Alamos Gold: This Healthy Retracement Is An Opportunity

Alamos Gold sold 119,392 ounces of gold at an average realized price of $1,448 per ounce for revenues of $172.9 million in the third quarter.

The company announced the suspension of construction activities at the Kirazli project in Turkey pending the renewal of the company's mining concessions which expired on October 13, 2019.

One strong support seems to materialize at $5.00 at which point I recommend accumulating.

Image: Aerial view of Alamos Gold's Young-Davidson mine site in Matachewan, Ontario. Courtesy: Dumas mining

Investment Thesis

The Toronto-based Alamos Gold (AGI) was created on February 21, 2003, as a result of the merger of Alamos Minerals and National Gold.

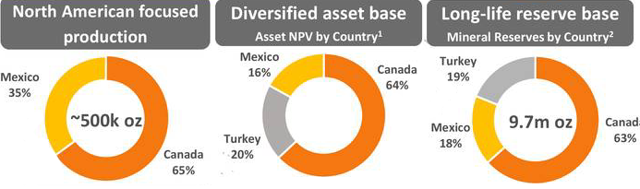

The mid-tier gold producer owns four operating gold mines in Canada (Northern Ontario) and Mexico (Sonora) with a production of 125.2K Oz in 2Q'19.

The company also owns development projects in Turkey (Kirazli, Agi Dagi, and Camyurt); in Manitoba, Canada, with Lynn Lake; and Mexico with the extension of Mulatos (La Yaqui, Cerro Pelon).

Alamos Gold presents a simple business model, easy to follow for non-professionals, with substantial assets and potential for future growth. One robust characteristic is that the company is debt-free, which is a crucial element from an investor's long-term perspective. Three critical elements are represented below:

Source: AGI Presentation (montage)

The investment thesis remains unchanged since the precedent quarter.

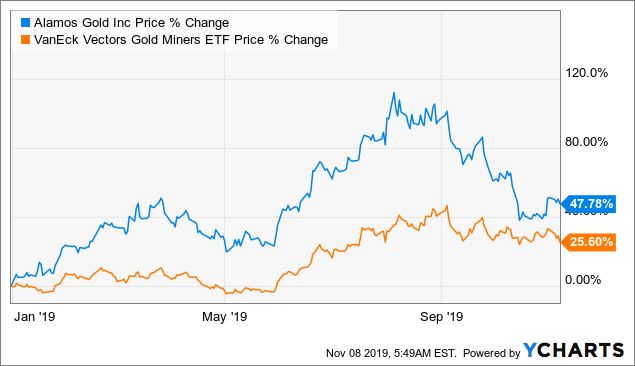

I recommend a long-term approach with accumulation on any weakness triggered either by temporary production setbacks or by the price of gold. In my preceding article, I was recommending taking some profit off the table because the stock seemed overbought, and I was right. However, despite a sharp retracement since August high, AGI is still outperforming the VanEck Vectors Gold Miners ETF as we can see in the chart below:

Data by YCharts

Data by YCharts

Hence, while the company is a good investment long term, it is also essential to trade the stock short term using the gold volatility, and I believe it is reasonable to use about 30% of your position solely for this purpose.

Alamos Gold financial snapshot 3Q'19: The raw numbers

| AGI | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 | 1Q'19 | 2Q'19 | 3Q'19 |

| Total Revenues in $ million | 161.7 | 173.1 | 168.9 | 146.7 | 163.1 | 156.1 | 168.1 | 172.9 |

| Quarterly Earnings $ million | -4.7 | 0.6 | -8.9 | 7.2 | -71.5 | 16.8 | 23.6 | 17.7 |

| EBITDA $ million | 48.1 | 60.6 | 51.9 | 41.7 | -21.0 | 60.5 | 69.1 | 78.4 |

| EPS (diluted) $ per share | -0.02 | 0.00 | -0.02 | 0.02 | -0.18 | 0.04 | 0.06 | 0.04 |

