Amazon Pushes Nasdaq to Fifth Straight Weekly Win

The Nasdaq and S&P both closed higher for the day and week

The Nasdaq and S&P both closed higher for the day and week

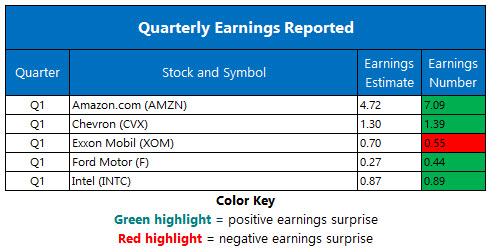

Stocks closed higher, with investors digesting gross domestic product (GDP) data that showed the U.S. economy grew 3.2% during the first quarter, well aboveforecasts. However, upside was contained following a batch of mixed corporate earnings reports, with an Intel (INTC) disappointment dragging on the Dow in early trading, while well-received Amazon.com (AMZN) earnings pushed the Nasdaq and S&P 500 to record-high closes. Though the Dow came up just shy for the week, the other two indexes nabbed weekly wins -- the Nasdaq marking its fifth straight.

Continue reading for more on today's market, including:

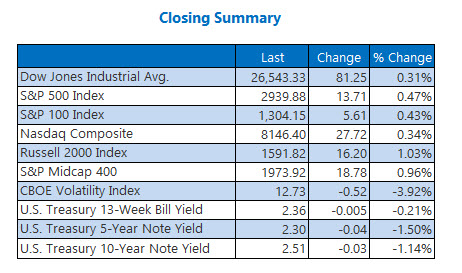

The sentiment signal flashing for first time in over a year.Analyst: This penny stock could surge 80%.Plus, Lyft, PayPal in focus ahead of Uber IPO; 2 weed stocks with new "buy" ratings; and retail stocks reacted to AMZN's one-day delivery news.The Dow Jones Industrial Average (DJI - 26,543.33) rallied 81.3 points, or 0.3%, for the day. UnitedHealth (UNH) was the best of the 20 Dow gainers, adding 2.7%. Meanwhile, INTC outpaced the 10 losers with its 9% drop. For the week, the Dow shed 0.06%.

The S&P 500 Index (SPX - 2,939.88) added 13.7 points, or 0.5%. The Nasdaq Composite (IXIC - 8,146.40) added 27.7 points, or 0.3%. The indexes gained 1.2% and 1.8% for the week, respectively.

The Cboe Volatility Index (VIX - 12.73) lost 0.5 point, or 3.9%. Week-over-week, the stock market's "fear gauge" added 5.2%.

5 Items on our Radar Today

Amid the ongoing measles crisis in the U.S., President Donald Trump weighed in this afternoon, telling reporters citizens "have to get their shots," and that it is "so important." Measles cases have been reported in 22 states, with just under 700 reported cases this year alone, the most since the Center for Disease Control and Prevention (CDC) proclaimed measles eliminated from the U.S. in 2000. (CNBC)Police in Sri Lanka are working to find 140 people believed to be connected to the Easter Sunday attack that involved multiple suicide bombings. Taking the lives of 253 people, the Islamic State claimed responsibility, and prompted the country's government to urge citizens to avoid public places of worship. (Reuters)Lyft, PayPal come into focus ahead of Uber's initial public offering (IPO).Analysts issued new "buy" ratings on these 2 weed stocks.2 stocks that reacted to Amazon's one-day delivery news.

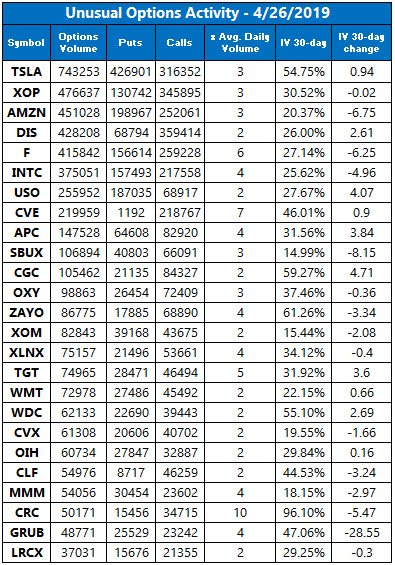

Data courtesy of Trade-Alert

Oil Falls on Trump, OPEC Controversy

Oil took a hit in today's trading, after Trump said he called the Organization of the Petroleum Exporting Countries (OPEC) and told the cartel, "Gasoline prices are coming down .. you've got to bring them down." The Wall Street Journal, meanwhile, said OPEC did not talk to Trump. June-dated oil lost $1.91, or 2.9%, to close at $63.30 per barrel for the day, and finished down 1.1% for the week -- snapping its longest weekly win streak in five years.

Gold moved higher as the greenback weakened in the wake of this morning's GDP data. June-dated gold added $9.10 or 0.7%, to settle at $1,288.80 per ounce. For the week, gold added 1%.