Applying Livermore Wisdom to 2024

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market, and explains why he believes investors should stay focused on goldandcopper.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market, and explains why he believes investors should stay focused on goldandcopper.

47 years ago, when I was training to become a crackerjack peddler of securities, I befriended a senior trader ("Jimmie") who dealt with some of the biggest names in the Bay Street institutional community. He had received his training in New York as a specialist on the old American Stock Exchange, where he would have after-hours soirees with the likes of Art Cashin and Louis Rukeyser (of Wall Street Week fame). He shunned the Yankees and Knicks but became an avid NY Rangers fan and idolized Vic Hadfield and Rod Gilbert, wingers on the legendary GAG ("Goal-A-Game") line of the 1970s. When he found out that I had a crack at the NHL in 1976, he began calling me every other day from the NYSE floor and shouting hockey questions at me over the din of hundreds of carbon units (human traders) that dominated the NYSE before the 'bots took over.

In return for my incredibly brilliant answers to his inquiries, he fed me information on stocks that were "running" or where there was unusual accumulation, such as the oil stocks back in the Arab embargo '70s. Far more important than the "hot tips," however, Jimmie fed me books. Dozens upon dozens of books would arrive in the mail, but the one he described as "The Stock Trader's Bible" was "Reminiscences of a Stock Operator" written by Edwin Lefevre, focusing on the life of legendary stock trader Jesse Livermore.

Livermore made and lost hundreds of millions of dollars during an era (1920's and 1930's) when a million dollars was "real money." Eclipsing the stories about his fabulous wins, the value of the book lies in his description of the losses and the aspect of human emotion from which they germinated. There is a wonderful chapter where he describes what it means to be a "sucker."

A "sucker" back in the '20s was a gullible rube that could be found in a rigged poker game or Ponzi scheme, and he always lost money. "Old Turkey," as Livermore was called in the book, described the various grades of suckers. There was the rookie first-time investor who makes all the mistakes that greenhorns make; then there was the "semi-sucker," the academic who could quote passages from every investment book ever written.

He knew every trick in the book, but he failed to absorb the wisdom that comes with actual trading. The third kind of sucker was the "Wall Street Fool" the seasoned trader that has done his homework and entered into a trade that he knows is right but falls victim to outside opinions. He describes the personality of the individual talking him out of the trade beautifully, and there is no better analysis than the one offered in this quote:

"To learn that a man can make foolish plays for no reason whatever was a valuable lesson. It cost me millions to learn that another dangerous enemy to a trader is his susceptibility to the urgings of a magnetic personality when plausibly expressed by a brilliant mind."

Think about it. A "magnetic personality when plausibly expressed by a brilliant mind. . ."

How many times have I been talked out of a trade or investment that I know is a winner because I listened to a so-called "authority" deemed smarter than me?

CNBC is a classic example of a "news" service that get the lion's share of its revenues from Wall Street. As such, they are actually not a news service; they are an extremely high-powered investor relations arm for the companies that advertise. The purpose of the CNBC anchors is to maintain interest in the U.S. equity markets; it is not to promote accurate and fair reporting of the data that drives earnings and cash flow for the listed companies.

The reason I bring this up is that if one really dives down and goes beneath the veneer of the current Wall Street narrative, you will see that the Achilles' Heel to the entire bullish theme for 2024 (and beyond) is debt, a topic rarely (if ever) discussed by the anchors or the guest commentators paid to spout intellectually-superior tidbits about "cash-on-the-sidelines."

The reason that debt is avoided is that it is the atomic bomb threatening the paper markets. Once the global investing public recognizes that the entire U.S. banking system is teetering on the brink of abject insolvency, they will sell and seek out the one asset that bears no counterparty risk and which has protected citizens from the debasement of the purchasing power of their savings for five-thousand years. That asset is gold.

People relying on the narrative created and promoted by the Wall Street spinmasters are precisely the kind of "suckers" that listen to quasi-experts and load their 401K's and RRSPs with paper in the face of ever-expanding debt and unsustainable deficits. To put it bluntly, It won't matter where NVidia trades if the currency of settlement is worthless.

