Alacer Gold Analysis - I Sold But There Are More Catalysts Ahead

Alacer is not a value play anymore, it is more of an exploration play now.

What the market didn't see last year was positive growth. What the market is missing now might be a negative in the form of future lower ore grades.

However, there are still 3 catalysts that could push the stock price higher.

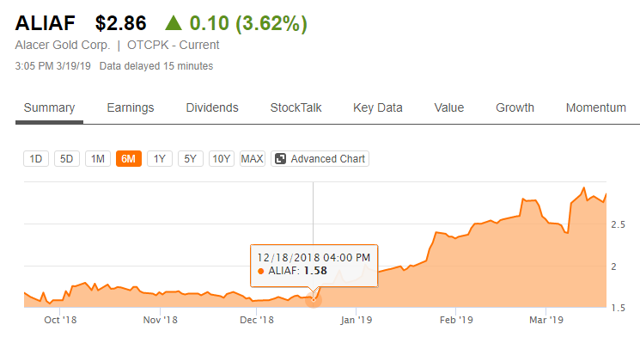

In 2018 I did a comprehensive analysis of gold miners, I spent more than a month on them and deeply researched about 40. I wasn't pleased with what I found but Alacer Gold (OTCPK:ALIAF) (OTC:ALACF) looked good. We can say it was my favorite gold miner in 2018 as it was not just a bet on gold, but a value play with a nice business proposition thanks to the Copler sulfide project.

Since then things have changed, most significantly the stock price increased as the market noticed what ALIAF has been doing.

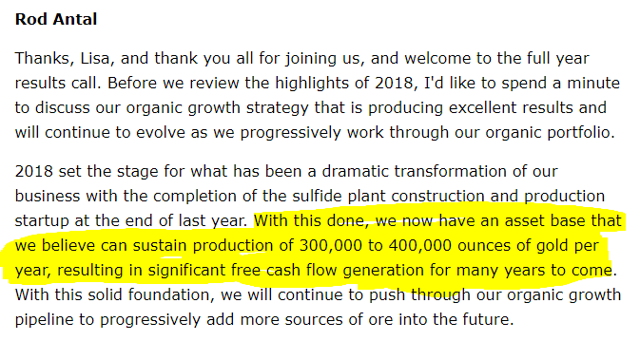

As the exploration results led to a new resource that will feed the old oxide plant, the management increased guidance and said ALIAF could become a 300k to 400k ounces producer.

As the exploration results led to a new resource that will feed the old oxide plant, the management increased guidance and said ALIAF could become a 300k to 400k ounces producer.

Source: SA Transcript

Source: SA Transcript

However, the path towards such high production levels is long and the ore grades of the sulfide ore aren't really indicative of higher sustainable future production. But this doesn't mean there are no catalysts for ALIAF or that it is a bad investment. The catalysts that could push it higher in 2019 are a dividend or buybacks, new successful exploration results and higher gold prices.

For me, when the stock price increases and reaches my intrinsic value, the risks are higher and the rewards lower so I prefer to find other less risky value investments with a margin of safety.

You can hear more about why I sold in my video discussion:

0:43 My Alacer Ownership

1:57 Why did I buy Alacer

3:35 Sum of parts value

4:28 What changed recently for ASR

5:28 Stockpile and ore grade difference

6:33 Ardich expansion and exploration

7:30 Cash flow model

7:58 3 future catalysts

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Follow Sven Carlin and get email alerts