A Surging Tech Stock With Cheap Options

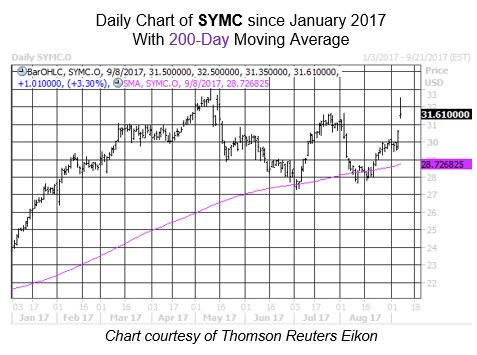

Symantec Corporation (SYMC) is up 32% year-to-date and 29% year-over-year. Following a recent bounce from its 200-day moving average, SYMC is now trading above the $29.50 area -- which roughly coincides with a double of its early 2016 lows -- and could have room to run higher from here.

Analysts remain skeptical, however. Of the 20 brokerages covering SYMC, 13 rate the stock a "hold" or "sell." This means that there is plenty of room for upgrades, which could provide tailwinds for SYMC.

Now is an opportune time to buy premium on SYMC options. This is according to its Schaeffer's Volatility Index (SVI) of 24%, which ranks higher than just 16% of all other readings from the past year. This implies that near-term options are pricing in relatively low volatility expectations.

Furthermore, the stock's Schaeffer's Volatility Scorecard (SVS) stands at 75, which means SYMC has a strong tendency to make bigger moves on the charts than its options have priced in.

Subscribers to Schaeffer's Weekend Trader Series options recommendation service received this SYMC commentary on Sunday night, along with a detailed options trade recommendation -- including complete entry and exit parameters. Learn more about why Weekend Trader is one of our most popular options trading services.