An Update On The Platinum-Gold Spread

Gold continues to make higher lows, but it fell to the bottom end of its trading range.

Platinum's price action looks a lot different.

"Rich man's gold" has been a poor performer since 2014.

Fundamentals favor a rebound in platinum.

Patience is a virtue, and the platinum-gold spread requires incredible fortitude.

Value is often a subjective concept. What is cheap to one person may be expensive to another. In the world of commodities, if the price of a raw material market declines, it does not necessarily mean it is cheap. If the price moves to the upside, in some cases, it could become cheaper than it was at a lower level given the myriad of factors when considering value.

When it comes to raw material prices, I believe that history tends to repeat, and value determinations can only come from comparing one commodity to another that can serve as a substitute or has similar characteristics that offer market participants a choice.

Precious metals are both industrial commodities and investment vehicles. Their density, resistance to heat, and electrical conductivity make them requirements for many products. At the same time, they have a long history as financial assets or means of exchange.

Platinum is one of the rarest precious metals with the lion's share of production each year coming from South Africa and Russia. Gold production is less concentrated and more abundant on an annual basis. Central banks around the world hold gold as a foreign exchange asset. Above ground stocks of platinum are less visible and likely a lot smaller than in the yellow metal.

Since the 1970s, the characteristics of gold and platinum has led the market to typically favor platinum when it comes to price. Over the past forty years, the median premium for platinum over gold has been in the $100 to $200 per ounce range. However, over the past four years, platinum has taken a backseat to the yellow metal which has seen its premium over the rarer precious metal grow.

When it comes to the technical state of both precious metals these days, gold continues to outshine platinum.

Gold continues to make higher lows, but it fell to the bottom end of its trading range

During the week of April 9, the price of gold rallied back to its highest level of 2018 when the price traded at $1365.40 per ounce on the continuous COMEX futures contract.

Source: CQG

As the weekly chart highlights, the price of the yellow metal has been making higher lows since December 2015, and critical support for this pattern is currently at the late 2017 low at $1236.50 per ounce. The high in April was at the same exact price as the peak in late January which is now a double top and area of critical resistance for the gold futures market. After the recent fall from the highs, price momentum and strength metrics have turned slightly negative for the gold market, but they are both in neutral territory. Weekly historical volatility has declined to 8.35%, the lowest level of this year considering that the price has only traded in a $63.10 range so far in 2018. Gold was trading at the $1313 level on Wednesday, May 9.

Platinum's price action looks a lot different

While gold's trading pattern has been bullish since late 2015, platinum has traded in a range making little upside progress.

Source: CQG

The price of platinum hit a low of $812.20 per ounce in January 2016 which still stands as critical technical support for the precious metal. As the weekly chart illustrates, in late 2017, the price of platinum fell to a low of $872.40 and rose to a high of $1022.60 at the end of January 2018. Since the high during the first month of this year, it has been all downhill for the price of platinum as the metal fell to its most recent low at $893.10 last week. Platinum was trading at the $916 level on Wednesday, May 9 just $103.80 above its early 2016 bottom. Meanwhile, over the same period, the price of gold is $266.80 above its late 2015 bottom. Over the period, gold has outperformed platinum by $163 per ounce.

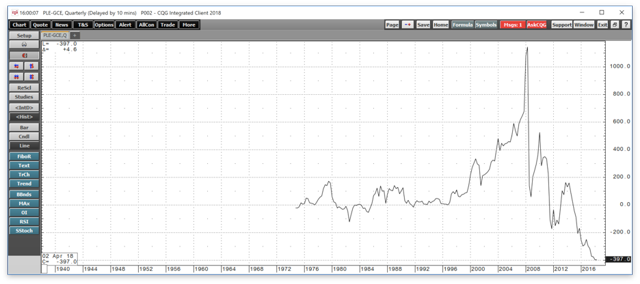

"Rich man's gold" has been a poor performer since 2014

Platinum's nickname is "rich man's gold," but it has been anything but that since 2014.

Source: CQG

The quarterly chart shows that platinum has spent the majority of its time trading at a premium to the price of gold since 1974. For more than four decades, platinum had been the most precious of the four metals that trade on the COMEX and NYMEX futures exchanges. The spread between the yellow metal and "rich man's gold" has ranged from a low of almost $450 per ounce discount over recent weeks, to a high of a more than $1140 premium for platinum in 2008. On May 9, the discount of platinum under the price of gold was trading at just under the $400 level, and since 2014, we have not seen gold trade at a price that is below platinum's.

