All Gold and Quiet on the Eastern Front / Commodities / Gold and Silver 2022

The war in Ukraine has entered itsseventh month and some people believe that China is gearing up for a war withTaiwan. Will bulls invade the gold market?

In August, half a year had passed sincethe beginning of the war in Eastern Europe. Ukraine defended its independence but lost 13% of its territory. The six months of war between Europe’s two largest nations have brought deathand suffering on a mass scale. More than 13 million people have been displaced,and nearly 7 million refugees have dispersed across Europe. Ukraine’s economycollapsed while the prices of food and energy have soared.

What is the situation on the front?Unfortunately, the aggressor’s troops maintain a relatively stable landconnection with Crimea and are slowlypushing the Ukrainian army from its positions in Donbas, the main area ofcombat. It means that taking control of the rest of the Donetsk Oblast bythe Russians is probably a matter of time, although it may take several moremonths. The change in favor of the Ukrainians is possible only if the Westsignificantly increases its military supplies, which would enable an effectiveUkrainian counter-offensive. It’s true that the Ukrainian counter-offensive inthe direction of Kherson in the south of the country is gaining momentum – inparticular thanks to the supplies of HIMARS – but a full scale operation isunlikely due to a lack of manpower and weapons.

However, that happened, Russia would thenhave to decide whether to give up and withdraw its troops or to announce auniversal draft and full mobilization, throwing all its potential into thefight. It would take war to a whole new level, which could boost gold prices, at least temporarily.

Whatare the possible scenarios for the war’s end? Well,given that Russia’s military capability is gradually decreasing and the countryneeds an operational pause to build up its forces, it would like to sit down atthe negotiating table with the aim of taking control of Donbas. However,Ukrainians are not ready to make any territorial concessions. Thus, theRussians will likely continue to bombard Ukrainian cities and blackmail thewhole world with the nuclear power plant in Zaporizhia, trying to force Ukraineto negotiate and accept some territorial losses.

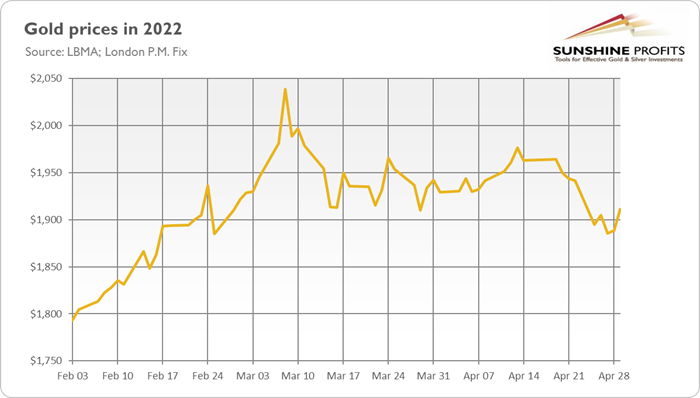

Whatare the implications for gold? Well, the war showsthat goldbulls shouldn’t count on geopoliticalevents. Although gold initially gained during the first phase of theconflict, the impact was short-lived, as the chart below shows. At this point,when the situation has stabilized somewhat, and the war of attrition could lastanother several months – if not years, as some experts believe – gold isunlikely to be significantly affected by the conflict. This may change, ofcourse, if the conflict escalates, for example, to the nuclear field.

Or to the Far East. You see, the war ishaving effects beyond Eastern Europe. For Beijing, the balance of power withthe U.S. is shifting in its favor, as Uncle Sam’s focus is on Ukraine. If youlook at the direction in which China is now going, you can clearly see itspreparation for a conflict outside its own country. This is a hugedeparture from the well-known doctrine that China defends itself only on itsown territory. Beijing’s angry response to Nancy Pelosi’s visit to Taiwan,including unprecedented drills, is very telling.

Is an invasion of Taiwan likely? Well,“the complete reunification of the motherland” is an official policy of China.What has recently changed is only the fact that China has built and modernizedan impressive army, reaching a pointwhere it could actually achieve its goal. The timing would be quite goodfor China, given its economic slowdown, President Xi Jinping’s aspirations, andthe ongoing war in Ukraine.

Sucha military conflict could be even more impactful than the war in Ukraine. This is not only because Taiwan is a great semiconductor producerand an integral part of the Western tech industry, but also because, unlikewith Ukraine, the U.S. government hasn’t ruled out direct intervention toprotect Taiwan. Actually, Uncle Sam, together with Japan and Australia, hasverbal agreements to intervene militarily in the case of China’s attack. Hence,it could trigger WW3.

Given the fact that Taiwan is an islandthat could be quickly blocked by China, the U.S. and its allies wouldn’t beable to choose a middle ground and deliver weapons to Taiwan throughneighboring countries like in the case of Ukraine. They would either give upTaiwan or engage in a full-scale military operation. Hence, the price of gold could react more vividlyto the invasion of Taiwan than to the invasion of Ukraine.

However, Beijing is unlikely to launch a full-scale invasion ofTaiwan in the near future, as China possesses only a fraction of thenecessary ships to execute an amphibious assault. Moreover, the possible landingsites on the west coast are blocked by nearby mountains, and the island lacksthe infrastructure to support invaders. Instead, China could choose optionsother than a full-scale amphibious invasion. It won’t be equally positive forgold prices, but the yellow metal could still gain somewhat, at least for awhile.

The bottom line is that the war inUkraine could last for several more months. However, gold bulls shouldn’t count that gold will benefit from it. Theyellow metal could gain more only if the conflict escalates either to thenuclear field or to the Far East, with China’s attempt to invade Taiwan.However, both these scenarios remain unlikely, and even if they happen, theirimpact on gold should be only temporary. Fundamental factors are much moreimportant for the long-term outlook of gold than geopolitical ones.

Thank you.

If you enjoyed the above analysis and would you like to knowmore about the gold ETFs and their impact on gold price, we invite you to readthe April MarketOverview report. If you're interested in the detailed price analysis andprice projections with targets, we invite you to sign up for our Gold & SilverTrading Alerts . If you're not ready to subscribe at this time, we inviteyou to sign up for our goldnewsletter and stay up-to-date with our latest free articles. It's freeand you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ MarketOverview Editor

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Przemyslaw Radomski, CFA and SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Przemyslaw Radomski, CFA and his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingPrzemyslaw Radomski's, CFA reports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Przemyslaw Radomski, CFA, SunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

Arkadiusz Sieron Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.