Another Fear-Driven Affair For Gold

Gold is threatening to break out out of its lateral trading range again.

A rally while the dollar is strong is not ideal for gold's long-term health.

Evidence shows that increased fear is the driving force behind gold.

For the second time this year we're seeing a market condition in which the gold price is being driven almost exclusively by fear. And while this condition can be quite profitable for gold investors and traders in the short term, rallies driven by fear tend to reverse quickly once investors' worries have subsided. In this report we'll discuss the reasons why gold investors should proceed with caution in the coming weeks as gold is becoming increasingly vulnerable to a sharp corrective pullback.

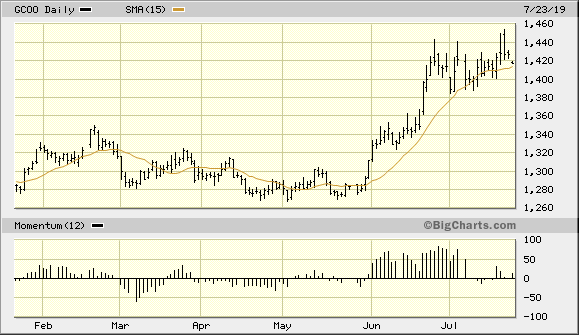

For most of July, the price of gold has remained in a fairly well-defined lateral trading range between roughly the $1,385 and $1,440 levels. This has been in keeping with my outlook since earlier this month of a period of consolidation for gold. After the steep run-in in the gold price in June, the gold price became over-extended from its widely watched 50-day moving average, thus creating a condition in which gold was vulnerable to a bear raid. To counteract the selling attempts on the part of the bears, gold entered a sideways trading range, which allowed the bulls to maintain control of gold's dominant short-term trend without giving back any of the metal's gains from last month.

Source: BigCharts

This consolidation phase has served gold investors well so far this summer by allowing them to retain most of their gains since the commencement of the metal's turnaround. Yet in recent days gold has made at least two lively attempts at breaking out of its trading range and pushing onward to higher levels. While the gold bulls definitely want to see higher prices, I would argue that the time is not yet ripe for gold's next sustained rally phase. Some additional consolidation of the gold price would be ideal before the metal attempts its next breakout higher. But as experienced participants know all too well, the market doesn't always give us what we want.

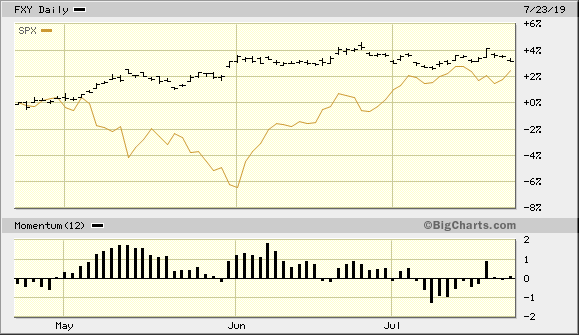

What seems to be happening in the gold market right now is that a growing number of investors are turning to gold as a safety hedge against a possible downward turn in the global equity market. The rise in the overall level of fear among investors can ascertained by the fact that other traditional safe-haven assets are outperforming equities right now on a short-term basis. For instance, the Japanese yen currency has long been regarded as a hedge against global market volatility. And as the following graph shows, the Invesco CurrencyShares Japanese Yen Trust (FXY), my favorite yen proxy, has outperformed the benchmark S&P 500 Index (SPX) for much of this summer.

Source: BigCharts

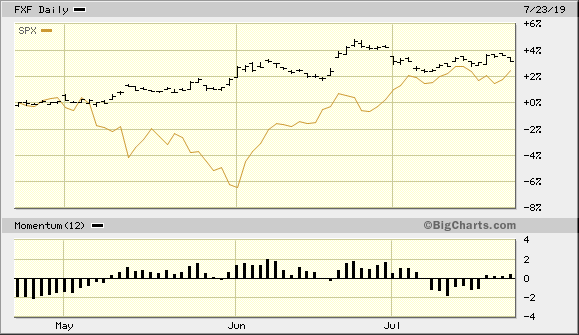

Another traditional safe-haven asset is the Swiss franc currency. As shown here, the Invesco CurrencyShares Swiss Franc Trust (FXF) is also outperforming the SPX. This doesn't normally happen unless there is genuine widespread concern over the global economic or financial market outlook.

Source: BigCharts

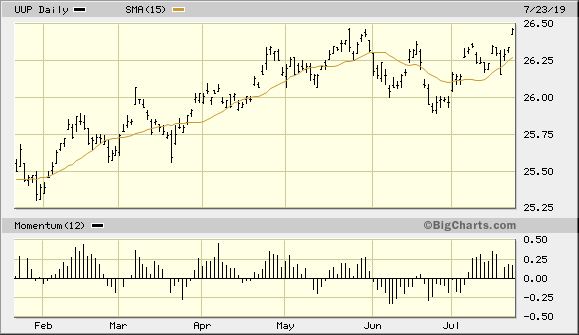

Yet another sign that gold's demand right now is primarily fear-based can be established by observing the recent performance of the U.S. dollar. While the dollar index itself hasn't yet made a new yearly high, the Invesco DB U.S. Dollar Index Bullish Fund (UUP) - my favorite dollar index proxy - established a new high for the year on July 23. This suggests that global investors are turning to the dollar in order to flee weaker local currencies. The dollar's latest strength may also be a result of investors liquidating foreign stocks and using the U.S. currency as a temporary haven.

Source: BigCharts

Yet the overall impact of a stronger dollar is that it typically weighs against the gold price since gold is priced in dollars. Despite the dollar's strength, however, gold is showing no signs of succumbing to it. Historically, whenever gold ignores a rising dollar for any length of time it means that investors are so worried about the financial market outlook that they're willing to buy gold in spite of a strengthening dollar. In other words, when gold and the dollar rally together it means that fear is the primary driver in the market.

As we've seen on more than one occasion since last autumn, fear is a powerful emotion which can propel gold prices to vertiginous heights. With the uncertainty being generated by the latest U.S. corporate earnings season, combined with increasing tensions in the Middle East and an ongoing U.S.-China trade war, gold has plenty of fuel for a continuation of its fear-driven rally in the coming weeks. However, with the dollar still rising and with fear being the main impetus behind gold's rally, investors should be prepared for a potentially sharp reversal of gold's rising trend at some point later in the summer.

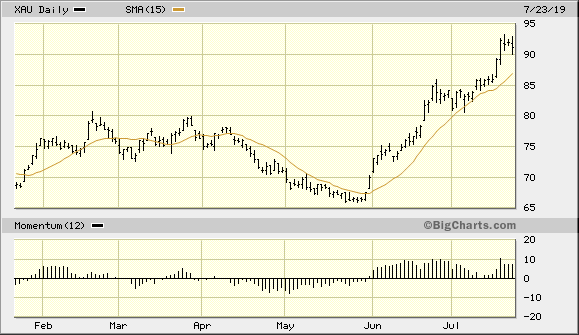

The obvious question that arises from this observation is, "How will we know that gold's trend is in imminent danger of reversing?" My answer is that the gold mining stocks should provide a helpful clue as to when gold's next trend reversal will occur. As we've talked about in past reports, the PHLX Gold/Silver Index (XAU) is often a useful leading indicator for the yellow metal itself. Investors typically buy gold stocks in order to leverage a rally in the bullion price. But when far-sighted investors perceive that the days are numbered for gold's rally, they'll usually react by liquidating the shares of companies which mine the metal. It thus often happens that the XAU index will reverse its rising trend before the gold price does the same.

Source: BigCharts

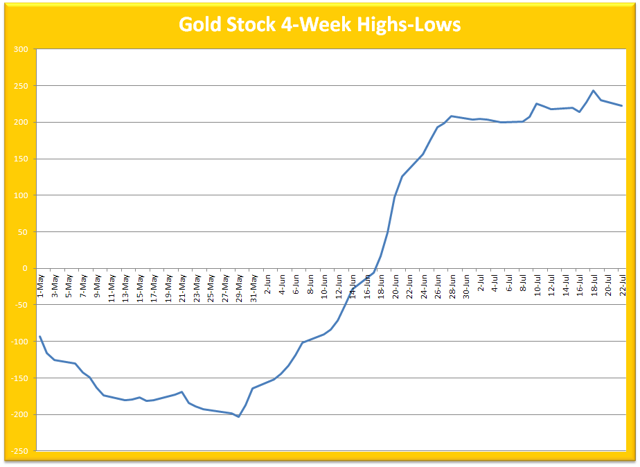

Another sign that trend reversal for the gold mining stocks is imminent will be provided by the following indicator. This is a 4-week rate of change oscillator of the new highs and lows for the 50 most actively traded U.S.-listed gold mining stocks. As long as this indicator is rising it indicates that the near-term path of least resistance remains up for gold stocks in the aggregate. The benign trend in this indicator since May reflects the increasing demand for gold stocks on an incremental basis. When, however, the number of gold stocks making new highs begins to shrink it will be time to consider selling the mining shares. As you can see here, this indicator is still confirming a bullish trend for the precious metals mining sector.

Source: NYSE

At some point, the worry-driven gold rally of the last several weeks will reverse as the prevailing emotion of fear dissipates. While gold's fear-driven bull market will likely continue this summer, at some point the market's concerns over the global economic outlook will be adequately addressed and subsequently discounted. When this happens it will be time for investors to take profits in the yellow metal. We should know when this time arrives by observing the gold stock internal momentum indicator mentioned above, along with the action in the XAU index. Right now, though, both the XAU and the gold price remain above the rising 15-day moving average which means that the dominant immediate-term (1-4 week) trend is still up. Investors are therefore justified in remaining long gold and the gold mining stocks.

On a strategic note, I'm currently long gold via the VanEck Vectors Gold Miners ETF (GDX). For this ETF I'm using a level slightly under $26.00 as a stop-loss on an intraday basis. Participants who haven't done so should also book some profit in GDX after its impressive run of the last few weeks.

Disclosure: I am/we are long GDX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts