Are You Being Tossed Around By The China News?

By: Avi Gilburt

As I watched and traded the market action over the last several weeks, I witnessed something quite amazing. Yet, this was not the first time I have seen this.

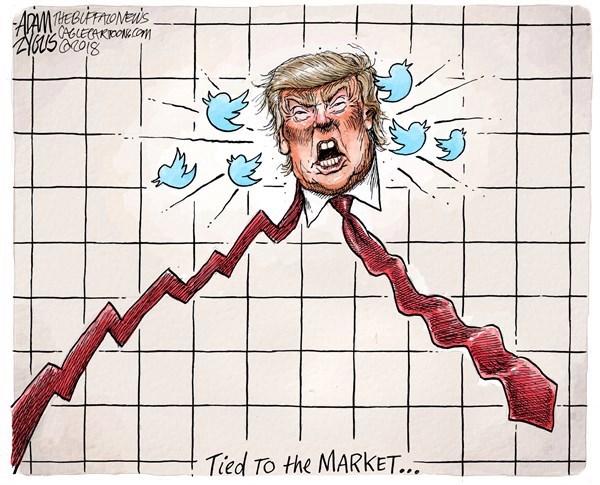

Each time the market was set up for a smaller change of directional move, a news event or a "tweet" seemed to have come out at almost the exact time we need to see the market change direction.

While many saw the news as affecting the market direction, I saw the news as fitting into the market cycle.

I guess it is a matter of perspective, right?

Well, I am quite certain that many of you are thinking to yourself - "boy, that Avi is really foolish. It was clearer than the nose on my face that the negative China news caused the market to drop, whereas seemingly good China news caused the market to then rally." And, if one takes a very superficial view of the market, one may come to that conclusion. However, I am attempting to open your minds to a much more mature and accurate perspective on how to view markets.

As Jeff Miller, my esteemed colleague at FATrader.com, noted during the week:

CNBC anchors breathlessly discussion the market "round trip" today. This consisted of a 70 bps move. This type of move happens all of the time for no particular reason. Humans want an explanation for everything.

Since the timing was loosely correlated with some reporting on the trade deal, that was grabbed as the reason. There was nothing in the news that you couldn't have seen in this morning's NYT.

And finally, there is the insistence that these are the reactions of "investors" who were "out over their skis" according to one source. Few investors are doing anything about news like this -- except maybe watching.I think Jeff said this rather well.

For those of you who still believe otherwise, I have one question that I would love for you to answer: If negative China trade news caused the market to "obviously" decline, then why did the market rally 9% last year during the exact same negative China trade war news?

Yes, I know, the silence is deafening. And, as you begin to pick your jaws up off the floor, allow me to show you how often this happens. Here is another example I love to use to prove this point.

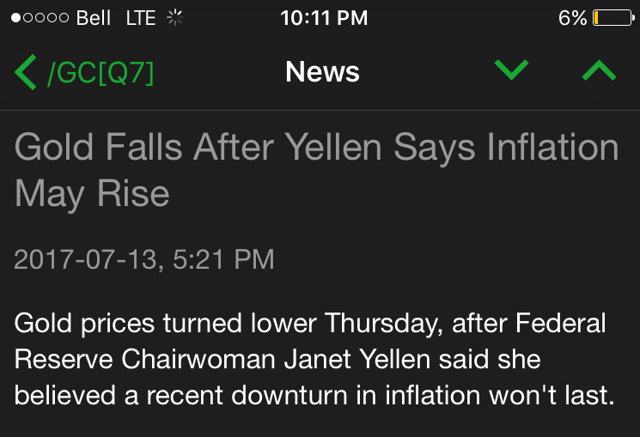

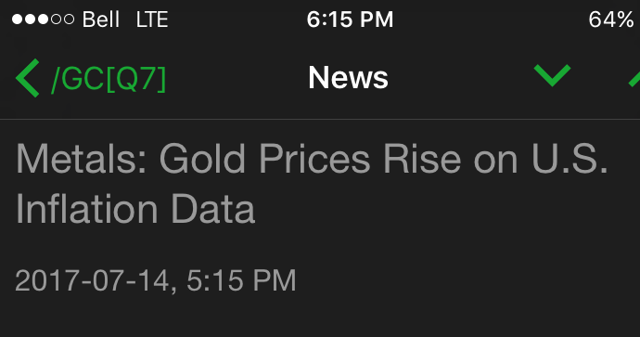

On August 17th of 2017, Janet Yellen was quoted as saying that inflation was likely to rise.

This was reported as the "cause" of gold dropping strongly that day immediately after she made this statement. So, obviously this was the fear of inflation which caused gold to drop. Yet, on the exact next day, economic news came out which suggested that inflation was indeed rising.

So, did gold continue to drop? Nope. Gold turned up quite strongly.

Do you not see how foolish it is to attempt to conflate the substance of a news event with a directional move in the market? We often see a market move in opposite directions supposedly based upon the exact same news.

And, if you still do not hear what I am trying to tell you, allow me to present what others have found in their long-term research about the market.

In a 1988 study conducted by Cutler, Poterba, and Summers entitled "What Moves Stock Prices," they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that "[m]acroeconomic news bearing on fundamental values explains only about one fifth of the movement in stock market prices." In fact, they even noted that "many of the largest market movements in recent years have occurred on days when there were no major news events." They also concluded that "[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events."

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years' worth of "surprise" news events and the stock market's corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

"Most such jumps weren't directly associated with any news at all, and most news items didn't cause any jumps."

And, just over the last several years alone, how many of you were following the news events such as Brexit, North Korea, terrorist attacks, cessation of QE, record hurricane damage in Houston, Florida, and Puerto Rico, Syrian missile attack, interest rates rising, Crimea, quantitative tightening, Trump, etc., and expected the market to crash on just one of these events? Yet, even taken cumulatively, the market continued to rally over 40% during the last several years. Do you still want to assume that geopolitical events or news will drive our markets?

Just because you see some news events coinciding with directional moves in the market does not support the thesis that this is accurate. Rather, as you just read, much long-term study has been conducted which suggests this is an immature and inaccurate way to view market action.

So, whether there is news to support this or not, allow me to present to you my overall shorter-term perspective. As long as the market remains below 2920/30SPX, we are now setting up a structure to shave off hundreds of points off the S&P500, and rather quickly. Should the market be able to exceed that region, then it can turn the probabilities towards another attempt at the 3000 region.

But, for now, the market is setting up a very dangerous structure, which can provide us a decline similar to what we experienced in the fall of 2018, in January of 2016, in August of 2015, and in August of 2011. While that set-up is not fully in place just yet, should that set up develop over the coming week or two, I would be very cautious about any long positions you hold in your portfolios. We will be tracking the market very carefully for this set up in The Market Pinball Wizard.

But, do not fret. The next decline in the market will simply be a major buying opportunity, setting us up for the next major rally I am expecting over the coming years, which should take us to the 3500-4000SPX region, and complete the bull market rally begun in 2009. It is not likely that this long-term bull market has come to an end just yet, even if we break the lows seen in December of last year.