Another Precious Metals' Reversal Coming Right Up! / Commodities / Gold & Silver 2019

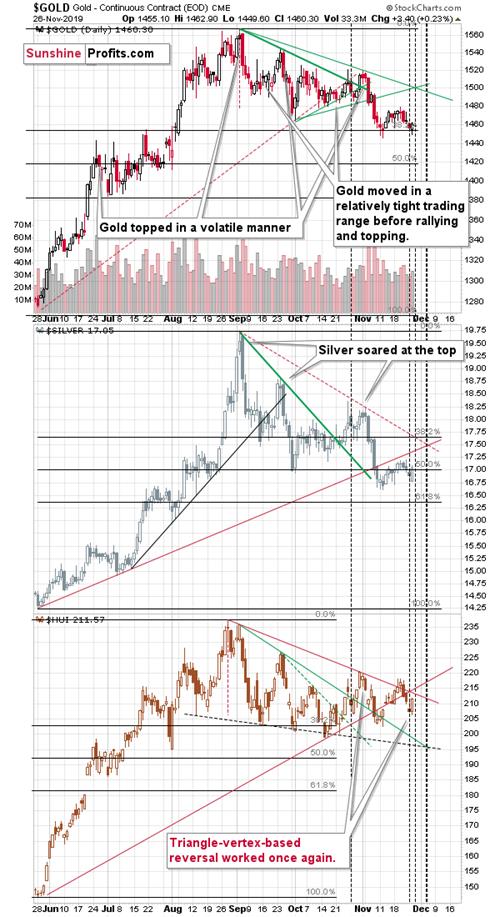

Goldreversed yesterday, and so did the rest of the precious metal sector.Mining stocks and – what’s important – silver showed strength relative to goldand rallied even more than gold. Silver’s strength is important because itindicates that we are already in the second half of the short-term upswing inthe precious metals market. If there only was a tool that would provide us witha more precise time prediction… Oh wait, there is one. And it just workedperfectly yesterday.

PreciousMetals’ Upcoming Reversal

Thetechnique is called the triangle-vertex-based reversal, but let’s just call it trianglereversals.When the rising support line crosses the declining resistance line, we have avertex of a triangle. This vertex marks a moment when we are likely to see somekind of reversal. Sometimes it’s relatively clear in advance what sort ofreversal we are likely to see, and at times it becomes clear only right beforethe reversal.

Itwasn’t 100% clear recently, but after prices declined on Monday, we wrote thatthe turnaround is very likely. It was confirmed by the pre-market price actionas well. However, what happened during the session made it even more obviousthat we saw the start of yet another quick upswing. What’s not to like aboutsuch a bullish set of circumstances?

Whatwe saw yesterday was not the only triangle reversal on the horizon. In fact,there’s one today and one early next week. Since this is the Thanksgiving weekend,the odds are that the particularly significant market action will be pushed offuntil the next week. But, once we’re there, things could get very hot verysoon.

TheTrue Seasonalityof gold confirms the above.

On average,gold price has been spiking around late November and early December. November 26 ismarked right on the goldchart.That’s the last pause before the final spike high in gold that is then followedby a decline to mid-December. This seasonality perfectly confirmswhat we can see based on the triangle reversals and what we can infer fromsilver’s relative strength.

Pleasenote that while on average gold performs best in late November, the accuracyreading actually rises strongly in the next several days. This means that whilethe biggest price moves usually happened sooner, some of them were a bit late.In case of the times when gold soared sooner, it didn’t decline immediately.The take-away here is that even if the above forecastfor gold is not 100% correct, and price spike doesn’t happen right away, it means thatit’s still likely to arrive shortly.

Basedon the triangle reversals, gold’s True Seasonality, and other factors, thefollowing week is likely to include an important top in gold, silver, andmining stocks.

Apartfrom outlining the take-profit targets of our long position opened rightafter the November 12 reversal, the full version of thisanalysis features a helpful hint from yesterday’s action in mining stocks, andthe analysis of both forthcoming precious metals’ triangle turning points, andsilver Q4 2019 seasonality. Bottom line, these are invaluable tools in planningwhen and where to profitably switch market sides – just as our precedingsuccess with the earlier short position. Please note that you can stillsubscribe to these Alerts at very promotional terms – it takes just $9 to readthe details right away, and then receive follow-ups for the next three weeks. Profitalong with us.

The above article is asmall sample of what our subscribers enjoy on a daily basis. Check more of ourfree articles on our website, including this one – just drop by and have alook. Weencourage you to sign up for our daily newsletter, too - it's free and if youdon't like it, you can unsubscribe with just 2 clicks. You'll also get 7 daysof free access to our premium daily Gold & Silver Trading Alerts to get ataste of all our care. Sign up for the free newsletter today!

Thank you.

PrzemyslawRadomski, CFA

Editor-in-chief,Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care

* * * * *

All essays, research and information found above represent analyses andopinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. Assuch, it may prove wrong and be a subject to change without notice. Opinionsand analyses were based on data available to authors of respective essays atthe time of writing. Although the information provided above is based oncareful research and sources that are believed to be accurate, PrzemyslawRadomski, CFA and his associates do not guarantee the accuracy or thoroughnessof the data or information reported. The opinions published above are neitheran offer nor a recommendation to purchase or sell any securities. Mr. Radomskiis not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFAreports you fully agree that he will not be held responsible or liable for anydecisions you make regarding any information provided in these reports.Investing, trading and speculation in any financial markets may involve highrisk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees andaffiliates as well as members of their families may have a short or longposition in any securities, including those mentioned in any of the reports oressays, and may make additional purchases and/or sales of those securitieswithout notice.

Przemyslaw Radomski Archive |

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.