Analysts Boost Price Forecasts on 4 Metals

Red Cloud Securities has a bullish outlook on gold, silver, copper and zinc now and through at least 2027, analysts noted in a thematic report.

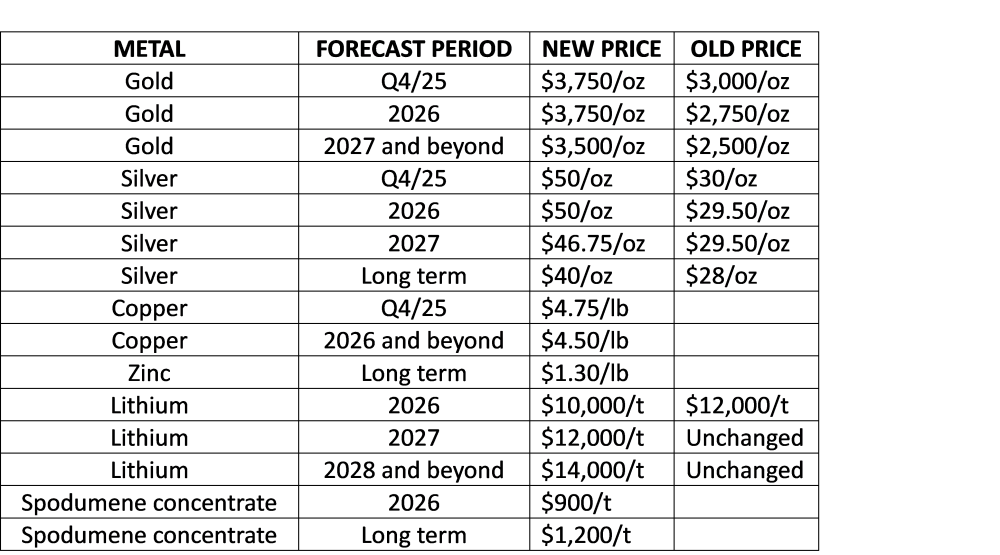

Red Cloud Securities raised its gold, silver, copper, and zinc forecasts for Q4/25, 2026, and 2027, its mining analysts reported in their Q4/25 Commodity Price Update dated Oct. 10.

"A remarkable precious metals run shows no signs of abating," the analysts wrote. "We are bullish on copper long term and have a solid outlook on zinc."

The analysts explained the rationale for their higher estimates in each metal.

'Gold Cold War'

The gold price has been breaking record after record in its current multiyear rally. This year alone, it is up 61%. Capital continues to flood into the yellow metal from central banks and investors.

"Central banks remain voracious buyers, led by China's aggressive accumulation of reserves and its new effort to position the Shanghai Gold Exchange as a global custodian for sovereign bullion," the analysts wrote.

As for investors, they have flocked to gold, given its safe-haven status, in the face of mounting global economic and geopolitical uncertainty.

Meanwhile, we are in a global dedollarization cycle without an end in sight, fueled by trade tensions, uncertainty about the long-term dominance of the U.S. dollar, and outflows of capital from the U.S.

"In our view, this is no longer just a bull market," the analysts wrote. "It's the opening phase of a global 'Gold Cold War,' where nations compete for monetary security, investors seek protection from policy volatility, and the metal's long-term trajectory looks decisively higher."

Also, the analysts expect future rate cuts by the U.S. Federal Reserve, rising inflation, and, ultimately, a weaker U.S. dollar. Anticipating these factors will "remain in place," they raised their gold price for Q4/24, 2026, and 2027 and beyond by about $100/oz.

Silver Outperforms Gold

Silver is up 84% year to date, and since May, it has outperformed gold. This is evidenced by the gold:silver ratio dropping to about 80:1 from roughly 100:1 during that time period.

"We are increasingly bullish on silver," wrote the analysts. "We expect the silver price to continue to keep pace with gold."

Looming Copper Deficit

The London Metal Exchange (LME) copper price rose about 22% this year to around $4.80 per pound ($4.80/lb). Accidents and disruptions at major mines in Chile, Indonesia, and the Democratic Republic of the Congo caused the recent run in copper prices.

Looking ahead, the analysts forecast a 6% decrease in U.S. copper demand next year, driven by U.S. trade wars and plummeting consumer demand.

"We see near-term price support and a rapid shift back to a deficit in 2027 as the global grid build-out continues to cope with the rise of artificial intelligence," the analysts wrote.

Zinc Supply to Increase

Red Cloud analysts' long-term zinc price is $1.30/lb, about where the London Metal Exchange zinc price is now.

Near-term availability of the metal is tight. However, mine supply of zinc is expected to grow over the next two years and peak in 2027, thanks to new projects coming online.

