Antofagasta cuts copper output guidance, sees increase in 2019

Chilean miner Antofagasta Plc. (LON:ANTO) said Wednesday that copper output for the first nine months of the year fell 4 percent, but it forecast an increase in production in 2019 as grades begin to improve at its operations.

The company, majority-owned by Chile's Luksic family, one of the country's wealthiest, said year-to-date copper production declined to 505,500 tonnes, from 526,500 tonnes in the first nine months this year.

Company now expects to produce between 705,000-725,000 tonnes of copper this year, down from the earlier 705-740,000 tonnes target.As a consequence, the miner adjusted down its production guidance for 2018 to 705,000-725,000 tonnes from the previous 705-740,000 tonnes, but maintained its net cash cost target $1.35 per pound.

"The physical copper market continues to look tight and the outlook for next year remains positive despite ongoing fears about disruptions to global trade," Chief Executive Officer Iv??n Arriagada said in the statement.

Arriagada noted the company expected copper production volumes to be "particularly strong" in the final quarter of the year, after a 15.4 percent increase in third-quarter production to 188,300 tonnes compared to the prior three-month period.

Gold production also dropped, but by much more - 30.1 percent to 120,100 ounces - due to lower grades at its Centinela mine.

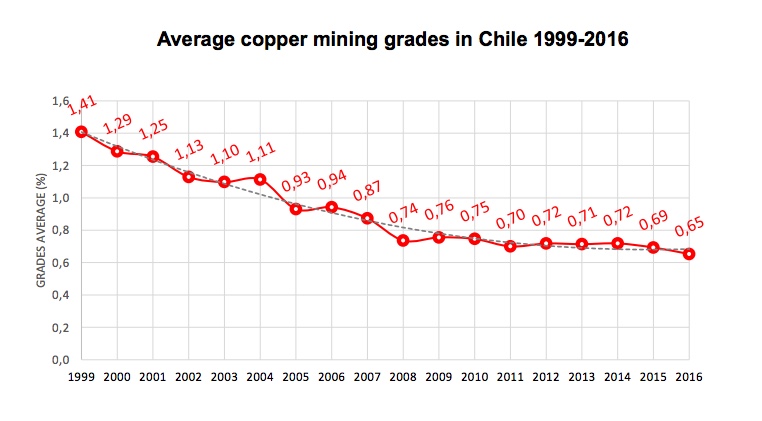

Copper miners in mature markets, particularly in Chile, which is the world's top producer of the red metal, have seen production costs rise as they need to dig deeper and process larger amounts of rock to obtain the same amount of copper they used to a decade ago.

The decrease in ore grade in Chile has been higher than the world average. (Courtesy of Chilean copper commission Cochilco.)

The company, however, said it expects capital expenditures for the year to be lower than the $1 billion it previously forecast.

Antofagasta also noted the physical copper market continues to look tight, but said the outlook for next year remains positive. It said it expects copper production in 2019 to increase to between 750,000-790,000 tonnes.