All Planets Are Aligned For Alamos Gold In 2019, So It Seems

During the fourth quarter of 2018, Alamos Gold generated revenues of $163.1 million. Revenues were up 0.9% from the same quarter a year ago and up 11.2% sequentially.

The company intends to purchase for cancellation up to 25,513,043 common shares, representing 10% of the Company's public float. AGI bought already bought 2.4 million shares at $4.07.

Furthermore, the company is doubling the dividend to $0.04 per share quarterly.

AGI is still a good opportunity. I suggest buying at $4.50 or below.

Image: Aerial view of Alamos Gold's Young-Davidson mine site in Matachewan, Ontario Courtesy: Dumas mining

Investment Thesis

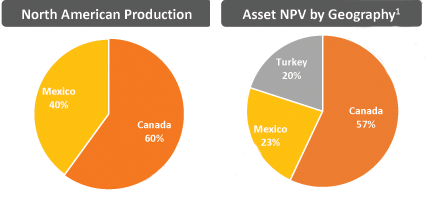

The Canadian-based Alamos Gold (AGI) was created on February 21, 2003, as a result of the merger of Alamos Minerals and National Gold. The mid-tier gold producer owns four operating gold mines in Canada (Northern Ontario) and Mexico (Sonora).

What I like the most with Alamos Gold is that it presents an elementary business model, easy to grasp quickly, with satisfying assets and potential for future growth. It is the financial and technical profile that generates the best return when you are lucky enough to get on the train at the right time.

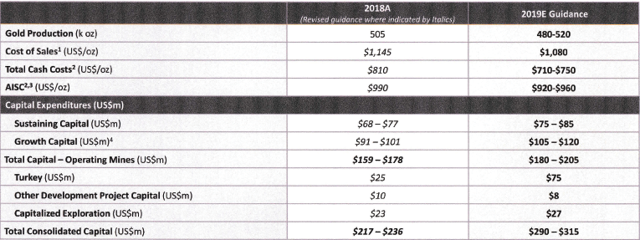

Source: AGI Presentation

Source: AGI Presentation

The company also owns development projects in Turkey (Kirazli, Agi Dagi, and Camyurt); in Manitoba, Canada, with Lynn Lake; and Mexico with the extension of Mulatos (La Yaqui, Cerro Pelon).

Data by YCharts

Data by YCharts

The company stock dropped precipitously after July 2018. The downtrend accelerated early October last year, in correlation with the weakening of the price of gold, which struggled hard to stay above $1,200 per ounce.

At the end of 2018, the stock reached an all-time low at $3 due to a lack of appetite for gold stocks, bad coverage from a few analysts who suggested to drop AGI at the worst moment, and guidance revision to the downside.

However, the stock price recovered and is trading now at the same level as October 2018 reflecting a more accurate stock value.

John McCluskey, the CEO, said in the conference call:

We closed this year on a high note with a strong performance from Young-Davidson and record production from Island Gold in the fourth quarter. Young-Davidson had a challenging start of the year. But a much better finish with the operation delivering its highest production and lowest costs of the year in the fourth quarter reflecting higher underground mining grades.

Alamos Gold financial snapshot 4Q'18. The raw numbers

| AGI | 3Q'16 | 4Q'16 | 1Q'17 | 2Q'17 | 3Q'17 | 4Q'17 | 1Q'18 | 2Q'18 | 3Q'18 | 4Q'18 |

| Total Revenues in $ million | 125.6 | 132.2 | 121.0 | 131.3 | 128.8 | 161.7 | 173.1 | 168.9 | 146.7 | 163.1 |

| Quarterly Earnings $ million | 4.8 | -20.6 | 0.1 | 2.4 | 28.8 | -4.7 | 0.6 | -8.9 | 7.2 | -71.5 |

| EBITDA $ million | 51.1 | 29.3 | 35.9 | 21.5 | 51.4 | 48.1 | 60.6 | 51.9 | 41.7 | -21.0 |

| Profit Margin in % | 3.82% | 0 | 0.08% | 1.83% | 22.36% | 0 | 0.35% | 0 | 4.91% | 0 |

| EPS (diluted) $ per share | 0.02 | -0.08 | 0.00 | 0.01 | 0.09 | -0.02 | 0.00 | -0.02 | 0.02 | -0.18 |

| Operating Cash Flow $ million | 36.7 | 33.1 | 20.1 | 51.4 | 43.4 | 48.6 | 58.8 | 62.5 | 45.2 | 47.4 |

| CapEx in $ | 37.2 | 32.3 | 33.6 | 51.5 | 38.2 | 39.2 | 51.5 | 53.4 | 55.1 | 61.5 |

| Free Cash Flow | -0.5 | 0.8 | -13.5 | -0.1 | 5.2 | 9.4 | 7.3 | 9.1 | -9.9 | -14.1 |

| Total Cash in $ million | 287.0 | 252.2 | 495.2 | 150.4 | 167.7 | 236.6 | 243.2 | 244.1 | 230.4 | 213.8 |

| Total LT Debt in $ million | 307.6 | 304.9 | 304.2 | 5.2 | 4.3 | 7.5 | 0 | 0 | 0 | 0 |

| Dividend $/ share (semi-annual) | 0.1 | 0.03 | 0.02 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.01 | 0.04 |

| Shares Outstanding | 267.1 | 289.5 | 323.3 | 302.8 | 303.9 | 340.6 | 392.4 | 389.6 | 394.6 | 390.5 |

