Argonaut Gold: Not Nearly As Attractive As Its Peers

Argonaut Gold has revised its prior cost guidance and is now guiding for all-in sustaining cost guidance of $1,075/oz vs. $1,025/oz previously.

The company is a laggard among the mid-tier producer space with high costs and also operates out of B grade jurisdictions.

I see the stock as an avoid in favor of lower-cost producers in better jurisdictions.

Argonaut Gold (OTCPK:ARNGF) has not seen an impressive start to FY-2019, with all-in sustaining costs coming in at $1,184/oz for the first half, up 33% from the $886/oz in the same period last year. While these costs are expected to come down a little in the second half, cost guidance was revised higher from $1,025/oz to $1,075/oz for the year. This places the company in the bottom 20% of all mid-tier producers from a margins standpoint. The only mid-tier producers in the Gold Juniors Index (GDXJ) with higher costs are Detour Gold (OTCPK:DRGDF), Harmony Gold (HMY), IamGold (IAG), and OceanaGold (OTCPK:OCANF) currently. It is worth noting that the company did deliver on its 3-year growth plan of 200,000-215,000 ounces of gold-equivalent production for FY-2019, but the spike in costs is not ideal from already high levels. The three things I look for in gold producers are earnings growth, margins, and location. Unfortunately, the company does not stack up all that favorably against peers when it comes to these three facets. For this reason, I see the stock as an Avoid. This does not mean it cannot go higher, but I expect it to underperform its lower-cost peers.

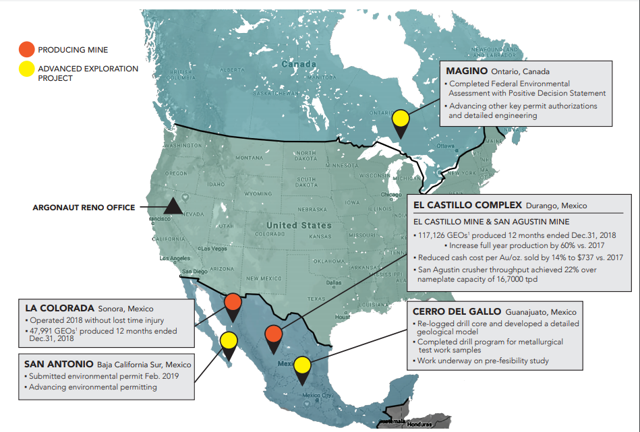

Argonaut Gold is a name I've never covered before and has operations in both Sonora and Durango, Mexico. The company's El Castillo Complex houses their El Castillo & San Agustin Mines, and Sonora is home to their El Colorada Mine. All of their mines are low-grade, high-cost operations, with a total annual production profile of 200,000 ounces per year. Despite the challenges in the first half of the year, the company is on track to meet guidance of 200,000 to 215,000 ounces for FY-2019. The issue stems from the fact that the company's already high-cost guidance has been revised higher by 5% due to challenges in the first half. While these are not material issues, it has dampened the outlook for FY-2019 quite a bit. My preference is to gravitate towards the miners with expanding margins, and a 32% increase in all-in sustaining costs in H1 2019 vs. H1 2018 has not helped margins in the slightest. Even with an expected 15% bump in the gold price, I expect margins to contract this year for Argonaut Gold. This does not mean the stock is a bad investment and can't work long term; it simply means that it's a less desirable option vs. peers firing on all cylinders. I have no problem with misses in guidance, but they hold more weight when these misses are coming on the back of already elevated cost-guidance.

Source: Company Website

One of the reasons for the higher costs stemmed from a water shortage at their San Agustin Mine with underperformance of their third water well. This saw Argonaut incurring costs for blasting, drilling, crushing, and stacking ore for the heap leach pad, but there was insufficient water to get this ore under solution. With the drilling of a fourth water well, the heavy lifting is already done with the ore stacking, and costs should trend lower into the back half of the year. For this reason, the costs associated with this issue aren't a big deal.

The area where Argonaut will have to hope for better performance is on a strip ratio standpoint. The waste to ore ratio at El Castillo jumped 13% in H1 2019 vs. H1 2018, and the waste to ore ratio at San Agustin skyrocketed 178% in the same period from 0.27 in H1 2018 to 0.75 in H1 2019. The company stated that this should normalize going forward as this was due to Phase 1 of their pit, and they are currently moving towards Phase 2, which should see improvements. Assuming the company does not see more waste where it expects to see ore in as they transition to Phase 2 of the Pit, this is also an isolated issue, as is the water well issue.

Source: Company News Release

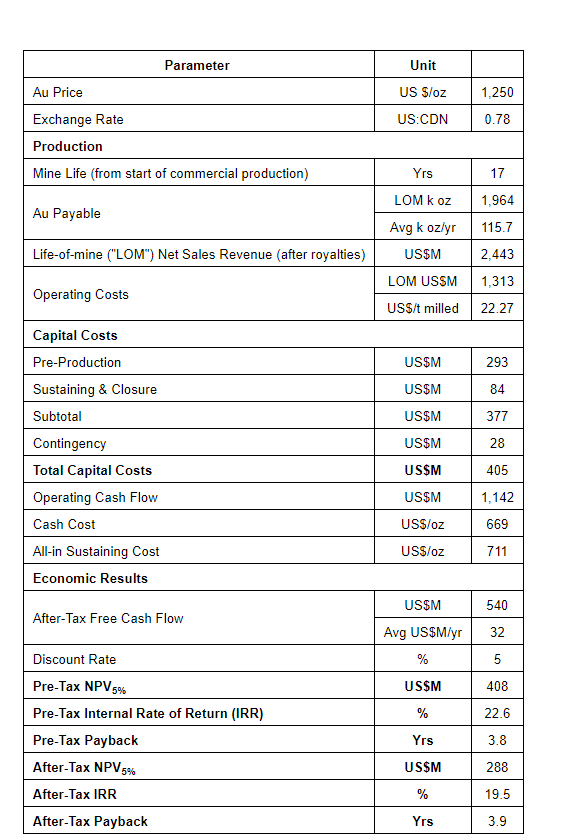

While it is comforting to know that the issues experienced in the first half are not material, the fact remains that even normalizing still leaves Argonaut as a very high-cost producer. I prefer to invest in the cost and margin leaders in a sector, and a company consistently producing at $975/oz or higher all-in sustaining costs is hardly a leader. The path forward to transitioning from a leader to a laggard would be putting their lowest cost development project Magino, which is located in Ontario, Canada, into production. All-in sustaining costs at Magino are projected at $711/oz, and this would be a game-changer for the company which is currently a low-grade and high-cost producer in B jurisdictions. A production decision for Magino would give the company a tier-1 asset as Magino is located in an A grade jurisdiction and has industry-leading all-in sustaining costs. The issue here, however, is that it's not easy for a company with a $500 million market capitalization to absorb a $293 million US Capex bill to start up the project.

For this reason, I believe partnering with another operator would make sense to absorb the costs and unlock this value. However, aiming to build out the project on their own would see debt spike or significant dilution, and neither would do much for helping the stock gain traction. The Magino Feasibility Study showed an After-Tax NPV (5%) of $288 M based on a $1,250/oz gold price, but this has increased significantly to $432 M using a $1,400/oz gold price. This project would unlock significant value for the company and make Argonaut deserving of a re-rating but putting it into production will not be easy without financing, a debt raise, or partnering with another operator. I see the latter option as the best as it avoids taking on a significant amount of debt or diluting shareholders.

Source: Company News Release

The Magino Project is an attractive low-cost open-pit project in Ontario, Canada, and was acquired when the company bought out Prodigy Gold in 2012. The upside to the Argonaut Gold investment case is that the company would begin to become a takeover target if we were to see a $1,700/oz gold price. At these gold prices, Argonaut would have an After-Tax NPV (5%) of over $600 million US, and it would be worth taking over Argonaut Gold at 0.5 P/NAV just for Magino itself. However, I am much less interested in takeover targets that require a 15% higher gold price to make themselves attractive takeover targets. I do not see the company's current producing assets as attractive, and, therefore, the only acquisition scenario I see is buying out Argonaut for Magino if gold prices trend higher above $1,700/oz, and then dumping the Mexican assets to another producer.

Source: Company Website

In summary, while Argonaut Gold's investment thesis improves significantly above $1,700/oz gold, every other gold company's investment thesis also improves significantly in this scenario. I prefer companies where I do not need to rely on a higher gold price to see them become takeover targets. This is why I prefer lower-cost producers like Roxgold (OTCPK:ROGFF), where the company is seeing margins of over 80% based on sub $800/oz all-in sustaining costs. Argonaut Gold's current margins are barely 30% at $1,075/oz guidance, despite a 20% rise in the gold price this year. While the company can certainly perform in a gold bull market and go higher, I expect it to underperform if gold stays in the $1,300-1,600/oz range. Within this range, it is a low-margin producer operating out of B grade jurisdictions and not attractive enough to be a takeover target. For the right price and an elevated gold price, this could change quickly.

A 15% dip in Argonaut Gold would make the company more attractive on a valuation basis, assuming that the strip ratio issues are isolated and do not continue. However, I would much rather buy high-margin producers on sale than low-cost producers when they're on sale. For this reason, Argonaut Gold is not on my radar as I see it as a relative laggard compared to its mid-tier peers.

Let's see what the technicals are saying:

Looking at the daily chart below, we can see that the stock is seeing steady selling pressure as it approached the C$2.75 level. The next strong support level comes in at C$1.95, closer to the stock's rising 200-day moving average (blue line). The most likely scenario here seems to be a new base being built between C$2.00 and C$2.75, before a possible move higher into year-end if the gold price bangs on the door of $1,600/oz.

Source: TC2000.com

In terms of the bigger picture, Argonaut Gold is running up into significant resistance at C$2.75. The stock has been unable to make any sustainable moves above this level since 2015, and I don't expect getting through this resistance zone to be a breeze for the stock. This leaves two hurdles in place for the stock:

1) Weekly resistance at C$2.75

2) Monthly resistance at C$3.00

Until both these levels are reclaimed, the stock will remain range-bound, without any confirmation it has begun a new uptrend. This makes Argonaut Gold a less ideal long candidate when the majority of its peers are already in new bull markets.

Source: TC2000.com

Argonaut Gold is not the typical laggard in the sector where they overpromise and underdeliver and can't seem to do anything right. Their issue, instead, is that they are operating high-cost mines in less attractive jurisdictions. The company has been instrumental in delivering on their three-year growth plan, but this still leaves them a laggard due to their high costs. Argonaut has stated that their development projects could unlock significant value, but the fact remains that they are not generating enough free cash flow to put them into production any time soon. Based on this, they are optionality plays only until the company finds a way to explain to the market how they'll unlock this value. If Argonaut Gold could break out through C$3.00 on a monthly close, this would improve the technicals and make it an attractive potential momentum play for traders. However, as we sit currently, the stock is a laggard both fundamentally and technically. For this reason, I see the stock as an Avoid as I expect the stock to remain a market performer at best. I prefer the leaders, and the stock does not meet my requirements for an investment thesis.

Disclosure: I am/we are long ROGFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts