Analysts: Buy These Low-Dollar Pharma Stocks

Oppenheimer expects one penny stock to more than double

Oppenheimer expects one penny stock to more than double

Penny stock AzurRx BioPharma Inc (NASDAQ:AZRX) is higher today, after analysts predicted the stock will more than double. Specifically, Oppenheimer initiated coverage of AZRX with an "outperform" rating and a $6 price target -- a premium of 140% to yesterday's close, and in record-high territory. Similarly, the shares of generic drugmaker Akorn, Inc. (NASDAQ:AKRX) are also higher, after Piper Jaffray upgraded the stock to "overweight" from "neutral," and lifted its price target to $9 from $5.

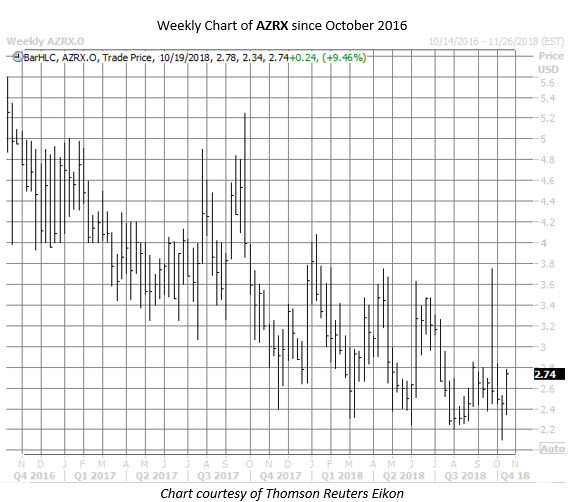

AZRX stock was last seen 9.5% higher to trade at $2.74. The equity touched a record low of $2.10 on Oct. 11, and has been in a channel of lower highs and lows since going public in late 2016. The new price target of $6 represents uncharted territory for AzurRx shares, which have never been north of $5.60.

Despite the equity's long-term downtrend, today's upbeat analyst attention merely echoes the current trend. Prior to today, the lone analyst following AZRX considered the stock a "buy," and the average 12-month price target of $8 is more than triple yesterday's close of $2.50.

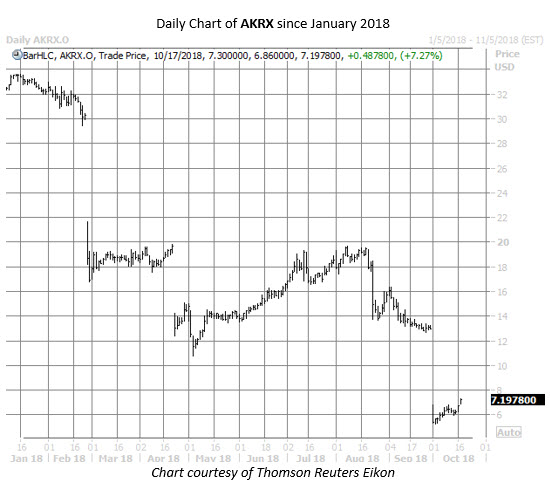

Akorn stock is up 7.3% at $7.20 in afternoon trading. However, the security still has quite a ways to go before erasing its latest bear gap -- the result ofa judge ruling that Fresenius (FMS) validly terminated its bid for Akorn and can walk away from the deal. AKRX touched a seven-year low of $5.25 on Oct. 2, but since then has gained roughly 37%.

All five analysts following AKRX maintain "hold" recommendations, likely in light of the M&A drama in 2018. However, recent options traders have been betting bullishly on the shares. This is indicated by the 10-day call/put volume ratio of 3.59 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), which ranks in the 86th percentile of its annual range. In simpler terms, options buyers have shown a healthier-than-usual appetite for long calls over puts during the past two weeks.