Adriatic Metals Plc (ASX:ADT, LSE:ADT1): Owns the World-Class, Very High-Grade Vares Silver Project, in Bosnia & Herzegovina and the Raska zinc Deposit in Serbia; Paul Cronin, Managing Director & CEO Interviewed

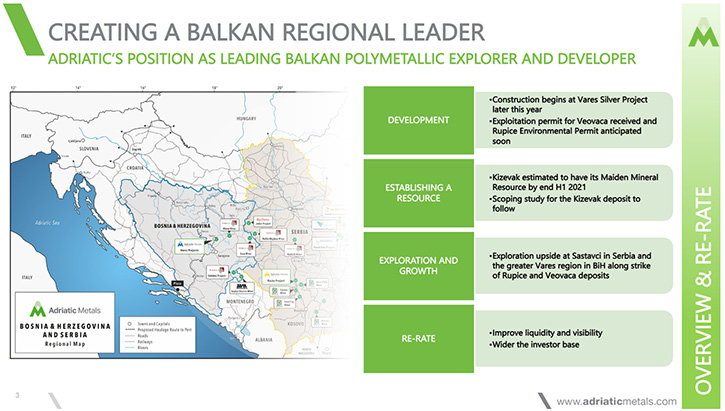

Adriatic Metals Plc (ASX:ADT, LSE:ADT1) is a precious and base metals explorer and developer that owns the world-class, very high-grade Vares silver project, in Bosnia & Herzegovina and the Raska zinc deposit in Serbia, pro-mining European regions, with highly-skilled workforces as well as extensive existing infrastructure and logistics. We learned from Paul Cronin, Managing Director & CEO of Adriatic Metals, that in October 2020 they released the pre-feasibility and got all of the permits required to commence construction on the Vares project this summer. Adriatic Metals PlcDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Cronin, who is Managing Director and CEO of Adriatic Metals PLC. Paul, could you give us an overview of your Company and what differentiates your Company from other companies. Also give us some of your highlights of 2020 and your plans for 2021?Paul Cronin:Sure, Al. Adriatic is a UK based Company, listed in both London and Australia. Our focus is exploration and development of European assets. We've commenced that work in Bosnia and Herzegovina, but we've also recently expanded into Serbia in 2020. We own the very high-grade, expected to be extremely profitable, Vares project in Bosnia. Since October, when we acquired a Canadian company called Tethyan Resource Corp, we've been conducting very aggressive exploration, with a huge amount of success on our first pipeline project, which is the Raska project in Southern Serbia. 2020 was a big year for us, despite a lot of companies being very negatively affected by COVID, we were very fortunate to be operating in a remote mountainous area in Bosnia, where COVID wasn't a particularly acute issue, when we were given special dispensation from the Bosnian government to continue our exploration operations there.Whilst at the same time, working behind the scenes on resource calculations on a pre-feasibility, which we released in October last year. And more importantly, getting all of the permits that we require to commence construction of the project this summer. So, 2020 was a hugely successful year for us. And I think 2021 will be even more successful, as we completed a definitive feasibility study. We're working on project financing at the moment, we're doing very extensive procurement and HR program roll outs to buy what we need and to appropriately resource the projects. And all the time we'll be continuing to extend our known resource footprint in Southern Serbia at the Raska project.

