Amarillo Grande now contains 19 million pounds of uranium

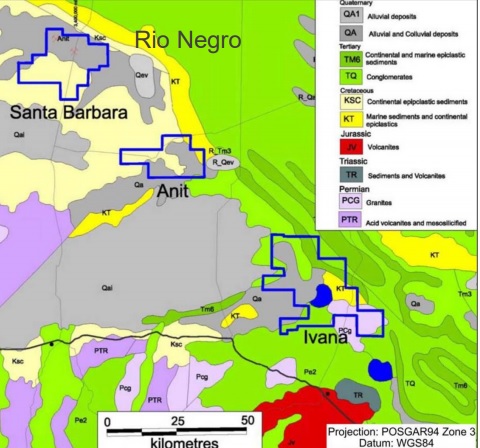

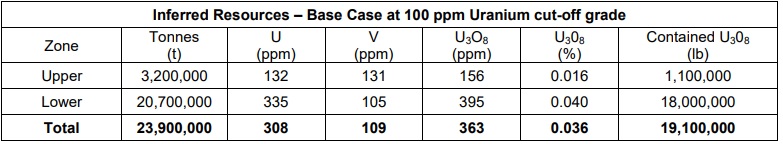

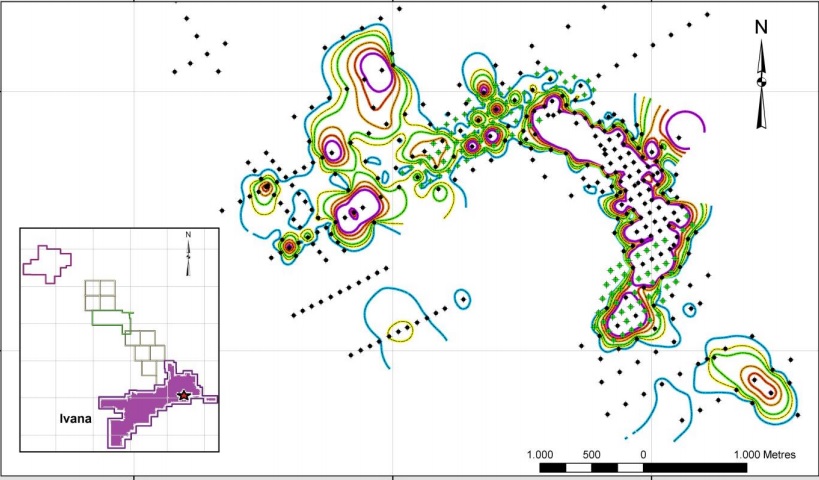

Blue Sky Uranium (BSK.V) has released a maiden resource estimate on its Amarillo Grande uranium project. As we expected in a previous update, we were underestimating the size of the Ivana target as the maiden resource contains 19.1 million pounds of uranium (compared to our previous estimates of 10-15 million pounds). The higher amount of uranium in the resource is great news (considering this resource is part of just a small zone of the 140 kilometer strike length), but the average grade of 363 ppm is slightly below our expectations (we would really like to see an average grade of approximately 1 pound of uranium per tonne of rock).

Fortunately even 363 ppm should be viable considering the resource is hosted in sandstone (below a superficial overburden consisting of gravel). Blue Sky is currently completing some metallurgical and beneficiation test work and the recovery rates from these tests will subsequently be sused in the maiden Preliminary Economic Assessment, which should be completed later this year. The resource estimate was based on an operating cost of $12/t and a recovery rate of 90%. This (very rough and preliminary) indication would result in an operating cost of just $17 per pound, and a sub-$20 operating cost is what we would like to see confirmed in the PEA.

The 23.9 million tonne resource also contains 109 ppm Vanadium, indicating an in-situ vanadium resource of 5-6 million pounds. Even though the vanadium price is still very strong, we would really like to see metallurgical test work on the vanadium before getting too excited. Could it be a nice kicker? Sure. But we would first like to see some numbers.

19.1 million pounds is a good start. Now it's up to Blue Sky's management to continue to develop the property.