tons, worth $27.7 billion, to their bullion holdings. That's the highest level on record since 1971 when President Nixon officially closed the gold window. This massive demand among central banks will help bolster the gold price and keep its multi-month recovery intact despite the short-term headwinds of a rallying dollar index.

Source: GFMS, Refinitiv, U.S. Global Investors

Source: GFMS, Refinitiv, U.S. Global Investors

In summary, gold investors should be closely monitoring the U.S. dollar index in the coming days. A weekly close in the DXY above the 50-day moving average would serve as an obstacle for the gold price by temporarily undermining its currency components. It also would likely result in a pullback in the gold price and possibly a test of its own 50-day MA. However, gold investment demand from individual and institutional investors, as well as central bank demand, should keep gold's intermediate-term recovery intact. Based on the technical and fundamental weight of evidence, investors are, therefore, justified in maintaining a bullish posture toward the metal for now.

Disclosure: I am/we are long IAU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts