Anglo finds returns outweigh risks as it renews Africa focus

Anglo American Plc is going where larger rivals fear to tread, returning to its African roots to tap mineral assets with compelling returns.

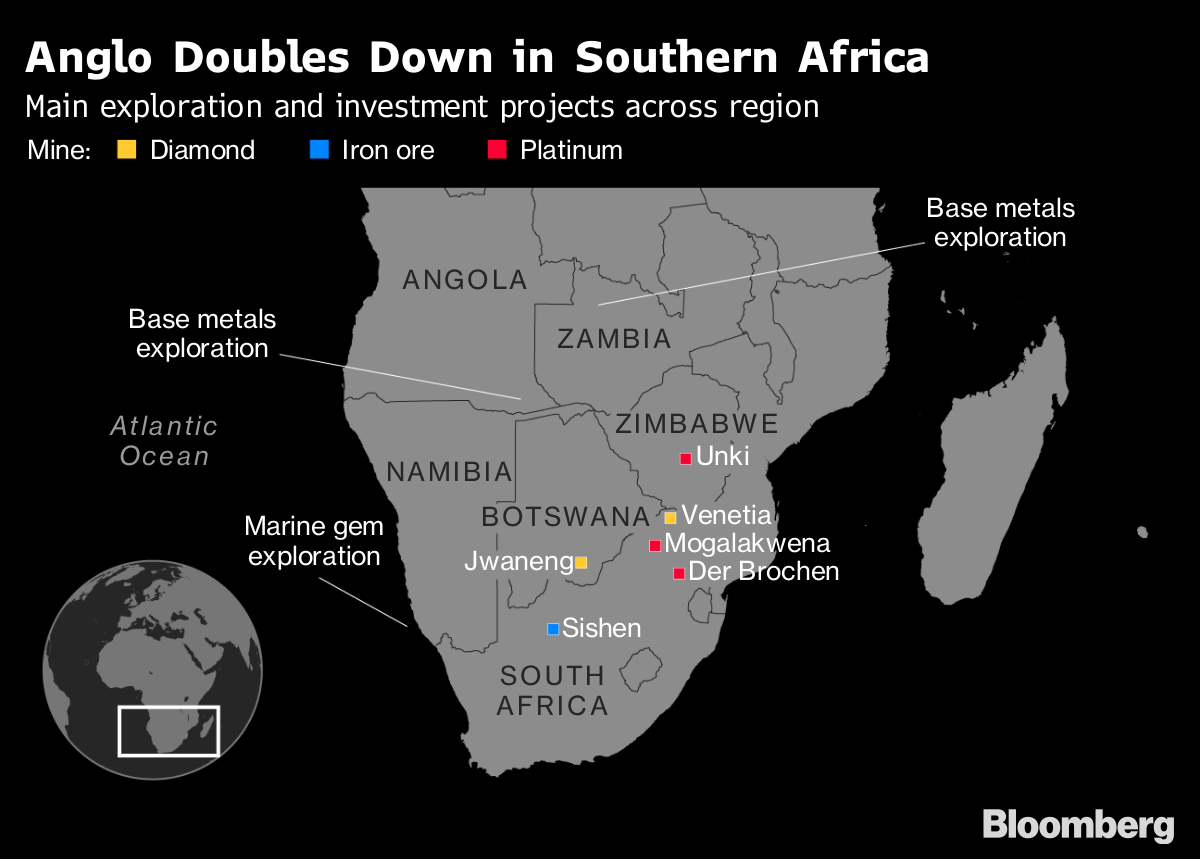

The storied mining company, founded by Ernest Oppenheimer in Johannesburg a century ago, is devoting a third of its exploration budget to the continent, including searching for copper and cobalt in Angola and Zambia. In South Africa, it's investing in platinum, diamond and iron-ore mines that are spitting out cash.

The miner is devoting a third of its exploration budget to the continent.The London-based company is betting that Africa can deliver a portfolio of new ore bodies, even as BHP Billiton and Rio Tinto Group largely shun the continent and focus on returning cash to shareholders. It's a reversal of Anglo's almost two-decade retreat from a continent that long weighed on its shares, but the miner retains a higher tolerance for risk in what used to be its backyard.

"They are working toward projects that can form the pipeline 30 years from now," said Hunter Hillcoat, a London-based analyst at Investec Securities Ltd. "Anglo is the only one working there and they have better comfort within the region, geographically."

After a collapse in commodity prices in 2015, the mining blue-chip talked about selling assets in South Africa, the home of its biggest diamond, iron ore and platinum mines. Early last year, Anglo confirmed that plan was dead. While exiting some higher-cost operations, its remaining mines in the country are the company's biggest cash contributors.

Glittering Prize

Now Anglo is doubling down on those assets: it plans to spend $2 billion developing underground deposits at Venetia, the biggest investment in a South African diamond mine in decades. Another $4 billion will be invested in iron ore, manganese and coal over the next five years.

"South Africa punches above its weight," Anglo Chief Executive Officer Mark Cutifani said earlier this year.

Anglo's shares have gained 13 percent this year, making them the best performers on the 11-member FTSE 350 Mining Index. The stock was up 3.2 percent as of 10:02 a.m. in London.

Further north, changes to Angola's mining code have persuaded Anglo to add copper exploration to its diamond prospecting activities. The Angolan government has identified an extension of the Copperbelt, the world's largest resource of the metal that stretches from Zambia through the southern part of the Democratic Republic of Congo.

"We are applying for exploration concessions to explore for base metals," said James Wyatt-Tilby, a spokesman for Anglo.

While Anglo exited its Zambian copper mines more than 16 years ago, a four-fold increase in prices has spurred the company to reconsider the prospects. The mining company is also more at ease than its rivals with the tough tax regimes found in places such as Zambia, said Ben Davis, an analyst at Liberum Capital.

"Anglo would like to have more exposure in the region but first they have to find the assets," Davis said.