Lithium in Oversupply

During the summer, lithium carbonate and spodumene prices dropped to multiyear lows of about US$8,000 per ton ($8,000/t) and US$600/t, respectively. In August, they began moving up after supply disruptions at some Chinese mining operations. Since lithium carbonate has traded between US$9,000 and US$10,000/t.

"On continued oversupply concerns and weak demand in the short term, we are reducing our forecast for 2026 but leaving 2027 and beyond prices unchanged," wrote the analysts. "We are also increasing our spodumene concentrate prices slightly."

They pointed out that the premium lithium hydroxide had over lithium carbonate has had historically no longer exists.

"Constantly evolving battery technologies have prompted Chinese lithium producers to build flexibility into their production lines, allowing shifts in production between hydroxide and carbonate based on battery demand," the analysts explained.

Here is a chart of Red Cloud's updated metals forecasts:

Favorite Names Now

In their report, the Red Cloud analysts pointed out their Top Picks. They are:

Blackrock Silver Corp. (BRC:TSX.V; BKRRF:OTCQX)Kootenay Silver Inc. (KTN:TSX.V)Koryx Copper Inc. (KRY:TSX.V; KRYXF:OTCMKTS)Northisle Copper and Gold Inc. (NCX:TSX; NTCPF:OTCPK)Outcrop Silver & Gold Corp. (OCG:TSX.V; OCGSF:OTCQX; MRG1:DE)Strickland Metals Ltd. (STK:ASX)Troilus Gold Corp. (TLG:TSX; CHXMF:OTC; CM5R:FRA)

| Want to be the first to know about interestingBase Metals,Cobalt / Lithium / Manganese,Silver,Copper andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers, contractors, shareholders, and/or employees of Streetwise Reports LLC (including members of their household) own securities of Outcrop Silver & Gold Corp.Doresa Banning wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Disclosures for Red Cloud Securities, October 20, 2025

Disclosure Statement Updated October 20, 2025 Disclosure Requirement Red Cloud Securities Inc. is registered as an Investment Dealer and is a member of the Canadian Investment Regulatory Organization (CIRO). Red Cloud Securities registration as an Investment Dealer is specific to the provinces of Alberta, British Columbia, Manitoba, Ontario, Quebec, and Saskatchewan. We are registered and authorized to conduct business solely within these jurisdictions. We do not operate in or hold registration in any other regions, territories, or countries outside of these provinces. Red Cloud Securities bears no liability for any consequences arising from the use or misuse of our services, products, or information outside the registered jurisdictions. Part of Red Cloud Securities Inc.'s business is to connect mining companies with suitable investors. Red Cloud Securities Inc., its affiliates and their respective officers, directors, representatives, researchers and members of their families may hold positions in the companies mentioned in this document and may buy and/or sell their securities. Additionally, Red Cloud Securities Inc. may have provided in the past, and may provide in the future, certain advisory or corporate finance services and receive financial and other incentives from issuers as consideration for the provision of such services. Red Cloud Securities Inc. has prepared this document for general information purposes only. This document should not be considered a solicitation to purchase or sell securities or a recommendation to buy or sell securities. The information provided has been derived from sources believed to be accurate but cannot be guaranteed. This document does not take into account the particular investment objectives, financial situations, or needs of individual recipients and other issues (e.g. prohibitions to investments due to law, jurisdiction issues, etc.) which may exist for certain persons. Recipients should rely on their own investigations and take their own professional advice before investment. Red Cloud Securities Inc. will not treat recipients of this document as clients by virtue of having viewed this document. Red Cloud Securities Inc. takes no responsibility for any errors or omissions contained herein, and accepts no legal responsibility for any errors or omissions contained herein, and accepts no legal responsibility from any losses resulting from investment decisions based on the content of this report. Company Specific Disclosure Details