| Cash from Operating Activities $ million | 48.6 | 58.8 | 62.5 | 45.2 | 47.4 | 42.4 | 72.3 | 67.9 |

| CapEx in $ | 39.2 | 51.5 | 53.4 | 55.1 | 61.5 | 53.3 | 71.1 | 66.3 |

| Free Cash Flow | 9.4 | 7.3 | 9.1 | -9.9 | -14.1 | -10.9 | 1.2 | 1.6 |

| Total Cash in $ million | 236.6 | 243.2 | 244.1 | 230.4 | 213.8 | 190.8 | 199.0 | 202.5 |

| Total LT Debt in $ million | 7.5 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Dividend $/ share (semi-annual) | 0.005 | 0.005 | 0.005 | 0.005 | 0.005 | 0.01 | 0.01 | 0.01 |

| Shares Outstanding | 340.6 | 392.4 | 389.6 | 394.6 | 390.5 | 394.2 | 392.9 | 394.4 |

Source: Company press release and Morningstar

Alamos Gold - Gold Production and balance sheet details

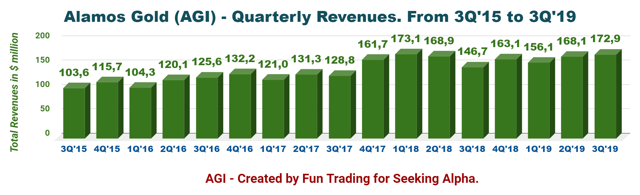

1 - Revenues and Trend. Revenues were $172.9 million in 3Q'19

During the third quarter of 2019, Alamos Gold generated revenues of $172.9 million. Revenues were up from the same quarter a year ago and up sequentially, as we can see in the chart above. AGI made a net income of $17.7 million, or $0.04 per share.

On an adjusted basis, the company posted net earnings of $23.4 million, or $0.06 per share. Operating cash flow before changing the non-cash working capital is a record of $80 million or $0.20 per share - a robust operational quarter fueled by a substantial price of gold.

In the press release, John A. McCluskey, President, and Chief Executive Officer indicated:

Our third quarter results were solid, driven by strong performances from Young-Davidson and Island Gold. Total cash costs were down 11% from a year ago and combined with the higher gold price, we generated record operating cash flow, before changes in working capital. With the strong year-to-date performance we remain well positioned to meet our full year production and cost guidance

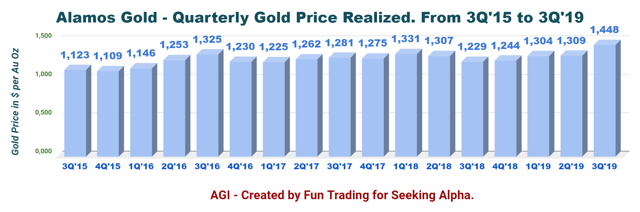

One influential factor is the gold sold reached an average realized price of $1,448 per ounce.

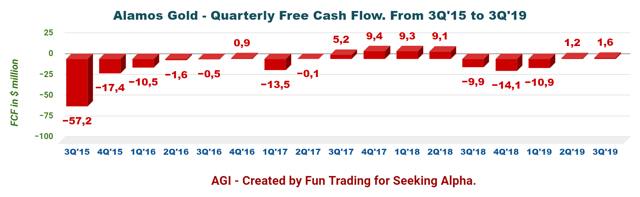

2 - Free Cash Flow was $1.6 million in 3Q'19

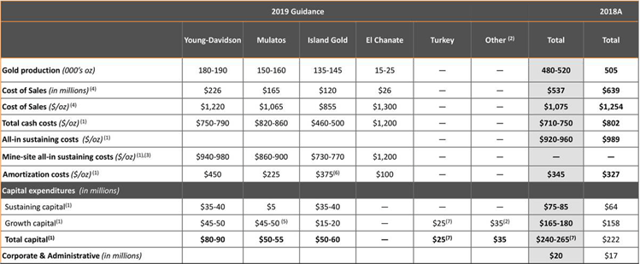

The company is not performing well at this level and shows a loss for the last four quarters of $27.8 million. CapEx has been high due to investment in new projects, which should pay off later next year. CapEx will continue to be high in 2019 with the ramp-up of spending at Kirazli and Island Gold. However, the company is changing CapEx in relation to delays in the Kirazli project.