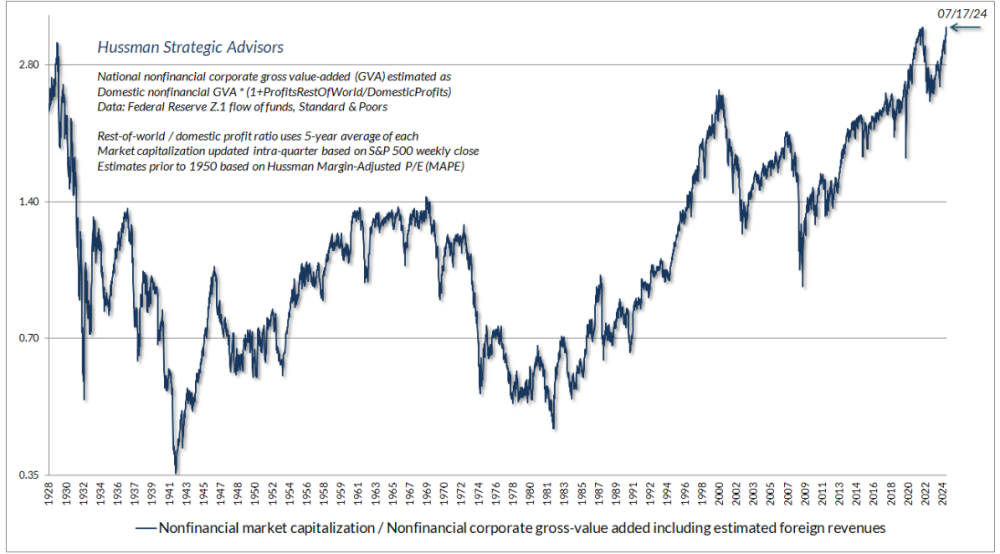

I have an opinion, a stance, on the risk associated with owning U.S. common stocks. The chart that best illustrates my intense resistance to the CNBC narrative is the one shown below (courtesy of John Hussman of Hussman Funds). The "stocks are cheap" mantra that is beautifully espoused by "magnetic personalities when plausibly expressed" is constantly trying to alter my stance and, by default, is demanding that I commit the Jesse Livermore Sucker #3 error and energetically join the party. I can assure you that I will not.

Gold/GLD/Silver

I learned many, many years ago that any rally in gold that failed to include silver as the leader within the precious metals complex was doomed to failure. As you all know, I have been harping on this for weeks, and for this reason, I elected to hold onto my gold and gold miner hedges despite the urgings of the masses that we should be mortgaging the farm to buy silver.

I have read tome after tome in the past few years describing the current global silver market as "tight," meaning that demand is outstripping supply and creating a guaranteed moonshot to $300 per ounce. The counterargument lies in a story I was told by a Glencore mining engineer a few years back to whom I was trying to "pitch" a 30-million-ounce Peruvian silver deposit. This gentleman was in his late sixties and had years of experience in the copper-zinc field moving millions of tonnes of waste rock around mine sites, so he must have known what he was talking about when he said, "Son, we have ten times that amount (of silver) in our slag heaps at Antapaccay." I have never forgotten that.

In my line of thinking, investors should stay focused on two metals: gold and copper. Readers will undoubtedly roll their eyes at the two primary reasons for this.

Why gold over silver?

Quite simply, I look to the buyers. The biggest buyers of any asset class are central banks. Central banks have an unlimited capacity for buying gold and have been for the past five years, accelerating since the arrival of that nasty little flu bug they purposely sensationalized to read "pandemic." The last time I glanced at the actions of the world's central banks, it was revealed that they were buying gold, not silver.

Why copper over the rest of the base metals complex?

The actions of the largest mining companies on the planet are the best weather vanes for trends in the demand-supply equilibrium for the metals. Look at the history of Freeport-McMoRan Inc. (FCX:NYSE), one of my absolute favorite blue-chip miners in existence. Founded in 1912 as a sulfur producer, over the years by way of discovery and/or acquisition, they have migrated into nickel, oil and gas, cobalt, and potash, finally residing in 2024 as the world's largest producer of copper and molybdenum (used to harden steel), and a substantial producer of gold through ownership of the Grasberg mine in Indonesia.

In recent addresses to shareholders, Barrick Gold Corp. (ABX:TSX; GOLD:NYSE) CEO Mark Bristow has emphasized the firm's commitment to expanding operations that include copper with primary interest now targeting large-scale porphyry copper-gold deposits around the globe. Comments on the impending structural global deficit have been echoed by CEOs and banks around the globe, which is why I listen to them instead of the Wall Street spinmasters who want you to believe that inflation is now "subdued."Not with $7.00/lb. copper it is. . .