Company Name Ticker Disclosures Company Name Ticker Disclosures Aftermath Silver Ltd. TSXV:AAG Kesselrun Resources Ltd. TSXV:KES Aldebaran Resources Inc. TSXV:ALDE 1,2 Kootenay Silver Inc. TSXV:KTN 1,2,3 Alkane Resources Ltd TSX:ALK Koryx Copper Inc. TSXV:KRY 3 Apollo Silver Corp. TSXV:APGO 3 Loncor Gold Inc. TSX:LN 3 Argentina Lithium & Energy Corp. TSXV:LIT 3 Lumina Gold Corp. TSXV:LUM Aris Mining Corporation TSX:ARIS 1,2 Major Drilling Group International Inc. TSX:MDI Aurion Resources Ltd. TSXV:AU 3 NeXGold Mining Corp. TSXV:NEXG 3 Aztec Minerals Corp. TSXV:AZT 3 NorthIsle Copper and Gold Inc. TSXV:NCX 1,2,3 Blackrock Silver Corp. TSXV:BRC 1,2,3 Orosur Mining Inc. TSXV:OMI 3 Borealis Mining Company Limited TSXV:BOGO 3 Outcrop Silver & Gold Corporation TSXV:OCG 3 Brunswick Exploration Inc. TSXV:BRW 3 Seabridge Gold Inc. TSX:SEA 1,2,3 Cassiar Gold Corp. TSXV:GLDC 3 Silver Storm Mining Ltd. TSXV:SVRS 3 Cerrado Gold Inc. TSXV:CERT 7 Silver Viper Minerals Corp. TSXV:VIPR 3,6 Critical Elements Lithium Corporation TSXV:CRE Silver X Mining Corp. TSXV:AGX 3 Defiance Silver Corp. TSXV:DEF 3,8 SolGold Plc LSE:SOLG Denarius Metals Corp. NEOE:DMET 3 Southern Cross Gold Consolidated Ltd. TSX:SXGC 3 Empress Royalty Corp. TSXV:EMPR Southern Silver Exploration Corp. TSXV:SSV 1,2,3 Excellon Resources Inc. TSXV:EXN 3 Spanish Mountain Gold Ltd. TSXV:SPA 3 Falco Resources Ltd. TSXV:FPC Strickland Metals Limited ASX:STK 1,2 Galleon Gold Corp. TSXV:GGO Torex Gold Resources Inc. TSX:TXG 1,2 GR Silver Mining Ltd. TSXV:GRSL 1,2,3 Troilus Gold Corp. TSX:TLG 3 Grid Metals Corp. TSXV:GRDM 1,2 West Red Lake Gold Mines Ltd. TSXV:WRLG 1,2 Jaguar Mining Inc. TSX:JAG 3 Westhaven Gold Corp. TSXV:WHN 1,2,3 Japan Gold Corp. TSXV:JG 3

1. The analyst has visited the head/principal office of the issuer or has viewed its material operations. 2. The issuer paid for or reimbursed the analyst for a portion, or all of the travel expense associated with a visit. 3. In the last 12 months preceding the date of issuance of the research report or recommendation, Red Cloud Securities Inc. has performed investment banking services for the issuer. 4. In the last 12 months, a partner, director or officer of Red Cloud Securities Inc., or an analyst involved in the preparation of the research report has provided services other than in the normal course investment advisory or trade execution services to the issuer for remuneration. 5. An analyst who prepared or participated in the preparation of this research report has an ownership position (long or short) in, or discretion or control over an account holding, the issuer's securities, directly or indirectly. 6. Red Cloud Securities Inc. and its affiliates collectively beneficially own 1% or more of a class of the issuer's equity securities. 7. Robert Sellars, who is a partner, director, officer, employee or agent of Red Cloud Securities Inc., serves as a partner, director, officer or employee of (or in an equivalent advisory capacity to) the issuer. 8. Red Cloud Securities Inc. is a market maker in the equity of the issuer. 9. There are material conflicts of interest with Red Cloud Securities Inc. or the analyst who prepared or participated in the preparation of the research report, and the issuer. Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is determined by revenues generated from various departments including Investment Banking, based on a system that includes the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and client feedback. Analysts are not directly compensated for specific Investment Banking transactions.

Recommendation Terminology Red Cloud Securities Inc. recommendation terminology is as follows: o BUY - expected to outperform its peer group o HOLD - expected to perform with its peer group o SELL - expected to underperform its peer group o Tender - clients are advised to tender their shares to a takeover bid o Not Rated or NA - currently restricted from publishing, or we do not yet have a rating o Under Review - our rating and target are under review pending, prior estimates and rating should be disregarded. Companies with BUY, HOLD or SELL recommendations may not have target prices associated with a recommendation. Recommendations without a target price are more speculative in nature and may be followed by "(S)" or "(Speculative)" to reflect the higher degree of risk associated with the company. Additionally, our target prices are set based on a 12-month investment horizon. Dissemination Red Cloud Securities Inc. distributes its research products simultaneously, via email, to its authorized client base. All research is then available on www.redcloudsecurities.com via login and password. Analyst Certification Any Red Cloud Securities Inc. research analyst named on this report hereby certifies that the recommendations and/or opinions expressed herein accurately reflect such research analyst's personal views about the companies and securities that are the subject of this report. In addition, no part of any research analyst's compensation is, or will be, directly or indirectly, related to the specific recommendations or views expressed by such research analyst in this report.