Fundamentals favor a rebound in platinum

Gold and platinum are both precious metals, and while supply and demand fundamentals favor platinum, in the world of precious metals it is often investment demand that determines the path of least resistance of prices.

When it comes to annual output, platinum is more than ten times rarer than gold. Yearly platinum production is around 250 tons per annum with almost all of the output coming from South Africa and Russia. In Russia, the production of platinum is often a byproduct of nickel ores in the Norilsk region of Siberia. South African production is typically primary.

Gold production each year is approximately 2800 tons with output coming from all over the world. While South Africa was the world's leading producer in past years, China moved into first place over recent years. Most of the Chinese output is consumed domestically with the government taking the lion's share to build their strategic reserves of the yellow metal. Gold output comes from many countries around the world, and while it is a byproduct of the production of copper, lead, zinc, and other ores, most of the gold mined each year is primary production. Additionally, since platinum occurs deep in the crust of the earth, it tends to have a much higher production cost than gold.

When it comes to industrial applications for gold and platinum, the latter has many more requirements each year on a per ounce produced basis. However, investment demand has favored gold over the past decade. The ugly decline in platinum in 2008 that took the price of all-time highs at $2308.80 in March to lows of $761.80 in October, a drop of $1547 or over 67% in just seven months, likely caused many potential investors and speculators to avoid the platinum market like the plague. The liquidity in platinum is far lower than in gold. On May 8 total open interest in the gold futures market stood at 491,398 contracts or 49,139,800 ounces, while the same metric in platinum was at 80,411 contracts of 4,020,550 ounces. Average daily trading volume in the platinum futures market is typically around the 20,000-contract level or one million ounces. In gold, more than 300,000 contracts or 30 million ounces trade on an average day.

The volume and open interest metrics stand as examples that investment and speculative demand for platinum are far lower than for gold these days. However, less liquid markets are often more susceptible to volatility which could work in platinum's favor in the future when the price finally decides to make a move and recover.

Patience is a virtue, and the platinum-gold spread requires incredible fortitude

I have been trading precious metals since the early 1980s, and for most of my career platinum has traded at a premium to the price of gold. It is hard to ignore the compelling advantage that platinum has when it comes to supply and demand fundamentals. However, investors and other market participants have been going for the gold since 2014 and platinum has become a precious metal that the market has ignored.

Platinum may have fallen into disfavor over the past four years and since it caused some very unpleasant losses back a decade ago in 2008 but ignore the metal at your peril as it is only a matter of time before it makes a significant and substantial comeback. Platinum has been a mangy dog with fleas in the precious metals sector, but every dog eventually has its day.

Source: Barchart

The Physical Platinum ETF (NYSEARCA:PPLT) has net assets of $503.60 million and trades an average of 42,765 shares each day. PPLT has traded in a range from $78.30 to $189.20 since January 2010. At just under the $87 level on May 9, the ETF is a lot closer to its low than its high over the past eight years.

The platinum-gold spread at a $400 discount of platinum to the yellow metal continues to tell us that platinum is cheap compared to gold on a historical basis. Either gold is too expensive, or platinum is too cheap at current prices, or a bit of both is the base. When it comes to platinum, the current price level continues to be compelling for a long position, and risk-reward favors the upside. However, for almost four years, this has been one of the most frustrating trades in the market. Patience and fortitude are characteristics that are necessary when it comes to a long position in the platinum market. "Good things come to those who wait" according to the old saying. Platinum will eventually have its day, and I continue to buy the metal on every dip which has been a labor of frustration that I hope turns into one of love.

The Hecht Commodity Report is one of the most comprehensive commodities reports available today from the #2 ranked author in both commodities and precious metals. My weekly report covers the market movements of 20 different commodities and provides bullish, bearish and neutral calls; directional trading recommendations, and actionable ideas for traders. More than 120 subscribers are deriving real value from the Hecht Commodity Report.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author always has positions in commodities markets in futures, options, ETF/ETN products, and commodity equities. These long and short positions tend to change on an intraday basis.

Follow Andrew Hecht and get email alerts