Source: Company filing and Morningstar

Alamos Gold - Gold Production and balance sheet details

1 - Revenues and Trend

During the fourth quarter of 2018, Alamos Gold generated revenues of $163.1 million. Revenues were up 0.9% from the same quarter a year ago and up 11.2% sequentially. AGI made a net loss of $71.5 million, or $0.18 per share.

On an adjusted basis, the company posted net earnings of $4.3 million, or $0.01 per share, "which includes one-time adjustments for a $64.0 million ($49.9 million after-tax) non-cash inventory impairment charge at El Chanate, as well as unrealized foreign exchange losses recorded within both deferred taxes and foreign exchange of $15.8 million, and other items totaling $10.1 million."

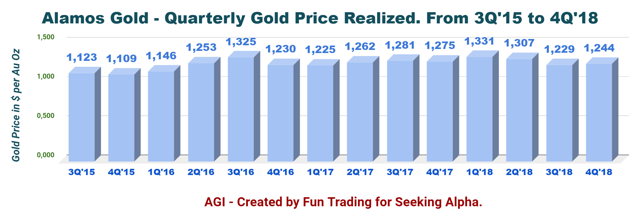

Note: The gold sold reached an average realized price of $1,244 per ounce, $17 above the average London PM Fix.

2 - Free Cash Flow

One crucial financial element that I always indicate in my analysis is the company free cash flow. AGI FCF is now minus $5.6 million for 2018.

One crucial financial element that I always indicate in my analysis is the company free cash flow. AGI FCF is now minus $5.6 million for 2018.

AGI is passing the FCF test.

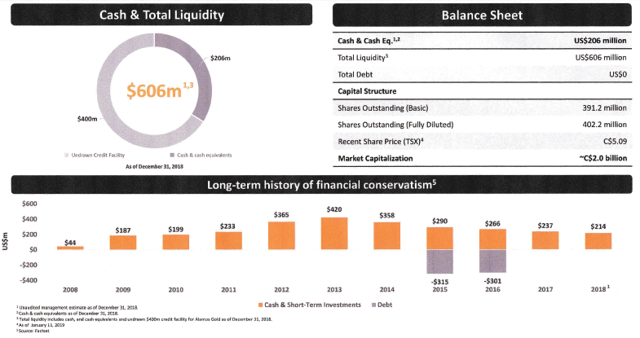

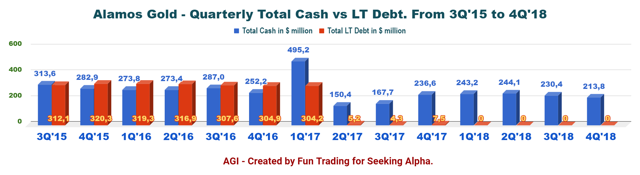

3 - No Net Debt and Liquidity of $606 million. Alamos Gold remains debt-free and total cash of $213.8 million at the end of the fourth quarter, down from $236.6 million at the end of December 2018.

Alamos Gold remains debt-free and total cash of $213.8 million at the end of the fourth quarter, down from $236.6 million at the end of December 2018.

Source: AGI Presentation

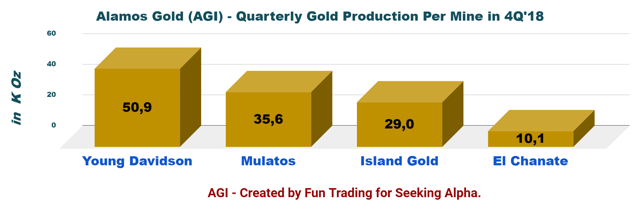

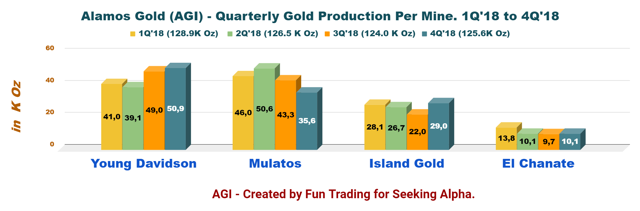

4 - Gold production details

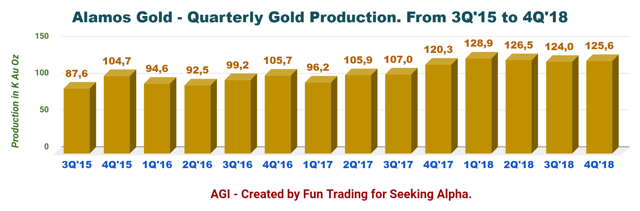

The company produced 125.6K Au Oz this quarter, up 4.4% compared to the same quarter last year, and up 1.3% sequentially. Alamos Gold sold a record "131,161 ounces of gold at an average realized price of $1,244 per ounce, $17 above the average London PM Fix."

Quick Production review per mine and per Quarter in 2018:

1 - Island Gold produced 29.0K Oz this quarter. Combined with higher grades, Alamos Gold is guiding a 32% increase in production to between 135K-145K Oz due to better grades and throughput. Costs are also expected to decrease.

1 - Island Gold produced 29.0K Oz this quarter. Combined with higher grades, Alamos Gold is guiding a 32% increase in production to between 135K-145K Oz due to better grades and throughput. Costs are also expected to decrease.

Exploration continues to be a crucial part of the Island Gold development.

2 - Mulatos had an output of 35.6K Oz. In 2019 production is expected to return to the long-term rate of 150k to 160k ounces. The work has commenced at the high-grade Cerro Pelon project, and the company anticipates to complete permitting for La Yaqui Grande during 2019. Production from these higher grade projects is scheduled in 2020 and 2021. However, Alamos Gold reached the end of the mine life at the high-grade San Carlos Underground deposit in 2018.

3 - El Chanate produced 10.1K ounces in the fourth quarter and 43,7K ounces for the year with mine-site all-in sustaining costs averaging $317 per ounce. Mining activity ceased at El Chanate in the fourth quarter, and the company has transitioned to residual leaching.

4 - Young?EUR?Davidson delivered the most robust gold output in the fourth quarter producing 50.9K ounces due to higher underground mining rates and grades. For the full year, the operation produced 180k ounces in line with the revised guidance. Cash cost decreased 7% sequentially as well as a decrease of 5% in AISC. The company faced some issues at Young-Davidson during the first half of 2018. But the company solved them now and expects better performance. Alamos Gold sees a gold production at Young-Davidson in 2019 to between 180K to 190K ounces with a lower AISC due to better quality ore.

The company expects to ramp up to 7,500 TPD in H2 2020 and 8,000 TPD in 2021.

Kirazli mine project in Turkey is on track.

Alamos Gold received the GSM permit for the Kirazli project and is ramping up full-scale construction until the end of the year. The capital budget for Kirazli has been reduced to approximately $25 million, owing to delays in finalizing the mining services and earthworks contracts.

Source: AGI Presentation

Note: In September 2018, the Turkish government issued amendments to decree 32 that required to denominate certain service contracts in Turkish Lira.

Peter McPhail said in the conference call:

At Kirazl??, we're expecting to ramp up full scale construction activities this year following receipt of the operating license, putting initial production on track for the latter part of 2020. This is expected to take our annual production to over 600,000 ounces per year starting in 2021, while further reducing our costs given its low cost profile.

Production guidance for 2019:

Source: AGI Presentation

Conclusion and Technical analysis (Short term)

Alamos Gold released its 4Q'18 results on February 20, 2019. Another good quarter overall with solid gold production, and a little lower all-in sustaining costs or AISC now at $983/Oz.

It seems that the challenges encountered recently at Young-Davidson have been resolved. Also, the company has been active and bought back shares since announcing a share buyback program in December 2018. Alamos Gold purchased 2.4 million shares at $4.07.

Furthermore, the company is doubling the dividend to $0.04 per share quarterly. CFO James Porter said in the conference call:

we initiated a share buyback in December and have been active. Today we purchased and cancelled 2.4 million shares at a cost of $10 million or $0.04 per share or $4.07 per share. We also announced the doubling of our annual dividend to $0.04 per share paid quarterly. This increase is well supported by our balance sheet, higher gold prices and a bright outlook with much stronger free cash flow on the horizon.

AGI is a stable gold company with an exciting pipeline of new midterm projects (Kirazli project, for one, with expected annualized production to over 600K Oz per year). The company's balance sheet is solid with no debt after repaying AGI high-yield notes in the first quarter.

The recent slide of the stock is quite puzzling and probably due to a very soft gold price trading just above $1,200/Oz now, or more than $100 below the price realized the second quarter.

Technical Analysis

AGI experienced a decisive breakout of its descending channel pattern late in January and increased to its first long-term resistance at $5 (I suggest selling about 20% of your position at this level unless gold price can trade above $1,350 per ounce). The new immediate support is about $4.50, which will need to be tested. Depending again on the future price of gold, I suggest adding a little at this level.

However, if further weakness the next strong support in the range $3.75-$4 (I suggest accumulation at this level and below).

On the positive side, AGI can continue climbing and re-test its June 2018 top (double top - I suggest selling half your position there and hold the rest for a year or two).

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below as a vote of support. Thanks!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in AGI over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Fun Trading and get email alerts