Activist Shareholders Propelling Detour Gold

Activist shareholders John Paulson and John Hathaway will demand performance or a sale of the company.

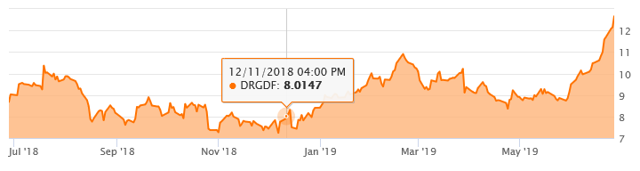

Stock price has gone nowhere the past 5 years under previous management.

New CEO experienced in driving down production costs.

Stock price has surged 59% from $7.82 on Dec. 19 announcement of new board members to $12.44 (today).

Detour Gold (OTCPK:DRGDF) stock price has gone nowhere fast under the previous Board and Management. The five-year span from November 2014 to November 2018, the stock price dropped from $8.86 to $7.53. Since activist shareholder John Paulson deployed 5 new board members on Nov. 28, 2018, the stock has surged 68% to $12.66 (6/26/2019). A positive catalyst with the tailwind of a rising price of gold ($1,420 per ounce) is propelling this stock in convincing fashion.

Resource Skeptic provided terrific data illustrating the strong beta correlation of Detour stock price relative to a rising price of gold. As previous management failed to drive down all in production costs, stockholders rightfully requested a change in leadership. Now, with new management in place, and gold on the rise, we could potentially see this stock retest its high of $39 per share back in 2011. I note that this recent stock price surge has included heavy volume in trading, which bodes well for stockholders. Average volume for the past 10 trading days has been 39,000 shares as compared to only 13,000 in the prior 90 days.

Production Costs

| All in Sustaining Costs (AISC) | AISC per ounce Gold |

| 2017 | $1,064 |

| 2018 | $1,158 |

| 2019 Projected by Detour Gold | $1,175-$1,250 |

Table compiled by Tim Paul - from Detour Gold March 7, 2019 Press Release

The table above shows all in costs have been going in the wrong direction under the previous management. Michael (Mick) McMullen is the new CEO and Director as of April 1, and he has demonstrated the ability to drive mining costs down.

Gold mining is a tough business, but if management cannot produce a rising stock price, it would better serve stockholders by selling the company. I am encouraged that John Paulson stepped up the pressure and demanded new leadership or a sale of the business. In 2018, Paulson indicated he found a willing buyer (reported to be Barrick Gold (NYSE:GOLD), and that was when the price of gold was languishing at $1,250 per ounce. One can be reasonably sure that a company sale price would be much higher today, as gold prices have broken through $1,400 per ounce.

Detour Gold Financial Strength

I prefer that a mining company has plenty of cash and limited debt, since gold prices fluctuate wildly. As of March 31, the company is flush with $201 million in cash, which represents an increase of $69 million over the past 3 months. Long-term debt is at $249 million, which is higher than my preference, but their overall balance sheet is much stronger than most all miners I have researched.

I strongly prefer a gold/silver miner operates in a friendly country, and focus on just one mine. Detour Lake mine is located in Canada, well known as a mine-friendly country. While there are risks at any mine, I believe that management is best when laser focusing on one mine, rather than multiple locations. Detour is one of the largest gold mines in Canada - producing 600,000 ounces per year, and mineral reserves at 15 million ounces.

Catalyst in place with Activist John Paulson

There are still many opportunities to be realized and I look forward to engaging with our stakeholders to determine the optimal way to create shareholder value going forward. (May 1, 2019-New CEO Mick McMullen).

Momentum - DRGDF

I was fortunate to have initiated my position in Detour at $10.55 per share and will continue to add shares on marginal price dips going forward. The case for owning a strong gold miner is paramount, but shareholders have to be willing to accept extreme volatility in the price of gold.

The argument for an investment in gold and precious metals mining stocks, we believe, has never been supported with as many considerations as now. Taken together, they make an extremely powerful argument for a timely investment in the precious metals sector. Should inflation rise, the markets fall, the economy slump, the dollar weaken, deficits widen, or populism run rampant, we expect gold to benefit. However, should these unexpected and unwanted outcomes interact, serious potential for a credit meltdown, similar or worse than the 2008 global financial crisis, would seem possible. Ground zero for the next systemic crisis could be sovereign credit itself. The promise to do "whatever it takes" in monetary and fiscal policies, no matter how drastic or innovative, we believe would now appear ineffective. (John Hathaway-Tocqueville Gold Fund-March 31, 2019)

Disclosure: I am/we are long DRGDF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Tim Paul and get email alerts