Amkor Call Volume Spikes Amid AirPods Buzz

Traders are betting on new highs for the rumored Apple partner

Traders are betting on new highs for the rumored Apple partner

The shares of semiconductor concern Amkor Technology, Inc. (NASDAQ:AMKR) are within striking distance of new annual highs, amid rumors the company has been chosen as the primary supplier for Apple's (AAPL) next generation of AirPods. MacRumors reported that analyst Ming-Chi Kuo expects two new AirPod models to begin production as early as the fourth quarter. Against this backdrop, AMKR options are flying off the shelves today.

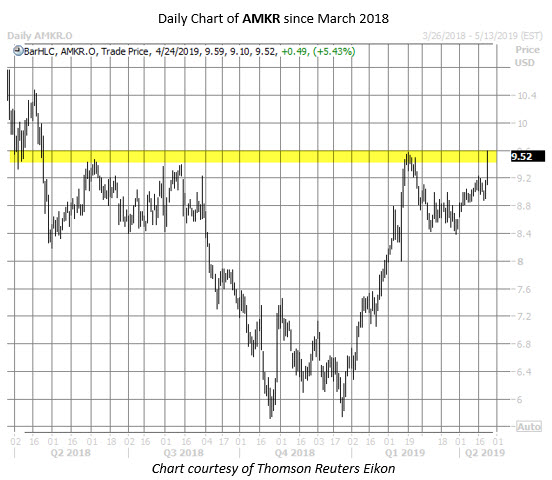

Amkor stock was last seen 5.4% higher at $9.52, set for its highest close in nearly a year. AMKR has already added more than 45% so far in 2019, but the $9.50-$9.60 area has acted as a speed bump over the past 12 months, containing the security's upward momentum in February. However, a FAANG partnership could be the catalyst that pushes the equity beyond this threshold to new annual highs.

As alluded to earlier, Amkor Technology call options are in demand amid the Apple buzz. So far today, the stock has seen nearly 3,000 calls cross the tape -- 64 times the average intraday volume, and already double AMKR's previous annual-high call volume of 1,150 calls traded in one day (in mid-February). For comparison, fewer than 40 Amkor puts have changed hands today.

Most of the volume is attributable to several early blocks of May 10 calls likely bought to open at a volume-weighted average price (VWAP) of $0.28. By purchasing the calls to open, the buyers will profit the higher AMKR shares rise above $10.28 (strike plus premium paid) before the close on Friday, May 17, when the front-month options expire.

Elsewhere, several short sellers could be kicking rocks today. Short interest on AMKR represents nearly 4% of the stock's total available float, or more than a week's worth of pent-up buying demand, at the security's average pace of trading. That's plenty of fuel for a short squeeze to propel the shares north of recent resistance.

A round of upbeat analyst attention could also be on the horizon. Despite the stock's impressive year-to-date rally, just two brokerage firms currently follow AMKR -- and not one considers it a "buy." Plus, the consensus 12-month price target of $7.27 now represents a discount of nearly 24% to the equity's current price. A batch of upbeat analyst initiations or price-target hikes could lure more buyers to AMKR.