Just as easily as gold prices rallied from the late-June lows around $2,300, I thought for a brief-beyond-belief second that the July spike might have the juice to take out $2,500 (basis August gold), but the tepid action in the silver market turned out to be the clarion call for the bulls to ring the register and the bears to spring to action. It took barely a week for the price to give back $130 of the $180 it gained in the June-July rally but silver was even more dramatic as it gave up 13% in a matter of a few days to torpedo the rally in not only the gold price but also the gold and silver miners.

It is the GSR (gold-to-silver-ratio) that told the tale of the tape with no better illustration than the one we see below.

Now, the gold miners, as represented by the NYSE ARCA Gold Bugs Index (HUI:US), are doing just fine up over 57% from the March lows. This performance is why I remain a stalwart bull on gold looking out to next year (and beyond) because I need both silver and the miners to outperform gold to confirm the longevity and sustainability of the rally.

Silver is lagging and may continue to do so, but the miners are unequivocally bullish, so to that extent, I remain bullish. The only difference is that for trading positions, the underperformance by silver is creating the volatility, so I am forced to hedge my longs with derivative positions on the SPDR Gold Shares ETF (GLD:NYSE), which are currently in place.

Near term, the action on Friday was yet another classic case of silver underperforming gold as the $33 bounce (1.39%) was accompanied by an absolutely anemic $0.09 (.32%) rebound in silver.

To me, that smells like a retest of the lows around $2,300 (basis Aug Gold) is in the cards before the next launch above $2,500.

Junior Resource Sector

The summer doldrums have arrived, as always, and the junior resource sector is somnambulating pitifully through the summer drilling season with little or no enthusiasm whatsoever.

Two major exploration programs that I follow include the current program in south-central B.C. by American Eagle Gold Corp. (AE:TSXV) on its NAK Project, where impressive grades of copper-gold mineralization have been recovered. The purpose of the 2024 drilling program is to link up the two zones from which the juice was discovered, which, if successful, will open this up to world-class scale and grade and Tier One status.

If it materializes, I think Teck Resources Ltd. (TECK:TSX; TECK:NYSE), which owns 19.9% of AE, will end up taking the remainder out. There are a number of geologists with whom I consult that have spent considerable years scouring around the B.C. interior and they are ALL unanimous bulls on NAK. I own a small position and am considering adding it next week.

Also upcoming is the Chilean copper-gold exploration program to be commenced by junior explorer Vortex Metals Inc. (VMSSF:OTCMKTS; VMS:TSX; DM8:FSE) run by founders Michael Willams and Vikas Ranjan. Running their Illapel Project is former BHP country manager John Larson, who has spent over forty-two years developing base metals projects around the world.

He has established three zones of particular interest located along strike and proximitous to the RIO-27 copper-gold mine. with two in the Cu-Au category and the third a straight Au target. Phase One includes a ten-hole program which should determine the potential for scale and grade and should commence around the middle of August.

There are a number of companies that I own that will be embarking upon exploration programs, but they all ask the same question: "What if we drill and pull decent grade and width, and nobody cares?"

I saw this exact thing happen in 2022 with Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) where they found not one but two new, high-grade gold zones, which included an impressive 25 meters of 10.4 g/t Au at the North Fork Zone and the stock actually went down.

As I have been writing about for what seems like ages, money migrates to where it is treated best, and until the market reaction to positive news results in higher prices, the new generation of investors that are being rewarded trading the U.S. "AI" space are not going to migrate over to the junior explorers and developers any time soon. On a valuation basis, all gold and silver miners are absurdly undervalued, but ask all the value-oriented portfolio managers out there how they are stacking up versus the growth-oriented momentum-chasers hiding out in the Mag Seven.

To put it in perspective, even after a 19.6% pullback off the June highs, Nvidia Corp. (NVDA:NASDAQ) is still up 126.7% YTD. Money does not change its preference any time soon, especially with performances like that. What will drive money to the resource space is a bona fide correction or secular bear market in the mega-cap growth space. The default location of that migration will be copper and gold.

Only the wisdom of Jesse Livermore can help me stay the fore. . .

| Want to be the first to know about interestingGold,Base Metals,Critical Metals andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Barrick Gold Corp., American Eagle Gold Corp., Getchell Gold Corp., Vortex Metals Inc., and Nvidia Corp. Michael Ballanger: I, or members of my immediate household or family, own securities of: Barrick Gold Corp., American Eagle Gold Corp., Getchell Gold Corp., Vortex Metals Inc., Teck Resources, and Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company. This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.