Apple, Chip Stocks Lead Surge on Wall Street

The Dow, S&P, and and Nasdaq are all higher at midday

The Dow, S&P, and and Nasdaq are all higher at midday

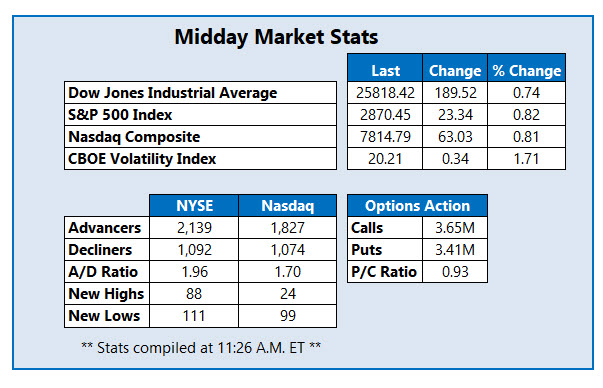

It's a strong start to the week for the Dow Jones Industrial Average (DJI), as President Donald Trump's trade commentsspark optimism on Wall Street. The blue-chip index has put on roughly 190 points, led by trade-sensitive Apple (AAPL), which has gained nearly 2%, and retailer Nike (NKE) stock, which is up 1.5%. Chip stocks, including Advanced Micro Devices (AMD) and Micron Technology (MU), are getting a huge boost, too, leading the S&P 500 Index (SPX) and Nasdaq Composite (IXIC) higher, as well.

Continue reading for more on today's market, including:

Analysts are losing hope fast for suffering Foot Locker stock. Cowen thinks this brand new weed stock could double. Plus, options bulls favor AMD amid chip sector's surge; ARCI stock skyrockets on recycling center opening; and MOGU's revenue flop sparks selloff.

Bulls are swarming chip stock Advanced Micro Devices, Inc. (NASDAQ:AMD), as the shares climb on a sector boost. So far, 156,000 calls have crossed the tape, 1.4 times what's typically seen at this point. The weekly 8/30 32-strike call is seeing the most action, and it looks like the bulk of these contracts are being bought to open. AMD is up 3.3% at $30.47, which means these traders are expecting even more upside for the stock by the time these contracts expire at the close this Friday, Aug. 30.

Appliance Recycling Centers of America, Inc. (NASDAQ:ARCI) is one of the top stocks on the Nasdaq today, after the company's subsidiary, ARCA Recycling, announced the opening of its new recycling center in Syracuse, New York. The equity is on course for its highest close in nearly a year, as well as its fourth straight win. At last check, ARCI is up 95.1% at $6.83.

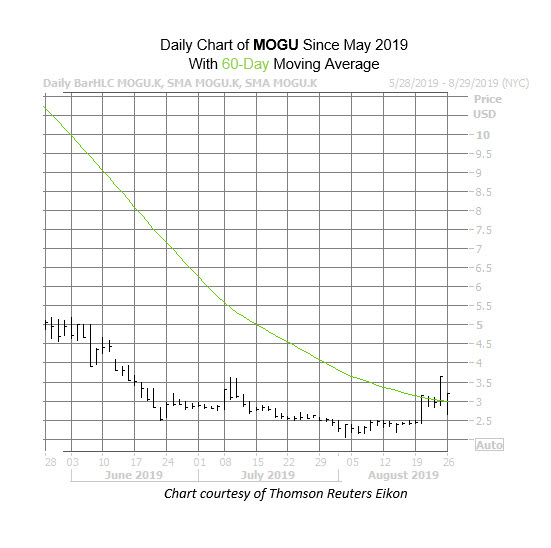

One of the worst performers on Wall Street is Mogu Inc (NYSE:MOGU), after the China e-commerce name reported a drop in first-quarter revenue, due to marketing revenue weakness. The security is down 14.1% at $3.12, testing its footing atop its 60-day moving average -- a trendline the equity has only finished north of twice since its formation.