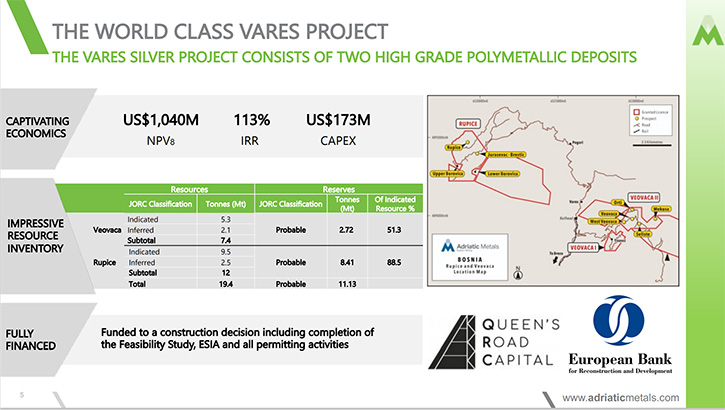

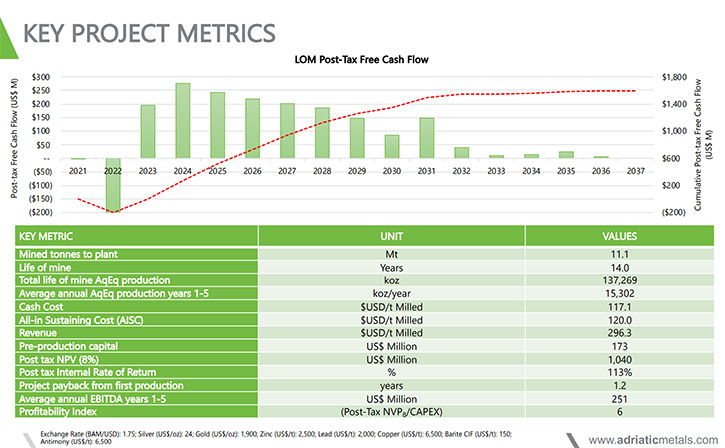

Adriatic Metals PlcDr. Allen Alper:This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Paul Cronin, who is Managing Director and CEO of Adriatic Metals PLC. Paul, could you give us an overview of your Company and what differentiates your Company from other companies. Also give us some of your highlights of 2020 and your plans for 2021?Paul Cronin:Sure, Al. Adriatic is a UK based Company, listed in both London and Australia. Our focus is exploration and development of European assets. We've commenced that work in Bosnia and Herzegovina, but we've also recently expanded into Serbia in 2020. We own the very high-grade, expected to be extremely profitable, Vares project in Bosnia. Since October, when we acquired a Canadian company called Tethyan Resource Corp, we've been conducting very aggressive exploration, with a huge amount of success on our first pipeline project, which is the Raska project in Southern Serbia. 2020 was a big year for us, despite a lot of companies being very negatively affected by COVID, we were very fortunate to be operating in a remote mountainous area in Bosnia, where COVID wasn't a particularly acute issue, when we were given special dispensation from the Bosnian government to continue our exploration operations there.Whilst at the same time, working behind the scenes on resource calculations on a pre-feasibility, which we released in October last year. And more importantly, getting all of the permits that we require to commence construction of the project this summer. So, 2020 was a hugely successful year for us. And I think 2021 will be even more successful, as we completed a definitive feasibility study. We're working on project financing at the moment, we're doing very extensive procurement and HR program roll outs to buy what we need and to appropriately resource the projects. And all the time we'll be continuing to extend our known resource footprint in Southern Serbia at the Raska project. Dr. Allen Alper:Well, it's great to have two fantastic projects and in very favorable regions, so that's excellent!Paul Cronin:Both regions: Serbia, has a lot of mining companies that are present, several operating mines. Bosnia is a little less developed, in terms of its mining industry. But I think, by virtue of the fact that the Bosnian government granted us the second exploitation permit ever granted in the last 30 years, it indicates their willingness to grow that industry. Both of those jurisdictions, being part of the former Yugoslavia, have fantastic infrastructure. Highly skilled work force is available. Just putting projects like this into production is so much easier when you have all the people around and all the infrastructure there that can be used to produce metals concentrates to deliver them to ports.Dr. Allen Alper:That's fantastic. Could you tell our readers/investors a little bit about the excellent job you have done and the fantastic IRR?Paul Cronin:We've updated our resource this year. We now have 19 million tons at both deposits of the Vares projects. We've used that to declare a reserve, we have 11 million tons in reserve. We put that into a mine plan that provides a 14-year mine life. In that earlier mine-life, there is an NPV of just over a billion US dollars, relative to our current market cap of around 300 million US dollars. You can see where that will go. It has a fantastic internal rate of return of over a hundred percent, on the basis of very reasonable CapEx costs, which I think is going to continue to decline as we replace estimated costs with actual credit costs from the region.

Dr. Allen Alper:Well, it's great to have two fantastic projects and in very favorable regions, so that's excellent!Paul Cronin:Both regions: Serbia, has a lot of mining companies that are present, several operating mines. Bosnia is a little less developed, in terms of its mining industry. But I think, by virtue of the fact that the Bosnian government granted us the second exploitation permit ever granted in the last 30 years, it indicates their willingness to grow that industry. Both of those jurisdictions, being part of the former Yugoslavia, have fantastic infrastructure. Highly skilled work force is available. Just putting projects like this into production is so much easier when you have all the people around and all the infrastructure there that can be used to produce metals concentrates to deliver them to ports.Dr. Allen Alper:That's fantastic. Could you tell our readers/investors a little bit about the excellent job you have done and the fantastic IRR?Paul Cronin:We've updated our resource this year. We now have 19 million tons at both deposits of the Vares projects. We've used that to declare a reserve, we have 11 million tons in reserve. We put that into a mine plan that provides a 14-year mine life. In that earlier mine-life, there is an NPV of just over a billion US dollars, relative to our current market cap of around 300 million US dollars. You can see where that will go. It has a fantastic internal rate of return of over a hundred percent, on the basis of very reasonable CapEx costs, which I think is going to continue to decline as we replace estimated costs with actual credit costs from the region. We're very excited about the project, we're very excited that at each stage of our pre-development from scoping the PFS, we've added more value, and I think we'll continue to do that in the definitive feasibility study. We are getting ourselves ready for a very rapid construction period. We think that will take somewhere around 14 to 16 months. That will mean we are going to be commissioning our plants in early 2023, with commercial production in the second quarter of 2023. Pretty exciting times for us, a lot of work to do, and we're really buzzed by the progress we're making at the moment. I think the team's coming together really well. We're adding more key members of staff every month and starting to see what is going to be a very well-staffed, appropriately skilled, with great assets, mining company with a first move advantage in a region that is irreplaceable.

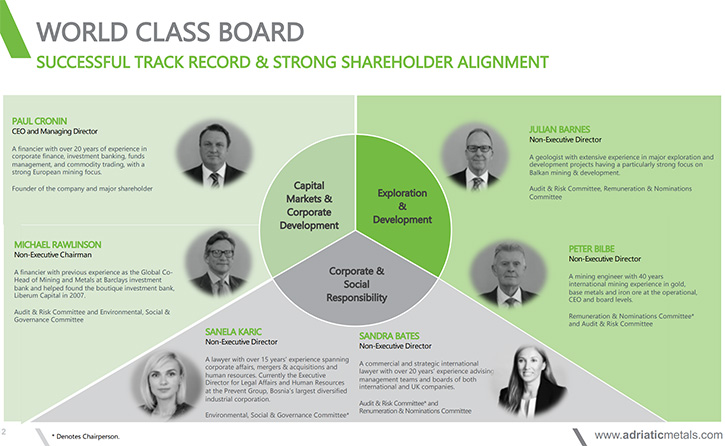

We're very excited about the project, we're very excited that at each stage of our pre-development from scoping the PFS, we've added more value, and I think we'll continue to do that in the definitive feasibility study. We are getting ourselves ready for a very rapid construction period. We think that will take somewhere around 14 to 16 months. That will mean we are going to be commissioning our plants in early 2023, with commercial production in the second quarter of 2023. Pretty exciting times for us, a lot of work to do, and we're really buzzed by the progress we're making at the moment. I think the team's coming together really well. We're adding more key members of staff every month and starting to see what is going to be a very well-staffed, appropriately skilled, with great assets, mining company with a first move advantage in a region that is irreplaceable. Dr. Allen Alper:Sounds like 2021, will be an amazing year for Adriatic Metals.Paul Cronin:Yes, I think it will be Allen. I think we've put the Company in a very good position and now it's time to deliver on that hard work.Dr. Allen Alper:That's excellent! Could you tell our readers/investors about your background and your Team?Paul Cronin:Sure. Up until 2015, I worked for RMB Resources, which was one of the most successful resource investment funds. Prior to that, I was commodity trading. And so, my background has always been financial services, either trading or investment banking and fund management. That doesn't make me the most useful person around. I have a purpose, but I have to augment those skills with really good technical people. I've been very successful in building a great technical team. Our exploration is led by Phillip Fox, formerly of Dundee Precious Metals and Graham Hill on our operations team. Graham was ex Anglo American, Silver Bears, built a number of mines in different jurisdictions around the world.In addition to that, we've added a great CFO. He's been the CFO of many operating mining companies, Geoff Eyre. Dominic Roberts joined us last year. Dominic was the Chief Operating Officer at Mineco, which is the only other British mining company operating in the Balkans. They have several operating mines and the smelter. And so, even that core team, we've built a lot of capability and it's that capability that's delivering for us. I have led it, but I wouldn't have been able to achieve what we've achieved without those people behind me.

