An Almost Pure Silver Play

Well just like Gamestop and the Wallstreet Bets crowds beat a few hedge funds at their own game, the same Reddit mob and traders took on silver. That week they rallied some of the major silver producers like First Majestic TSX-FR and then started making a run on the metal itself. This rings music to the ears of both silver and gold bugs alike because silver being the smallest market in the world is so easily manipulated and no one in power seems to do anything about it. In fact I was reading that just the turnover of cash in the Gamestop episode would buy four years of global silver production.

Now the one thing about silver miners is that there are very few of them and because the price of silver has been suppressed for so many years a lot of juniors don't really spend that much time and energy and dollars searching for it. Compared to gold explorers, the number of pure play silver explorers is just a fraction at best. This factor alone is great especially when it come time to search out juniors to invest in that are focused on being a pure silver play. Silver stocks offer probably the greatest upside or better worded, bigger bang for the buck do to the volatility of the metal itself.

While searching for silver juniors I came across a Venture listed junior, Aftermath Silver TSX-V:AAG. Aftermath doesn't have an actual silver mine at present but they do have properties that have been past producers and some of the properties have NI 34-101 reports that are quite impressive. The company's three properties are located in Chile and Peru which are well known as being very mining friendly. Twoof the projects are former producing silver mines.

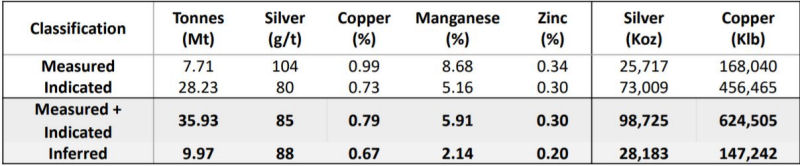

The first property is Berenguela which is a silver-copper-manganese deposit located in southern Peru. There has been a lot of work done on this property that was performed back in the 90's by another junior including 318 core and RC holes totaling 35,400 meters drilled during that time. Exploration & engineering data from the previous junior shows grades as follows below. The company at this time is doing follow up work for verification of this data and is in the process of compiling thier own NI 43-101 report on this property.

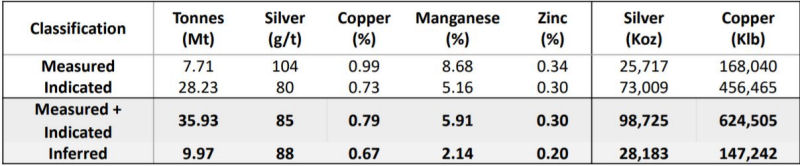

The two properties in Chile are the Challacollo and the Cachinal. The company has an option to earn 100% in Challacollo property. This property covers approximately 19,000 hectares and has an NI 43-101 resource estimate that was completed in Dec. 2020. See table below.

The above data is based on 112 drill holes (19.2km of drilling) 57 diamond core & 55 RC. This property also has good infastructure such as a paved road that passes through the Challacollo exploration areas as well as high voltage powerlines close by. Along with updating the NI 43-101 report the company is core cutting about 3000 meters of old core and preplanning a 2021 drilling program.

The third property, Cachinal is being evaluated for a drill program. This property is a low sulphide silver-gold with potential for high-grade silver at depth. This property is also being evaluated for open pit potential.

One of the things I like about this company is the trading volume of the shares. So many junior stocks are illiquid with huge spreads that make it hard for the average investor to own. There is nothing worse than owning a stock that you can't sell if you need to. This company has about 160 million shares fully diluted and has some very impressive holders of ths stock like Sprott owning 24.1m shares (19%), Palisades Gold owning 8.25m shares (6.5%) and Axxion which owns 2.3m shares (1.8%)

If you enjoyed this article, please feel free to share. When seeking out mining stocks always use Due Diligence and see our Disclaimer and be sure to sign up for our free news letter located on the right hand side of this page.

Added note: The author of this article holds postions in the above company at the time of this writing. The author may buy or sell any time going forward.