Anglo American 'shows off' - doubles profits, halves debt, pays highest divvy in a decade

Global miner Anglo American (LON:AAL) was full of good news Thursday as it announced it had doubled its net profit in 2017, slashed debt and said it would pay its highest dividend in a decade, thanks mainly to rising commodity prices and lower costs.

The company, the last of the world's largest miners to report annual results this month, said earnings before interest, tax, depreciation and amortization climbed 45% to $8.8 billion last year. Revenue jumped 19% to $26.2 billion, while pre-tax profits doubled to $5.5 billion.

Among the top global miners, Anglo's results are one of the most impressive, as it was on the brink of collapse in 2015.Iron ore, manganese and coking coal accounted for the bulk of Anglo's earnings last year at almost 60%, the company said.

Anglo, one of the miners hardest hit during the commodity prices crash of 2015 and 2016, was able to generate almost $5 billion of free cash flow in the 12 months to December, which allowed it to declare a full-year dividend of $1.02 a share - the highest it has paid in a decade.

From a debt load of about $13 billion only three years ago, the world's fifth largest diversified miner has now a $4.5 billion -balance, half of what it owed in 2016.

Rio Tinto, BHP and Glencore have all reported soaring profits, hefty dividends and lighter debt burden in the past month, but Anglo's results are one of the most impressive, as the company was on the brink of collapse in 2015, with a jaw-dropping $5.6 billion full-year loss, that forced it to sell dozens of mines and laying off thousands.

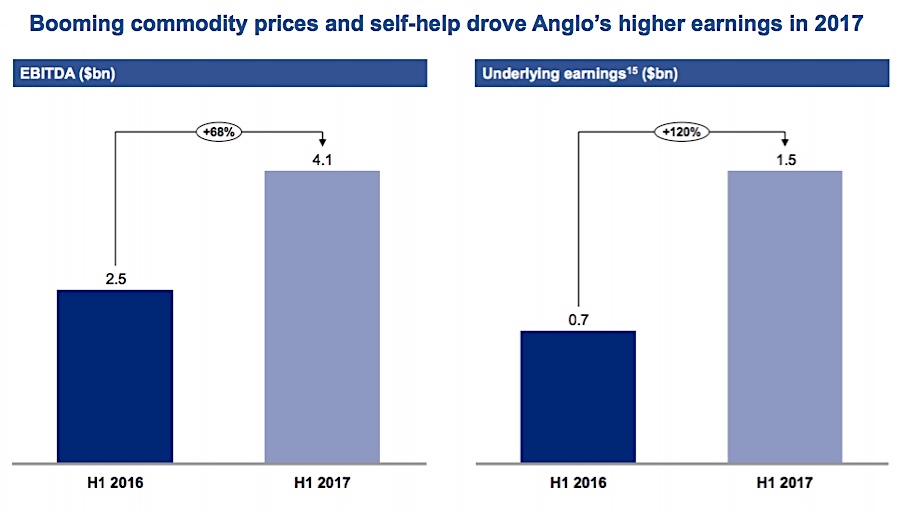

Taken from Anglo American 2017 results presentation.

"While we have already driven a material operational turnaround, we believe there is significant additional upside within the business both through further operating gains and from selected organic growth options," chief executive officer Mark Cutifani said in a statement.

He added the company is now targeting an additional $3-4 billion annual run-rate improvement by 2022 through cost reductions and improved productivity.

Watch CEO Mark Cutifani talking about Anglo American's results: