Anglo American to cut 85,000 jobs, dividend and assets in sweeping restructuring

Anglo American's overhaul reflects the dire straits the global mining industry is in these days. (Image: Screenshot from Anglo American video via YouTube)

Shares in Anglo American (LON:AAL) nosedived Tuesday after the miner announced drastic measures meant to cope with an ongoing rout in commodities prices, including massive lay offs, asset sales and an expected suspension of dividend payments.

The stock was trading 11.7% lower to 325.85 pence in London mid-afternoon, following Anglo's announcement of what it called a "radical portfolio restructuring," unveiled at today's investor day.

The company, which mines iron ore, copper, coal, manganese and nickel, said it would cut around 85,000 employees, or 63% of its workforce. The figure is far greater than the 53,000 positions the miner said it would cut in July.

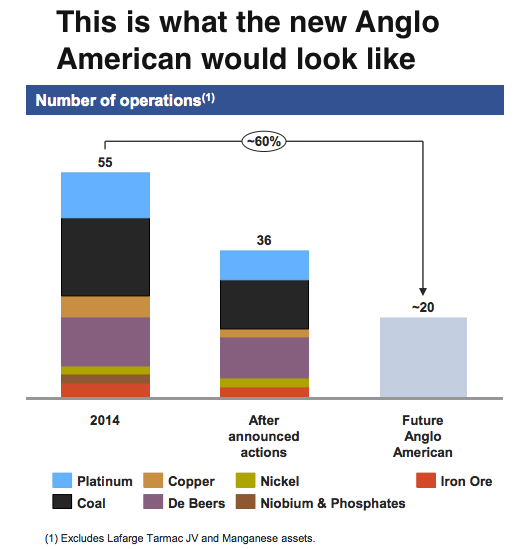

It also announced it would reduce its current assets from around 55 mines and smelters to the "low 20s" by the end of the restructuring.

The bone-deep cuts also include suspending dividend payments for a year, even though -according to chief executive Mark Cutifani- the company "has delivered on performance and business restructuring objectives."

"No one likes to suspend a dividend," Cutifani said. "We think it's the right thing to do to make sure the company remains in good shape." RBC said in a note Tuesday the dividend suspension is estimated to save Anglo about $1.7 billion through 2016.

The last time Anglo American cut its dividend was in 2009, during the depths of the global financial crisis.

A "very different" company

As part of Anglo American's drastic response to the relentless plunge in commodities, Cutifani said the company would consolidate its business into three units from six and increased its target for selling assets to $4 billion from its previous minimum of $3 billion, including the sale of its phosphates and niobium businesses.

Source: Mark Cutifani's presentation to investors, Dec. 8, 2015.

The pared-back business will remain broadly diversified among base metals such as copper, bulk materials such as coal and iron ore and diamonds, the company added.

Anglo American will be "a very different company" after it follows through on the restructuring plan, Cutifani promised.

The miner became this year the second-worst performer in the FTSE 100 after Glencore (LON:GLEN). It has lost about 73% of its value since January.