Are Silver's Liquidity Dreams a Mirage? / Commodities / Gold & Silver 2023

The white metal is priced for aneconomic outcome that’s unlikely to materialize.

AI Optimism

With liquidity-fueled assetsoutperforming in 2023, they’ve decided that QT and higher interest rates arenot going to spoil their party. Moreover, with silver and goldalso liquidity beneficiaries, they have adopted similar attitudes.However, while the gambit can persist in the short term, a major climax shouldunfold over the medium term.

Please see below:

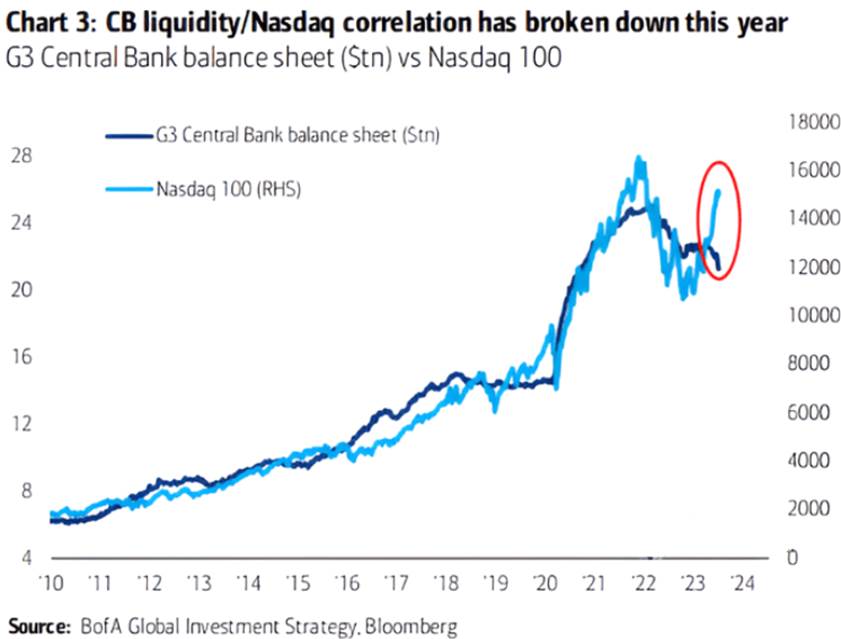

To explain, the light blue line abovetracks the NASDAQ 100, while the dark blue line above tracks the combinedbalance sheets of the Fed, the ECB, and the BOJ. If you analyze the divergenceon the right side of the chart, you can see that AI optimism has the crowdassuming that liquidity no longer matters.

But, with QT continuing tointensify, a Big Tech drawdown should sink theS&P 500 and capsize the PMs.

Please see below:

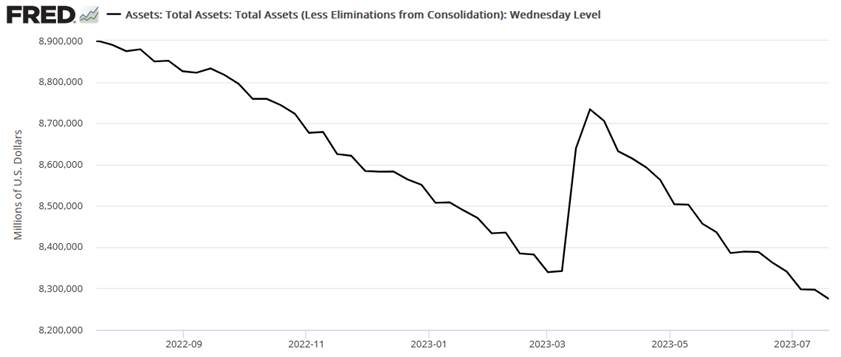

To explain, the Fed’s balance sheet hit another cycle low this week (updatedon Jul. 20), as the bank-run rally is long gone. As such, the central bankcontinues to siphon liquidity out of the system, and the policy action shouldhave immense consequences in the months ahead.

For example, we have stated repeatedlythat higher interest rates are the first part of our bearish fundamentalthesis, and the second is a recession. Furthermore, while the USD Indexbenefits from higher Treasury yields, it often soars during periods of economicstress. And with recession winds blowing despite the soft landing narrative,historical probabilities continue to support an ominous economic conclusion.

Please see below:

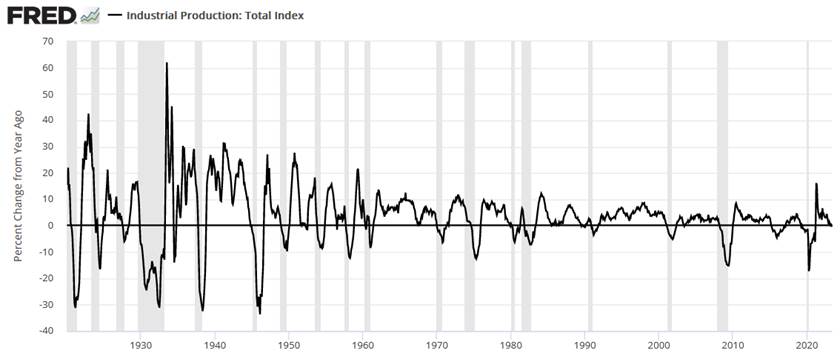

To explain, the black line above tracksthe year-over-year (YoY) percentage change in U.S. industrial production, whilethe vertical gray bars represent recessions. And on Jul. 18, the metric wentnegative YoY for the first time since before the coronavirus pandemic.

Moreover, while a false signal wasrealized in 2015, 18 of the last 23times U.S. industrial production has gone negative YoY, it’s culminated withrecessions (since 1920). As a result, while silveris priced for perfection, storm clouds continue to form, and itshould not be a surprise if (when) an economic malaise arrives.

Resilient Consumers

Before the second act can begin, theliquidity drain should continue as consumers remain relatively cash rich. Asevidence, Bank of America – the second-largest U.S. bank – released itssecond-quarter earnings on Jul. 18. CFO Alastair Borthwick said during the Q2conference call:

“Broadly speaking, average depositbalances of our consumers remain at multiples of their pre-pandemic level,especially in the lower end of our customer base.”

He added:

“The consumer is still in a prettyhealthy place. You can see that in the unemployment statistics, and you can seeit in the way that they're just continuing to spend a little bit more moneyYoY. So, you know, I feel like we've been pretty consistent. The consumer ispretty resilient. That remains the case, and we're benefiting it from rightnow.”

Please see below:

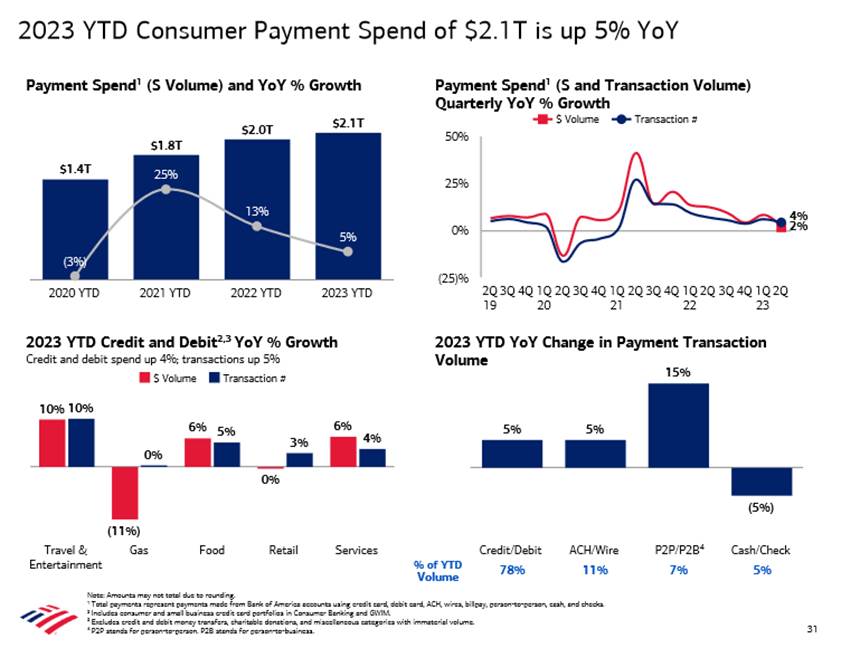

To explain, Bank of America has consumerspending up by 5% YoY, with strength seen in travel & entertainment andservices. So, while we warned throughout 2022 that consumers would keep theFed’s foot on the hawkish accelerator, little has changed. They’re stillspending money, and as Bob Prince noted, it’s driven by income, not creditgrowth. And with oil prices ratcheting higher,the outlook is bullish for MoM inflation.

