About $5B in assets to be sold due to Barrick-Randgold merger - expert

Up to $5 billion worth of mining assets may be offloaded as a result of the merger between Barrick Gold (TSX, NYSE:ABX) and Randgold Resources (LON:RRS), expected to happen in the first three months of 2019.

According to BMO Capital Markets analyst Andrew Kaip, it is almost certain that the New Barrick will sell a number of non-core assets to position the company as the lowest cost western-based gold producer, but not necessarily the largest.

Largest potential deal would be Barrick's Lumwana copper mine in Zambia, which could fetch as much as $1.3 billionKaip went on flagging a total of 13 mines from South America to Zambia he sees as likely to be sold following the $6 billion-merger. Those assets currently account for 750,000 ounces of gold and 400 million pounds of copper production.

The expert believes the largest potential deal would be Barrick's Lumwana copper mine in Zambia, which could fetch as much as $1.3 billion. The merged mining company may also sell its 50% stake in Chile's Zaldivar mine, its majority stake in Tanzania-focused miner Acacia, as well as Randgold's Tongon, Massawa and Morila assets, Kaip wrote in a report to investors.

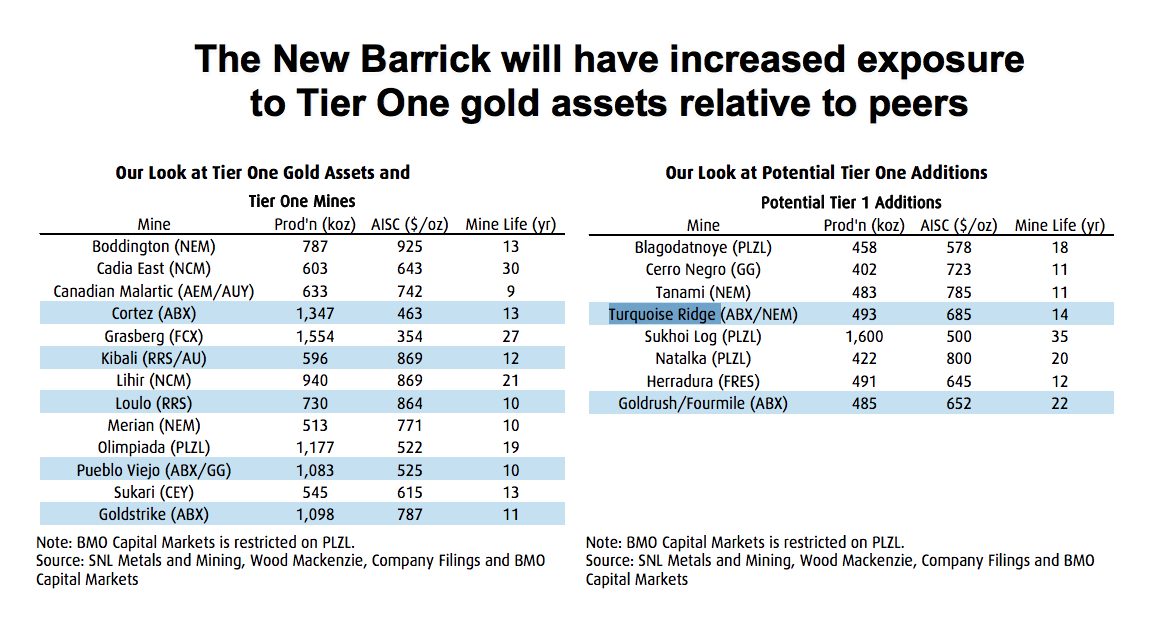

Yet, Barrick and Randgold are of the view that their combination will create a new company that will own five of the top-ten tier-one gold assets, namely Cortez, Goldstrike, Kibali (45%), Loulo-Gounkoto (80%), and Pueblo Viejo (60%).

After the asset sales, the new company may look into adding some key assets, including Goldcorp's Cerro Negro in Argentina and Newmont's Tanami mine, in Australia.

List produced by Andrew Kaip | BMO Capital Markets.)