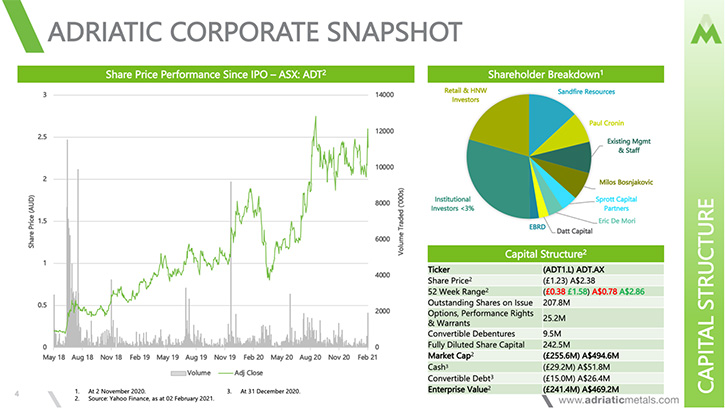

Dr. Allen Alper:Sounds like 2021, will be an amazing year for Adriatic Metals.Paul Cronin:Yes, I think it will be Allen. I think we've put the Company in a very good position and now it's time to deliver on that hard work.Dr. Allen Alper:That's excellent! Could you tell our readers/investors about your background and your Team?Paul Cronin:Sure. Up until 2015, I worked for RMB Resources, which was one of the most successful resource investment funds. Prior to that, I was commodity trading. And so, my background has always been financial services, either trading or investment banking and fund management. That doesn't make me the most useful person around. I have a purpose, but I have to augment those skills with really good technical people. I've been very successful in building a great technical team. Our exploration is led by Phillip Fox, formerly of Dundee Precious Metals and Graham Hill on our operations team. Graham was ex Anglo American, Silver Bears, built a number of mines in different jurisdictions around the world.In addition to that, we've added a great CFO. He's been the CFO of many operating mining companies, Geoff Eyre. Dominic Roberts joined us last year. Dominic was the Chief Operating Officer at Mineco, which is the only other British mining company operating in the Balkans. They have several operating mines and the smelter. And so, even that core team, we've built a lot of capability and it's that capability that's delivering for us. I have led it, but I wouldn't have been able to achieve what we've achieved without those people behind me. Dr. Allen Alper:Well, that's great to have such a strong, proven team that you have put together to move forward with your projects.Paul Cronin:Yes, that is. And we'll continue to add to that team over the next several months as we get ready for construction.Dr. Allen Alper:That's excellent! Could you tell our readers/investors about your share and capital structure? I know you personally have a big stake in the Company and you're a Founder.Paul Cronin:Our shares capital structure is probably a little bit tidier than most junior mining companies. We have about 205 million shares on issue at the moment and, on a fully diluted basis, it's about 220 million shares. We do have now some debt on the balance sheet, we entered into a convertible note with Queen's Road Capital in Hong Kong. Queen's Road is run by Warren Gilman, who was a former Vice Chairman of CIBC and is backed by, quite frankly, Australia's mining billionaires. QRC did pretty extensive due diligence on us late last year, when we entered into that note in November.

Dr. Allen Alper:Well, that's great to have such a strong, proven team that you have put together to move forward with your projects.Paul Cronin:Yes, that is. And we'll continue to add to that team over the next several months as we get ready for construction.Dr. Allen Alper:That's excellent! Could you tell our readers/investors about your share and capital structure? I know you personally have a big stake in the Company and you're a Founder.Paul Cronin:Our shares capital structure is probably a little bit tidier than most junior mining companies. We have about 205 million shares on issue at the moment and, on a fully diluted basis, it's about 220 million shares. We do have now some debt on the balance sheet, we entered into a convertible note with Queen's Road Capital in Hong Kong. Queen's Road is run by Warren Gilman, who was a former Vice Chairman of CIBC and is backed by, quite frankly, Australia's mining billionaires. QRC did pretty extensive due diligence on us late last year, when we entered into that note in November. In addition to that, we did a placement with a group in London called The European Bank for Reconstruction and Development, which is a large parastatal bank that funds a lot of projects in the Balkans, whether it's infrastructure or the mining industry. But EDRD is renowned because it sets the standards for environmental, social and governance in the mining industry. By having them come in and take an equity position in the Company, it really shows that on those ESG credentials, we are working very hard to try and set a new standard for the junior mining industry. Over the next few months, we'll be announcing several of those initiatives, which are designed to come up with a very, very robust pathway for best-in-practice ESG implementation.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors, the primary reasons they should consider investing in Adriatic Metals?Paul Cronin:I think we have a world-class, tier one deposit. The end of the project is over a billion US dollars, our market cap is slightly just over 300 million, we have 50 million Aussie dollars in the bank. So, we're not going to be going out to raise more capital anytime soon. But you'd logically expect, for a Company like this, trading at about 0.3 times Net Asset Value (NAV), that as you get closer to finishing, your definitive feasibility and all your permitting in hand, it will close up to 0.6, 0.7 of NAV. And that basically represents a significant amount of potential share price growth, given we won't be raising more capital during that period of time. And we are very aggressively ticking all the boxes on the DFS and on the permits, most importantly, to be able to commence construction this summer.