Jamie Porter, the CFO, said in the conference call:

Capital spending is expected to increase in the fourth quarter of 2019, primarily driven by the deferrals of surface infrastructure projects at Island Gold originally planned for earlier in the year. Given lower spending at Kirazli we have reduced our full-year capital guidance by $50 million between $240 million and $265 million.

However, the company is still buying back shares, and I do not recommend it with FCF negative. The company bought back 200K shares in 2Q'19 and recently doubled the dividend to $0.04 per share yearly.

The company repurchased 2.7 million shares for the first half of this year at an average price of $4.17 per share for a total cost of $11 million.

AGI is not passing the FCF test, but we cannot view it as a negative due to CapEx spending. The company said that it expects the transition to a period of strong free cash flow growth starting in the second half of 2020. The price of gold now reaching over $1,500 per ounce will help.

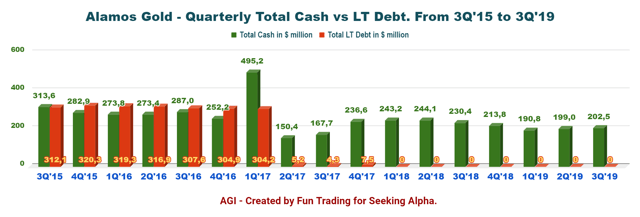

3 - No Net Debt and Liquidity of $583 million

Alamos Gold remains debt-free and has total cash of $202.5 million at the end of the third quarter.

The company is debt-free since 1Q'17, which is a rare situation.

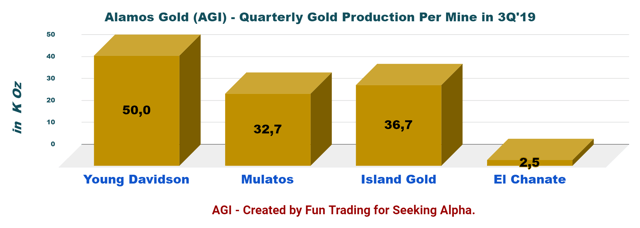

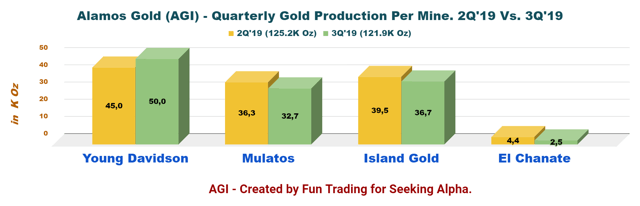

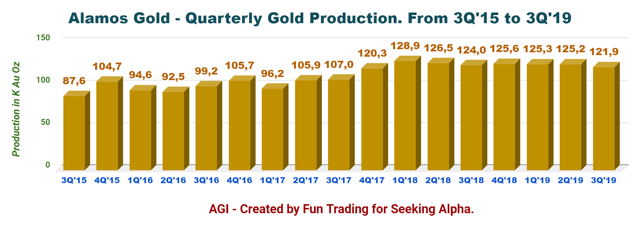

4 - Gold production details. The company produced 121.9K Oz and sold 119,392 Oz in 3Q'19  The company produced 121.9K Au Oz this quarter, down 1.7% compared to the same quarter last year, and down 2.6% sequentially. Alamos Gold sold 119,392 ounce of gold at an average realized price of $1,448 per ounce. Gold sales were about 2,000 ounces higher than production in the quarter.

The company produced 121.9K Au Oz this quarter, down 1.7% compared to the same quarter last year, and down 2.6% sequentially. Alamos Gold sold 119,392 ounce of gold at an average realized price of $1,448 per ounce. Gold sales were about 2,000 ounces higher than production in the quarter.

