Anglo close to selling part of stake in giant Peruvian copper project

Anglo American (LON:AAL) may sell close to 30% of its $5.5-billion Quellaveco project in southern Peru to Japanese companies, including Mitsubishi, which already has a 18% stake in the asset, considered the world's next major copper mine.

The miner, which has already invested over $1 billion in Quellaveco since acquiring the property in 1992, had said its board would not make a final investment decision until it has de-risked the project by reducing its 82% holding in the copper asset.

Chief executive Mark Cutifani has repeatedly said he wants to keep at least 51% of Quellaveco, which has the capacity to generate 225,000 tonnes of copper a year.Chief executive Mark Cutifani told investors last year he wanted to keep at least 51% of Quellaveco, which has the capacity to generate 225,000 tonnes of copper a year, adding he had been "engaging" with potential parties interested in joining the project.

As an existing partner, Mitsubishi has an option to increase its stake in Quellaveco to 30%, sources familiar with the matter told Reuters on Thursday. The company may have to fend off fellow Japanese trading houses Sumitomo, Mitsui, JX Nippon Mining & Metals and Itochu, all of which are said to be about to present Anglo with a formal offer.

Quellaveco has the permits needed for its development but has been stalled since 2013.

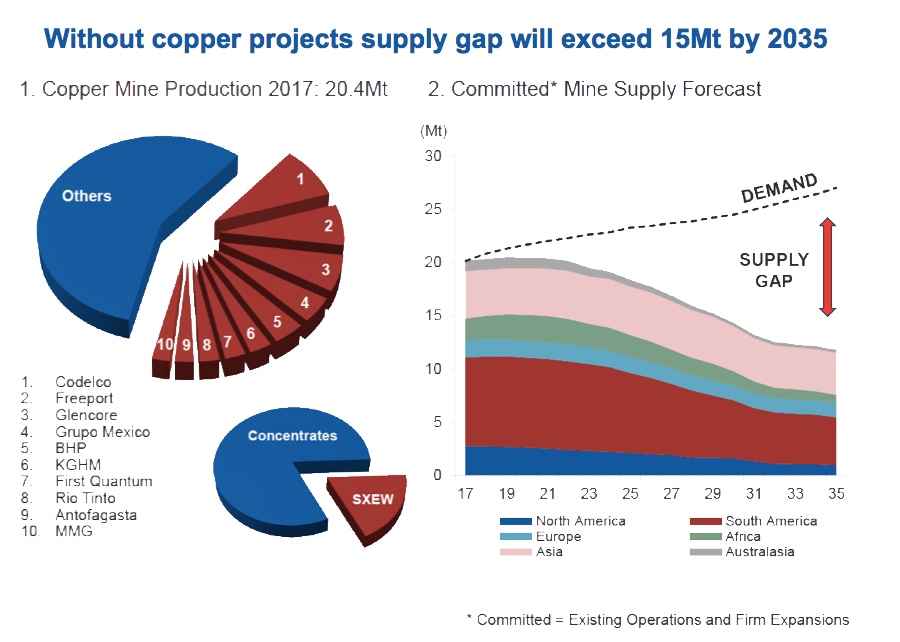

Now that producers are emerging from a sharp price downturn with stronger balance sheets and healthy margins, they are also looking at increasing their exposure to copper, as demand for the metal is expected to surpass supply as early as 2020.

Graph courtesy of Hamish Sampson | Analyst at CRU's Copper Team.

The situation looks even worse when considering that over 200 copper mines currently in operations will reach the end of their productive life before 2035.

Additionally, the current copper pipeline is at the lowest seen this century, both in terms of number and capacity of projects.

According to CRU analysts, only if every single copper project currently in development or being studied for feasibility is brought online before then, including most discoveries that have not yet reached the evaluation stage, the market could meet projected demand.