A Weaker Dollar Would Revitalize Gold

Gold's safety bid has weakened after trade war has cooled off.

The metal's currency component is poised to strengthen, however.

Crude oil rally suggests inflation-sensitive commodities are in demand.

Although gold has lately lost its safety bid, that doesn't mean its dominant intermediate-term (3-6 month) bull market is in danger of dying. As I'll explain here, the prospects for continued gold price strength heading into the fourth quarter are good based on the likelihood of a weaker U.S. dollar.

Gold and gold mining stocks have experienced a September setback thanks to profit-taking and a decline in risk aversion among retail and institutional investors. A rebound in U.S. and global equity prices this month has underscored the willingness of investors to embrace risk now that trade war rhetoric between the world's two biggest economies has cooled down.

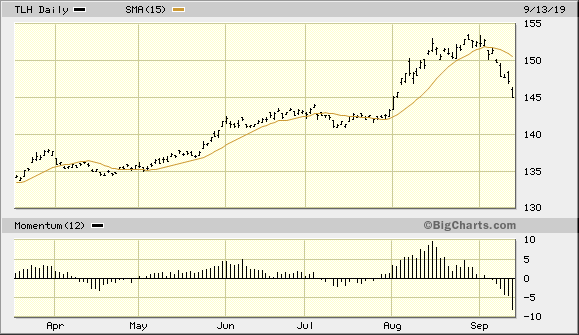

While investors have snapped up bargains in the stock market in recent weeks, there has been a concomitant move out of safety-oriented investment vehicles, particularly U.S. Treasury bonds. The sharp decline in T-bond prices in recent days is emphatic proof that investor confidence in the global economic outlook has improved. The graph of the iShares 10-20 Year Treasury Bond ETF (TLH) illustrates the extent to which investors have fled from the safe havens.

Source: BigCharts

Source: BigCharts

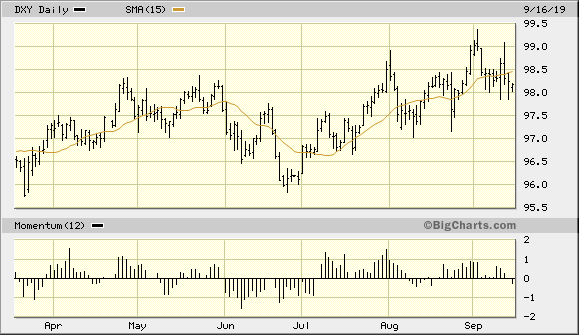

The bond market plunge is only half the story, however. A bigger part of the picture is the U.S. dollar index (DXY). And while the dollar has also seen a measure of weakness in the first half of September, a steeper decline in the dollar is needed for gold to regain its luster on a short-term basis. Although DXY has established a series of lower highs in the last two weeks and is below its 15-day moving average as of mid-month, a move below the 97.60 level is required to confirm that the dollar's intermediate-term rising trend has been decisively broken. By closing under the 97.60 level (the nearest pivotal low from Aug. 23), the dollar will establish a series of lower lows which, along with the recently establish lower highs, will form the basis of a descending trend.

Source: BigCharts

Source: BigCharts

A confirmed downward trend in the dollar index would in turn serve as a significant underpinning for gold by strengthening the metal's currency component. Dollar weakness is actually the single most dominant driver for gold's near-term directional movements in the vast majority of cases. Only in exceptional times will gold and the dollar rally in unison. This happens only when the fear level among investors is so high and the demand for safety is so intense that gold is the favored asset of choice along with greenbacks. In rare instances like the one we've seen this year, foreign flight capital pushes the dollar's value higher while also lifting gold prices.

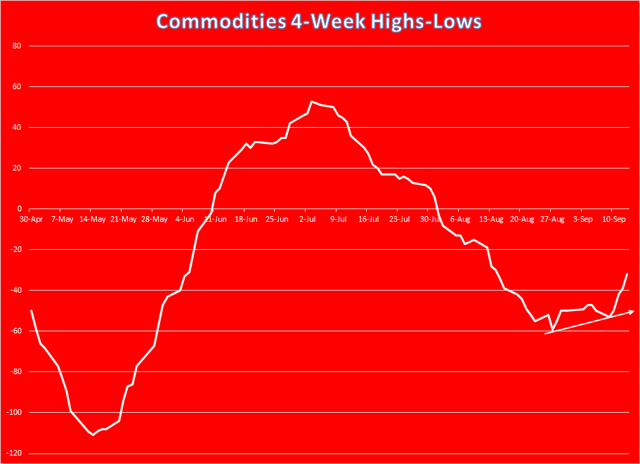

But when the dollar's value declines, gold prices will respond by moving higher since gold, like other commodities, is priced in dollars. Moreover, broad strength in the commodities arena also tends to benefit gold. As I mentioned in a recent report, commodities are looking good as we head closer to the fourth quarter of this year. Shown below is the 4-week rate of change in the new highs and lows among all actively traded U.S. commodity futures contracts.

Source: Barchart

What this indicator shows is the momentum behind the incremental demand for commodities as a group. Whenever this indicator is rising it means that the near-term path of least resistance for commodities is up. As you can see here, this indicator has recently reversed a long decline and is in the process of turning up again. If this continues, participants should expect to see not only some increased upward pressure in other commodities, but for gold prices as well.

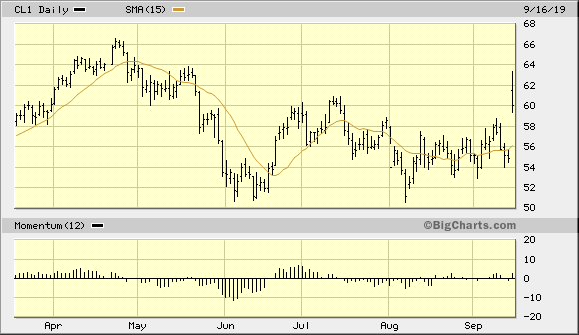

Another recent factor which bodes well for the gold price heading into Q4 is the dramatic sentiment shift taking place in the energy sector. While energy stocks were among the downside leaders this summer, there has been a categorical rally in the stocks of oil and energy production and exploration companies this month. More importantly, the crude oil price has also seen a reversal of fortunes in recent days after drone attacks on Saudi Arabian oil facilities. The attacks reportedly disrupted half of Saudi's oil capacity, amounting to approximately 5% of the daily global oil supply.

Source: BigCharts

Source: BigCharts

The rally in the oil price is significant not only for the broad commodity market outlook, but also for gold. For commodity market rallies often begin with crude oil since oil is widely regarded as the most politically and economically sensitive of natural resources. Institutional money managers, whose collective decision making has an outsized impact on the direction of prices, view sharp rallies in the oil market as a reason for buying other commodities, and especially inflation-sensitive gold. Indeed, many a gold price rally in past years has been preceded by a sharp run-up in the price of crude.

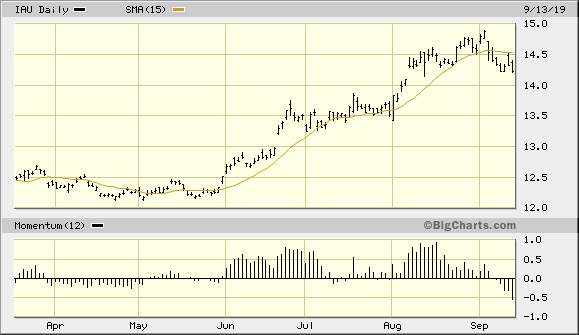

My favorite gold proxy and trading vehicle for the yellow metal is the iShares Gold Trust (IAU). Based on the rules of my trading discipline, a 2-day higher close above the 15-day moving average in IAU would confirm that the immediate-term (1-4 week) trend for gold has turned up again. This would ideally also be accompanied by a downward move in the U.S. dollar index as discussed above. The combination of a rallying oil price along with the improving internal structure of the broad U.S. commodity futures market should eventually allow the gold ETF to find a bottom and turn up again by later this month. Until this happens, though, I recommend that participants exercise patience and wait for the confirmation signal mentioned here before initiating any new positions in physical gold or the gold ETFs.

Source: BigCharts

Although gold got a much-needed "correction" of sorts in the first half of September, the factors discussed here suggest that the precious metals sector still has bullish potential entering the fourth quarter of 2019. The main ingredient needed to initialize another extended rally for gold is continued weakness in the U.S. dollar index. Continued strength in the crude oil price, moreover, would provide some additional attention for gold and other inflation-sensitive assets and would likely serve as a catalyst for renewed demand. Moreover, the broad commodities market should benefit from the return of a "risk-on" approach among investors, and this in turn would further boost the gold price outlook. While gold's immediate-term trend is still unsettled, its longer-term trend is still bullish and investors can maintain longer-term investment positions in the yellow metal.

On a strategic note, I was stopped out of my trading position in the VanEck Vectors Gold Miners ETF (GDX) after it violated the $28.00 level on Sept. 9. A 3-month rally in GDX and a gain of almost 30% made this a worthwhile trade. The recent pullback in GDX, however, puts me back in a cash position on a short-term basis as I await the next confirmed bottom and re-entry signal from my technical trading discipline.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts