America's New Steel and Aluminum Protectionism / Commodities / Steel Sector

Now that the White House seeks to turn China’ssteel and aluminum overcapacity into a national security matter, America’s newprotectionism risks international trade discord.

Now that the White House seeks to turn China’ssteel and aluminum overcapacity into a national security matter, America’s newprotectionism risks international trade discord.

Following a tradeinvestigation of imports, U.S. Department of Commerce recently recommendedimposing heavy tariffs or quotas on foreign producers of steel and aluminum inthe interest of national security. Armed with steel and aluminum reports, Commerce Secretary Wilbur Ross stated that steel is vital to U.S.national security and current import flows are adversely impacting the steelindustry.

Ross urged PresidentTrump to take immediate action by adjusting the level of imports through quotasor tariffs. Trump is likely to invoke the Section 232 of the 1962 Trade Act,which allows the president to impose tariffs without congressional approval. Hemust respond to the reports by April 11 and 19 for steel and aluminum,respectively.

China, the main targetof the proposals (though a minor steel importer in the U.S.), contends the U.S.already has excessive protections on domestic iron and steel products and itreserves the right to retaliate.

The proposed policy instruments suggest that the Trump administration iswilling to subsidize American steel and aluminum, even at the expense of farbigger and more consequential U.S. industries – and the world trade.

From Trade Expansion to Trade Contraction

While the proposedmeasures extend from broad adjustments that involve many countries to targetedadjustments that focus on a few countries, the rationale of the suggestedfigures is fuzzy and ultimately undermined by geopolitical considerations.

In steel industries, theCommerce Department recommends that the U.S. could introduce a global tariff ofat least 24 percent on steel imports from all countries. Another option wouldbe a tariff of 53 percent on all steel imports from 12 countries (none areadvanced economies, except for South Korea), with a quota on steel imports fromall other countries equal to 100 percent of their 2017 exports to the U.S. Inthe third option, a quota could be enacted on steel products from equal to 63percent of each country’s 2017 exports to the U.S.

In aluminum, theCommerce Department recommends a 7.7 percent tariff on imports from allexporter countries. The second option is a 23.5 percent tariff on aluminumproducts from China, Hong Kong, Russia, Venezuela and Vietnam, with a cap forall countries at 2017 import levels. A third option would be an aluminum importquota on all countries of 86.7 percent of their 2017 imports.

Nevertheless, PresidentTrump is given substantial geopolitical leeway. He could have specificcountries exempted from the proposed quota, based on U.S. economic interests ornational security. Moreover he could also take into account the countries’willingness to cooperate with the U.S. to address global excess capacity (read:turn against China) and other challenges that face U.S. aluminum and steelindustries.

The leeway permitsTrump to seize unilateral geopolitical objectives to undermine any semblance ofmultilateral economic cooperation and to deploy the imperial “divide and rule”principle to play targeted countries against each other.

Ironically, PresidentKennedy used the Trade Expansion Act of1962 to negotiate tariff reductions of up to 80 percent, which pavedthe way for the Kennedy Round of General Agreement on Tariffs and Trade("GATT") negotiations that ended in 1967 and eventually led to theWorld Trade Organization (WTO) in 1995. In contrast, President Trump isexploiting the seldom-used Section 232 of the Act to increase trade barriers, in order to undermine or reverse 50 yearsof trade progress in just a few years.

In effect, Trump istrying to use the Trade Expansion Act for trade contraction.

Broadeningthe scope of new protectionism

In his campaign, Trump targeted those economies with which America hasthe largest aggregate trade deficit. In order to legitimize a trade offense,which has a highly questionable legal basis, he is starting by focusing onsteel, but is expanding to aluminum. The ultimate objective is to targetAmerica’s deficit partners, however. The proposed measures are just means tothat final goal.

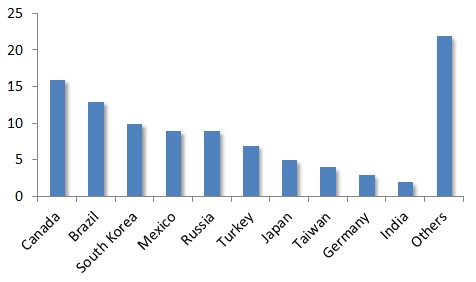

In 2017, U.S. imports increased 34 percent to $22 billion. The U.S. isthe world’s largest steel importer. The top 10 source countries for steelimports represent 78 percent of the total steel import volume. Canada accountsfor the largest share (16%) followed by Brazil, South Korea, Mexico and Russia(Figure a). Although China has a key role in the proposed tariffs andquotas, it is not even among the top-steel importers in the U.S. If the WhiteHouse would target its tariffs and quotas proportionately, it should hithardest its North American Free Trade (NAFTA) allies and trade partners inAsia, which together account for a half of all steel imports.