Please see below:

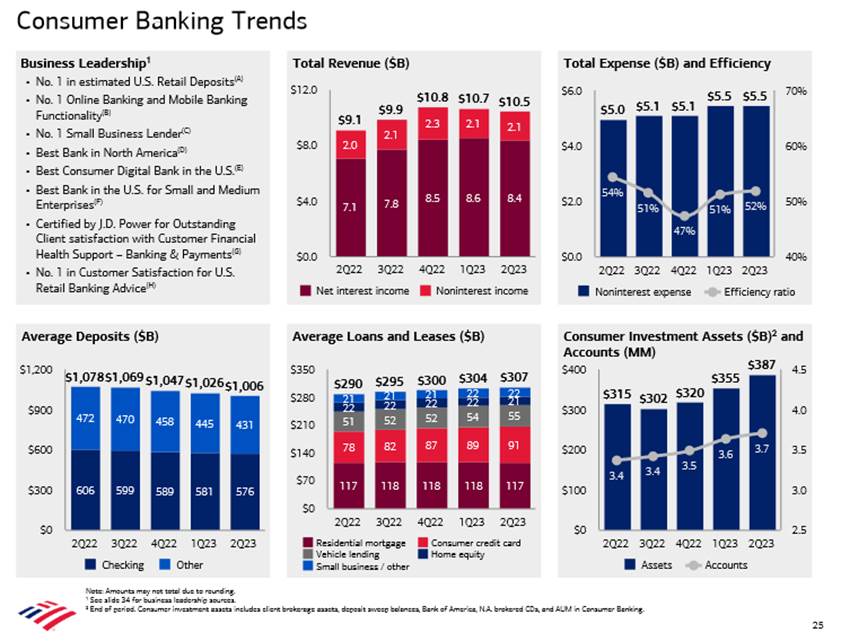

To explain, Bank of America has thelargest U.S. retail deposit base, and the chart at the bottom left shows howchecking account balances have only declined by $30 billion from their Q2 2022high of $606 billion. In contrast, the chart at the bottom right shows thatconsumers’ investment assets have risen by $72 billion over that timeframe. Assuch, Americans are far from tappedout, and financial conditions should continue to tighten to eradicate inflation.

Overall, the crowds’ misguidedpivot hopes hurt the U.S. dollar. But, that narrative reversedon Jul. 20, as interest rates and the USD Index rallied. And with more of thesame poised to materialize over the medium term, gold, silver and mining stocksshould suffer as the Fed further suppresses the U.S. economy.

Why do you think risk assets have ignoredthe liquidity drain?

By Alex Demolitor

Alex Demolitor hails from Canada, and is across-asset strategist who has extensive macroeconomic experience. He hascompleted the Chartered Financial Analyst (CFA) program and specializes inpredicting the fundamental events that will impact assets in the stock,commodity, bond, and FX markets. His analyses are published at GoldPriceForecast.com.

Disclaimer

All essays, research and information found aboverepresent analyses and opinions of Alex Demolitorand SunshineProfits' associates only. As such, it may prove wrong and be a subject tochange without notice. Opinions and analyses were based on data available toauthors of respective essays at the time of writing. Although the informationprovided above is based on careful research and sources that are believed to beaccurate, Alex Demolitorand his associates do not guarantee theaccuracy or thoroughness of the data or information reported. The opinionspublished above are neither an offer nor a recommendation to purchase or sell anysecurities. Mr. Radomski is not a Registered Securities Advisor. By readingAlex Demolitorreports you fully agree that he will not be heldresponsible or liable for any decisions you make regarding any informationprovided in these reports. Investing, trading and speculation in any financialmarkets may involve high risk of loss. Alex DemolitorSunshineProfits' employees and affiliates as well as members of their families may havea short or long position in any securities, including those mentioned in any ofthe reports or essays, and may make additional purchases and/or sales of thosesecurities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.