A Trade War Or A Real War Is Bullish For Gold

Trade tensions ramp up and cool down - tariffs are historically bearish for the dollar.

The Middle East is about ready to explode.

A trade war or outright war could curb the Fed's enthusiasm.

Gold is close to a breakout level.

Better opportunities in the yellow metal's precious cousins?

The price of gold traded to a low in December 2015 at $1046.20 per ounce, and since then the yellow metal has been making higher lows. In July 2016, the shock of the Brexit referendum and uncertainty surrounding other European elections in light of a rejection of the EU sent gold to its highest price since 2014 at $1377.50 per ounce.

Recently, the precious metal has been flirting with those highs and has found a base around the $1300 level. Gold wears many hats; it is a metal or a commodity, and it is the longest-standing world currency. Long before the dollar, euro, yen, yuan, or any other foreign exchange instruments became legal tender, gold was a means of exchange. Every ounce of gold ever produced in the history of the world still exists in above ground stocks or individual holdings. Gold ownership only lasts a lifetime, while the metal continues to exist long after we are gone from this world.

The yellow metal has come a long way from the turn of the century when the price was below $300 per ounce. Gold has not traded below $1000 since 2009, and it has been above $680 per ounce for over a decade. These days, many bullish factors could push the price of the precious metal back over the $1400 level and launch it on an attack of the all-time nominal high of $1920.70 from 2011.

Trade tensions ramp up and cool down - tariffs are historically bearish for the dollar

One of the most significant issues facing markets over recent weeks has been protectionist policies announced by the Trump Administration. On the campaign trail, the President pledged to level the playing field when it comes to foreign trade. He blamed past administrations for multilateral trade deals that put U.S. workers and products last when it comes to international trade and promised to renegotiate "better deals" for American interests. In March, the administration rolled out 10% and 25% respective tariffs on aluminum and steel and announced $60 billion in protectionist measures aimed at China. When the Chinese threatened to retaliate, President Trump upped the ante saying he would add an additional $100 billion in tariffs on the world's most populous nation. After trade rhetoric reached a frenzy at the beginning of this month, China's president Xi made a conciliatory speech in Beijing which amounted to an olive branch, which the U.S. leader accepted as a sign that negotiations would eventually reach an accommodation and deal on trade.

Tariffs have been historically bearish for the U.S. dollar, and a weakening greenback tends to be supportive for the price of gold. With the tariffs issue ramping up and cooling down, bilateral trade negotiations could keep the issue on the table for months into the future before any agreements or deals take shape. The dollar has been in a bearish trend since early 2017, and uncertainty over the future of international trade agreements and the potential for a trade war and tariffs could weigh on the U.S. currency. Given the historical relationship between the dollar and gold, the current environment when it comes to the trade issue is likely to provide support for gold which is the world's oldest instrument that is a means of exchange.

The Middle East is about ready to explode

Another factor that underpins the yellow metal these days in the political landscape in the Middle East. The recent chemical attacks in Syria have caused a growing rift between the U.S. and the Assad regime's allies, Russia and Iran. It is likely that President Trump will punish the Syrian government with military action, which would cause a further deterioration of relations with the Putin government to a new post-Cold War low. At the same time, the U.S. Administration is in the process of deciding on if it will recertify the Iran nuclear nonproliferation agreement that was negotiated by the Obama administration and other governments around the world. The recent replacement of the Secretary of State and National Security Director in Washington with Mike Pompeo and former-Ambassador John Bolton has put two hardliners by the President's side and makes recertification unlikely. Abandoning the Iran deal will likely increase tensions in the region.

Meanwhile, a proxy war in Yemen between the Kingdom of Saudi Arabia and Iran continues to rage. This week, Iranian-backed rebels fired missiles into Saudi sovereign territory once again. At the same time, the blockade of Qatar by the Saudis and their allies in the Gulf States have added to the potential of hostilities in the region. We have seen the price of crude oil rise to a new high for 2018 this week as the Middle East is home to more than half the world's reserves of the energy commodity. The price action in the oil market is a sign of the growing tensions in the region. An escalation of violence or outright war in the region would increase fear and uncertainty around the world and gold is likely to be a beneficiary of the geopolitical landscape in the area that has been the most turbulent region of the world for many decades.

A trade war or outright war could curb the Fed's enthusiasm

A trade war between the U.S. and China would likely weigh on the U.S. economy. Retaliation over tariffs by China could hit the U.S, farm belt directly in their pocketbook as exports to China will slow over retaliatory and reciprocal tariffs. If trade issues deteriorate and no agreement results over coming months, economic growth in the U.S. could become a victim of a trade war. The U.S. central bank has been raising interest rates since December 2015, but the Fed is highly sensitive to economic data on a month-to-month basis. A decline in economic growth could slow the process of increasing the Fed Funds rate which could mean both a lower dollar and a rising gold price.

When it comes to a war in the Middle East, any hostilities are likely to put the two most powerful military nations on opposite sides. The fear and uncertainty that would result from a conflict that pits the U.S. against Russia could be a highly bullish factor for gold as investors and traders. It is likely that market participants will head for quality assets and gold has a history of performing best during periods of geopolitical turmoil.