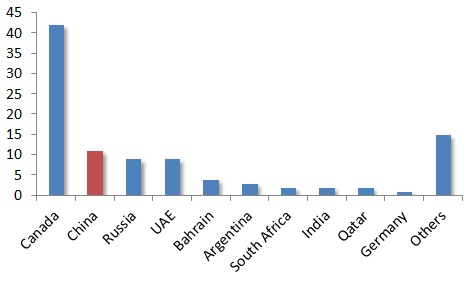

In 2017, U.S. aluminum imports increased some 31 percent to $13.9billion, while U.S. production of primary aluminum decreased for the fourthconsecutive year to the lowest level since 1951. Like in steel, Canada is theleading source of aluminum imports into the U.S., accounting for more thantwo-fifths of total imports by both value and weight in 2016. Imports fromChina amounted to only half of that, a slight decline from 2015 levels, whilethe Commerce Department argues imports from China were significantly up (Figureb).

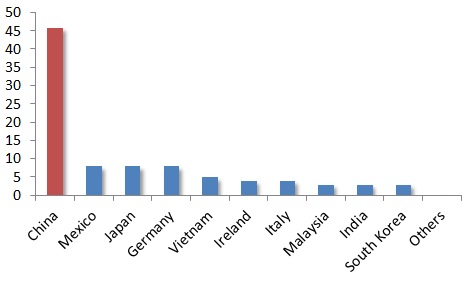

What are the economic realities of the U.S. trade deficits? In 2017,America incurred a $863 billion trade deficit (up 8.1% from 2016). The highestdeficit was with China ($396 billion), followed by Mexico ($74 billion) andJapan ($72 billion). These are the countries that Trump is really after (Figurec). In order to achieve that objective, the White House seems to be willingto risk its economic and strategic cooperation with China, undermine ties withits NAFTA partners, alienate its European North American Treaty Organization(NATO) allies and undercut alliances with the rest of its trade and securitypartners in Asia.

The record to date is distressing. Recently, the Trump administrationannounced tariffs on imported solar cells and modules, which protects a smallnumber of U.S.-based solar manufacturers (including one Chinese-owned firm),while destroying some 23,000 American solar workers’ jobs. China has alreadyretaliated. Moreover, South Korea is considering filing a complaintwith the World Trade Organization if the U.S. levies heavy duties on steel.

In turn, Trump is likely to resort to Section 301 of the Trade Actof 1974 to unilaterally seek remedies for unfair Chinese trade practices, whichwill risk Chinese retaliation and a tit-for-tat trade war, just as the TariffAct of 1930 did with dark consequences. Such moves risk undermining not justinternational trade but the very institutions -trade-dispute resolutionmechanisms – that support it.

Time to apply the right lessons

Amidthe world trade collapse in 2008, Jagdish Bhagwati published his Termites in the Trading System, whichdemonstrated how preferential agreements undermine free trade. Since the end ofthe Cold War, both Republican and Democratic leaders have moved toward suchpacts. Until 2016, those moves were gradual and occurred with one pact at atime, however. In the Trump era, the shift is disruptive and multilateral.Today, the international trading system is not threatened by little termitesnibbling away walls, but a huge stealth termite – new protectionism – munching awaythe very foundations of world trade.

Steeland aluminum overcapacity crises are multilateral and have globalrepercussions, not bilateral as the U.S. measures imply. China’s rise has notcome at the expense of the U.S. After the Cold War, the U.S. economy accountedfor a fourth of global GDP. Today, the corresponding figure is about the same.Moreover, research indicates that U.S. job losses are the net effect oftechnology and automation, not just of offshoring to China, India and emergingeconomies.

Second,since China continues to support world trade and investment, its role is vital inglobal growth prospects. And as s industrialization will intensify in India andother emerging economies, so will their need for steel, aluminum and othercommodities. Rapid economic development that supports global growth prospectsshould not be penalized.

Third,through the Silk Road initiatives (OBOR), Chinese overcapacity can serveindustrialization in emerging economies that participate in these initiatives,which also offer opportunities to advanced economies.

Finally,any sustained success in overcoming the global steel and aluminum friction mustbe based on multilateral cooperation with all major producers that will seek toreduce overcapacity in the largest producers but will also ensure emergingeconomies’ opportunities for rapid economic development in the future.

Thecommentary was released by China-US Focus on February 27, 2018

FIGURE U.S. Trade Deficits,Steel and Aluminum Imports

Sources:International Trade Center; World Steel Association; International TradeAdministration

Dr Steinbock is thefounder of the Difference Group and has served as the research director at theIndia, China, and America Institute (USA) and a visiting fellow at the ShanghaiInstitutes for International Studies (China) and the EU Center (Singapore). Formore information, see http://www.differencegroup.net/

© 2018 Copyright DanSteinbock- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2018 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.