In addition to that, we did a placement with a group in London called The European Bank for Reconstruction and Development, which is a large parastatal bank that funds a lot of projects in the Balkans, whether it's infrastructure or the mining industry. But EDRD is renowned because it sets the standards for environmental, social and governance in the mining industry. By having them come in and take an equity position in the Company, it really shows that on those ESG credentials, we are working very hard to try and set a new standard for the junior mining industry. Over the next few months, we'll be announcing several of those initiatives, which are designed to come up with a very, very robust pathway for best-in-practice ESG implementation.Dr. Allen Alper:That sounds excellent. Could you tell our readers/investors, the primary reasons they should consider investing in Adriatic Metals?Paul Cronin:I think we have a world-class, tier one deposit. The end of the project is over a billion US dollars, our market cap is slightly just over 300 million, we have 50 million Aussie dollars in the bank. So, we're not going to be going out to raise more capital anytime soon. But you'd logically expect, for a Company like this, trading at about 0.3 times Net Asset Value (NAV), that as you get closer to finishing, your definitive feasibility and all your permitting in hand, it will close up to 0.6, 0.7 of NAV. And that basically represents a significant amount of potential share price growth, given we won't be raising more capital during that period of time. And we are very aggressively ticking all the boxes on the DFS and on the permits, most importantly, to be able to commence construction this summer. We're doing a lot of work on our project financing and our data management, and we're making great strides on that. I think we'll have some announcements to make on that towards the end of April, which I think will send a very clear message to the market, that Adriatic means business. We are going to put this mine into production and in its first five years of operation, it will generate over a billion US dollars of post-tax free cash flow. That gives us a wonderful platform for growth of the Company, both at our Raska asset in Serbia, but also in terms of fulfilling our strategic objective, which is to become a base and precious metals producer, from multiple projects and multiple jurisdictions, across the European continent.

We're doing a lot of work on our project financing and our data management, and we're making great strides on that. I think we'll have some announcements to make on that towards the end of April, which I think will send a very clear message to the market, that Adriatic means business. We are going to put this mine into production and in its first five years of operation, it will generate over a billion US dollars of post-tax free cash flow. That gives us a wonderful platform for growth of the Company, both at our Raska asset in Serbia, but also in terms of fulfilling our strategic objective, which is to become a base and precious metals producer, from multiple projects and multiple jurisdictions, across the European continent. Dr. Allen Alper:Wow. Those are outstanding projects that you have and those are very compelling reasons for our readers/investors to consider investing in Adriatic Metals. Paul, is there anything else you'd like to add?Paul Cronin:No, I think that probably sums it up pretty well, Allen. Thanks very much. Dr. Allen Alper:I enjoyed learning more about Adriatic Metals. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.adriaticmetals.com/Paul CroninManaging Director & CEOinfo@adriaticmetals.com

Dr. Allen Alper:Wow. Those are outstanding projects that you have and those are very compelling reasons for our readers/investors to consider investing in Adriatic Metals. Paul, is there anything else you'd like to add?Paul Cronin:No, I think that probably sums it up pretty well, Allen. Thanks very much. Dr. Allen Alper:I enjoyed learning more about Adriatic Metals. We'll publish your press releases as they come out so our readers/investors can follow your progress. https://www.adriaticmetals.com/Paul CroninManaging Director & CEOinfo@adriaticmetals.com