Gold is close to a breakout level

On a technical basis, gold has been flirting with the July 2016 high and level of critical resistance in 2018.

Source: CQG

As the daily chart of June COMEX gold futures highlights, the yellow metal has traded in a range from around $1300 to $1375.50 so far in 2018. June futures were trading at the $1348 level on April 13, close to the middle of the trading range and most technical metrics were in neutral territory.

Open interest is the total number of open long and short positions in a futures market. When the metric rises with price, it is typically a bullish technical sign. At the same time, when it falls with the price of a commodity, it is not a technical validation of an emerging bearish trend. The daily chart of gold futures shows that the metric has risen during times of price appreciation and declined during corrective periods since the start of 2018. The moves in open interest over the past three and one-half months could be telling us that gold is consolidating and preparing for a challenge of critical technical resistance that is currently at the July 2016 peak at $1377.50 per ounce. Above that level, we could see a move that carries gold above $1400 per ounce and perhaps higher.

Better opportunities in the yellow metal's precious cousins?

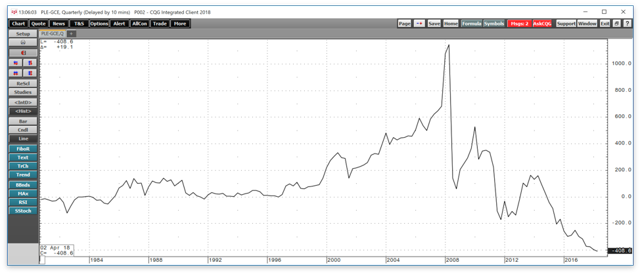

Gold is looking good these days, and it may be a matter of time before the yellow metal breaks out to the upside. Meanwhile, two other precious metals in the sector have been lagging the price action in gold as the prices of both platinum and silver are cheap compared to their precious cousin.  Source: CQG

Source: CQG

The quarterly chart of the price of platinum minus the price of gold futures dating back to the early 1980's shows that the long-term historical average for the price relationship is a premium for platinum over gold. Platinum's nickname is "rich man's gold" as has spent the majority of the time over decades trading at a higher price than the yellow metal. Platinum is a rarer metal, as each year there is only around 250 tons of production compared to 2,800 ton of gold output. Platinum has a higher production cost because it tends to come from mines that are deeper in the crust of the earth than gold producing mines. Finally, on a per ounce produced basis, there are more industrial applications for platinum than gold. However, since 2014, platinum has traded at an ever-increasing discount to the yellow metal, and over recent weeks, gold's premium over the more-precious metal has risen to over $400 per ounce for the first time in modern history. Either platinum is too cheap at its current price compared to gold, or gold is too expensive. Given the technical and fundamental position of the gold market these days, it appears that platinum is inexpensive and could offer lots of opportunities if the yellow metal were to break to the upside.

Source: Barchart

As the chart dating back to 2010 illustrates, the platinum ETF product (NYSEARCA:PPLT) is trading at close to its lowest level in eight years. PPLT has traded in a range from $78.30 to $189.20 per share since 2010. At $88.54 on April 13 it is close to its lows, while gold is threatening to break to the upside.

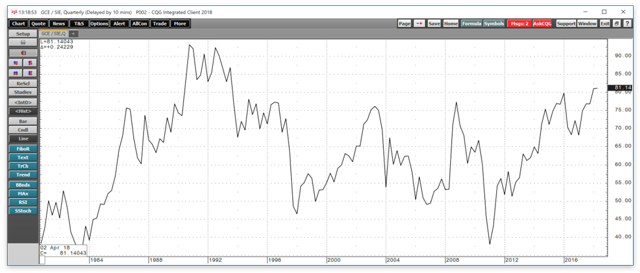

Silver is another precious metal that is trading at an inexpensive level when compared to gold these days.

Source: CQG

The quarterly chart of the silver-gold ratio shows that the median level for the price relationship between silver and gold is around the 55:1 level or 55 ounces of silver value in each ounce of gold value. When the ratio is higher than the median level, silver is cheap compared to gold on a historical basis. At 81:1 on April 13, the ratio is telling us that either silver is too cheap, or gold is too expensive.

Source: Barchart

The chart of the triple leveraged silver ETN instrument (NASDAQ:USLV) was trading at $10.41 per share on April 13. If gold is on the verge of challenging its critical level of technical resistance, and silver decides to go along for a bullish ride, USLV could offer explosive potential over coming weeks.

A trade war or real war could push the price of gold above its July 2016 and set it on a course for $1400 or much higher. A bullish break to the upside in the yellow metal would likely take platinum and silver appreciably higher. Platinum is an industrial and a precious metal, and a recovery rally in the metal is long overdue. When it comes to silver, the most volatile metal in the precious metals sector has a habit of moving the most on a percentage basis and could be the best performing metal if a bull market in the precious metals sector takes hold.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. More than 120 subscribers are deriving real value from the Hecht Commodity Report.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Follow Andrew Hecht and get email alerts