1 - Island Gold produced 50K Oz this quarter, an 11% increase sequentially. In the conference call:

We continue to see excellent drill results with our large exploration program at Island Gold. Since we acquired the operation in 2017, we've discovered initial -- additional 1.2 million ounces reserves and resources to the end of 2018.

Note: On May 9, 2019, Alamos Gold indicated a high-grade gold deposit at its Island Gold property.

2 - Young?EUR?Davidson produced 50.0K Oz.

Young-Davidson production increased to 50,000 ounces of gold reflecting higher grades, consistent mining rates of 6600 tons per day. This marks a 10% increase in mining rates from a year ago and a 7% improvement year-to-date reflecting much stronger and steadier performance for 2019.

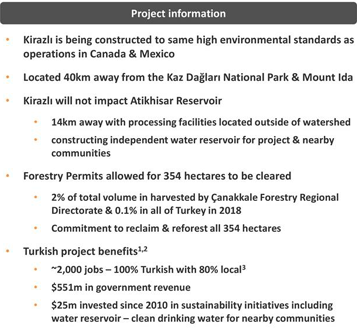

3 - Kirazli's mine project in Turkey has been delayed by the renewal of the company's mining concessions ending on October 13, 2019.

Alamos Gold received the GSM permit for the Kirazli project and is ramping up full-scale construction until the end of the year. The company is working on the water reservoir and installing the power lines. Work is to be completed by the end of the year, according to the company.

Source: AGI Presentation

Peter MacPhail said in the conference call:

Earlier this month, we suspended the construction activities at Kirazli pending renewal of our surface mining concessions, which expired on October 13. It met all regulatory requirements for the concessions to be renewed and we expected the renewal before the exploration date. In the preceding months, we've received all the major outstanding permits required to build Kirazli, increased our workforce nearly 300 and commenced major earthworks. We're disappointed with this delay and we're disappointed that we'll call a delay in our construction schedule. But we believe that ultimately, the reaction to this has been overdone. Our mining concessions have not been revoked, nor have our permits.

The project is encountering significant protests against the project. While we should not be alarmed, I see this situation as concerning because it always brings delays and extra costs.

Thousands of Turks, including opposition lawmakers, have been protesting against the mine, saying the company would use cyanide to extract gold, contaminating the soil and waters of a nearby dam. They have also said Alamos has cut down more trees than it had declared.

Alamos Chief Executive Officer John McCluskey told Reuters in August that the firm had pre-paid for reforestation at the project, adding that it was impossible for cyanide to leak into the environment as protesters fear.

2019 Guidance

Source: AGI Presentation

Conclusion and Technical analysis (Short term)

Alamos Gold released its 3Q'19 results on October 30, 2019. Production was this quarter relatively in line with expectations. No lousy surprise is always a pleasant surprise for shareholders. The main issue is the delays at the Kirazli project, which should be resolved in due time.

AISC is now at $950/Oz and is firmly below $1,000 per oz, which is excellent and gives almost $600 per Oz profit margin.

The challenges faced by the company in 2018 at Young-Davidson have vanished. The company recorded a third strong consecutive quarter at 50K Oz.

Kirazli project in Turkey has been delayed as indicated above, waiting for new concession approval. As I said, we should not be overly concerned about it.

The company's balance sheet is pristine with no debt after repaying AGI's high-yield notes in the first quarter of 2017.

However, the main topic this quarter is the sharp increase in the gold price, which is now trading above $1,450-$1,500 per oz. It will have a profound effect on free cash flow for the company in Q4.

Technical Analysis

AGI experienced a sharp retracement after reaching a record high in August at about $7.75. AGI is showing a steep descending channel pattern with line support around $4.50 and line resistance at $5.60. However, one strong support seems to materialize at $5.00

The short-term strategy is to start accumulating again between $5.00 and $4.50 with a potential uptick when the company will receive the new concession approval at Kirazli, which should happen before the end of 2019, in my opinion.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AGI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I will be interested at or below $5

Follow Fun Trading and get email alerts