As a recession signal heats up, cryptos are beating gold as a safe haven

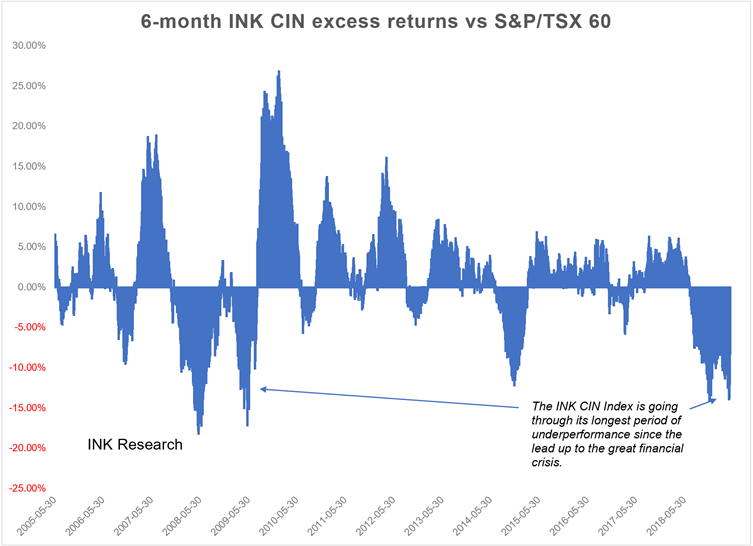

In my May 23rd interview with Jim Goddard I tackle some key themes that we have been developing over the past week. I start off the broadcast highlighting the warning sign being sent by the losing streak of the mid-cap-oriented INK Canadian Insider Index versus the large-cap S&P/TSX 60 Index. As we display in the chart below, the INK CIN has not underperformed the 60 this long since the lead up to the great financial crisis.

We then quickly move on to a topic we raised in our May 22nd US market report, the inverted 5-year minus 3-month Treasury yield curve. Unfortunately, as markets evolved during the week, this recession signal gained further steam.

The interview then briefly discusses Canada-China relations.

We close off discussing our rant in the May Top 20 Gold Report about the World Gold Council's response to the Grayscale Drop Gold campaign. I make the case that the gold industry needs to get moving on a gold-backed cryptocurrency ideally tied to a major sovereign currency. In the meantime, cryptocurrencies and related stocks such as the Grayscale Bitcoin Trust (GBTC) are benefiting from safe-haven flows instead of gold during the recent market pullback.

In our May Top 20 report, we listed four crypto-related stocks that have shown up with some notable insider buying. Of the four, only one has an INK Edge outlook ranking. The rest are much smaller and should be viewed as highly speculative. That said, the fact that the majority of the list have been more-or-less shunned by investors so far this year probably suggests that the there is still time for speculators and those looking for an alternative to mainstream stocks to participate in the broad cryptocurrency and blockchain groups.

If you have not done so already, the report is worth checking out for ideas. If you are not a member of the Canadian Insider Club, you can get access to the report, a 3-month archive and much more by joining us here. You can also buy the May Top Gold in our PDF store.