Antofagasta copper output up in Q2 despite Los Pelambres pipeline issue

Chilean miner Antofagasta Plc. (LON:ANTO) said Wednesday that copper production in the second-quarter of the year jumped 6.1% to 163,200 tonnes, while costs fell by 7.5% to $1.85 per pound.

Higher output at its Centinela and Antucoya mines mitigated declines at Los Pelambres and Zald?-var.The company, majority-owned by Chile's Luksic family, one of the country's wealthiest, said it expected the higher-output/lower-cost trend to continue for the rest of the year.

Production at its flagship Los Pelambres mine came to 78,000 tonnes, 3.8% lower than the previous quarter, due to a blockage in the concentrate pipeline in April and May. But higher output at Centinela and Antucoya mines mitigated declines at Antofagasta's biggest mine and Zald?-var.

The mining operation and the processing plant continued to operate normally during the situation. Concentrates containing 9,200 tonnes of copper were stockpiled at the plant, which will be pumped down to the port in the third quarter.

Full-year production guidance was maintained at between 705,000-740,000 tonnes, compared to 704,300 tonnes produced in 2017. Net cash costs were kept at $1.35 per pound.

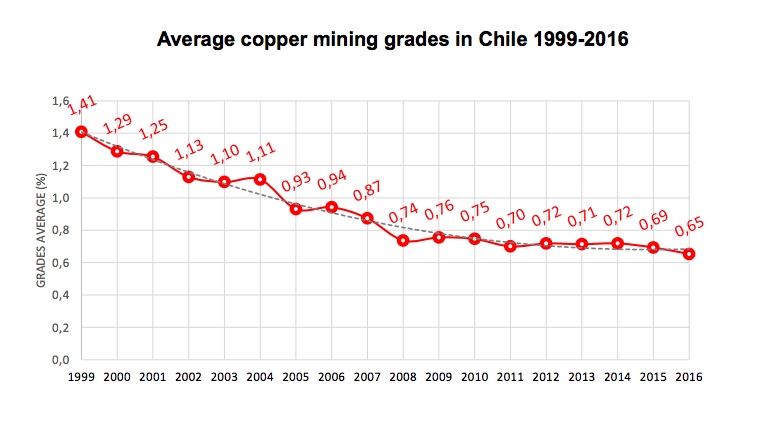

The decrease in ore grade in Chile has been higher than the world average. (Courtesy of Chilean copper commission Cochilco.)

"With the smaller operations appearing challenged at the moment, achieving much more than the bottom end of guidance could be a stretch," BMO Capital Markets analyst Edward Sterck said in a note to investors Wednesday, warning that output would have to jump at least 22 percent to meet targets.

Copper miners in mature markets, particularly in Chile, which is the world's top producer of the red metal, have seen production costs rise as they need to dig deeper and process larger amounts of rock to obtain the same amount of copper they used to a decade ago.