As China goes green, Copper market expected to tighten further / Commodities / Copper

The mostpessimistic forecasts of copper demand, and pricing, during the worst pandemicin 102 years, have failed to materialize.

From afour-year low in March, when the coronavirus slammed into Europe and NorthAmerica, the red metal used widely in construction, communications,transportation and energy transmission, has mounted a serious comeback.

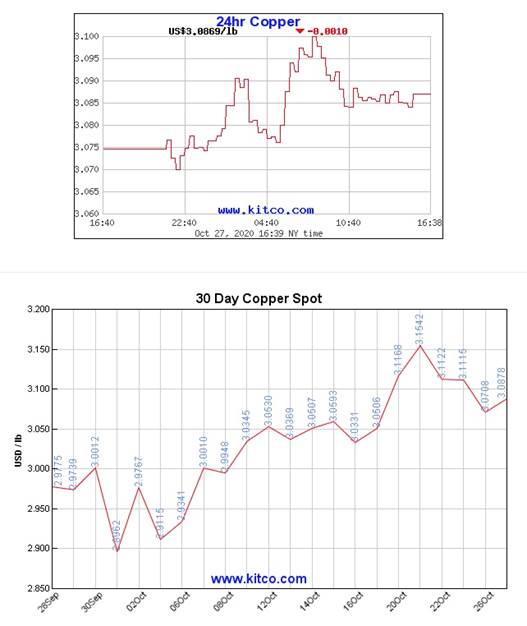

As ofthis writing spot copper is trading at $3.08 per pound, compared to around$2.10/lb in mid-March – a gain of 46%. The spot price has stayed above $3.00since Oct. 8 – which is remarkable considering the reports of impendingeconomic doom, amid a second wave of covid-19 infections in Europe and NorthAmerica.

Thefollowing analysis by AOTH has copper showing no signs of slowing down; infact, while the copper market was tight before the pandemic began, we expect itto tighten even further, due to a constellation of factors, starting withChina.

TheChinese economy became the first major world economy to return to its pre-virusgrowth trajectory, when it posted positive numbers in the second quarter.Recent figures from China’s National Bureau of Statistics indicate thatthird-quarter GDP growth is up 4.9% from a year ago. Between April and June,Q2, the bureau reported a 3.2% rise. The Chinese are well ahead of theirtrading rivals as they strive to put the pandemic for which they wereresponsible, behind them.

Accordingto the World Bank and the OECD, the Chinese economy in 2020 will grow 2% - theonly G20 country to mark positive economic output this year. Beijing hasmanaged to largely contain the virus in recent months after the pandemic shutdown its economy. Commerce and travel have been allowed to resume, which isdriving economic growth and fueling demand for copper and other industrial metals,like aluminum and nickel, whose prices are also climbing.

Otherreasons for a rising copper price include covid-related restrictions imposed onthe copper mining industry, along with speculative interest in the metal due toa weaker US dollar.

Copperoutput from the world’s top 10 producers declined 3.7% during the secondquarter, due to nation-wide lockdowns in Chile, Peru and Mexico.

China’scopper dominance

Chinese growthstatistics have always figured prominently in copper price forecasts – nosurprise considering that China is responsible for just under half of theworld’s production of copper and copper alloys semis, the industry term forfirst-stage products made from refined copper.

The Asian superpower isalso the largest importer of unwrought copper, along with copper ores andconcentrates.

Itsmanufacturing sector back on track, China’s copper imports rose sharply overthe past four months; in September, the country imported 62% more copper thanthe same month in 2019. Unwrought copper imports of 4.9 million tonnes duringthe first nine months of the year, were up 41% from the same period last year.

Accordingto Reuters columnist Clyde Russell, China has been vacuuming up copper,boosting the price at a time when demand elsewhere in the world was lookingsickly as the virus spread.

Why is Chinaimporting so much copper? Russell claims the buying spree is being driven byBeijing’s stimulus spending following the national lockdown during the firstfour months of the year. But he also says it is likely that substantial volumesof copper are flowing into stockpiles, either strategic or commercial.

We agree, and havebeen writing quite a bit about this lately.

Obviously we can’tsay for sure, given China’s opaque statistics, but we suggest a good chunk ofthe raw materials are going into bulking up the Chinese Military, in particularits navy patrolling the South China Sea. In other words, Chinais preparing for war.

The mining industry’sexperience of China locking up the world’s mineral resources testifies to howfar the Chinese will go to ensure their ever-growing demand for minedcommodities is met.

Lockingup supply

While iron ore adcopper were the hot targets of overseas acquisitions by Chinese firms as theysought to feed an economy that up until 2015 was growing at double digits, theChinese have also gone after gold, nickel, tin and coking coal. More recently themost desired metals are those that feed into the global shift from fossil fuelsto the electrification of vehicles. This has meant a hunt for lithium, cobalt,graphite, copper and rare earths - metals that are used in electric vehicles,of which China has become the world’s leading manufacturer.EVs use a lot ofcopper, four times as much as a regular vehicle, and China hasn’t been shyabout boosting its copper reserves to meet expected demand.

Two large Peruviancopper mines are owned by Chinese companies. Chinese state-run Chinalco ownsthe Toromocho copper mine, while the La Bambas mine is a joint venture betweenoperator MMG (62.5%), a subsidiary of Guoxin International Investment Co. Ltd(22.5%) and CITIC Metal Co. Ltd (15%). The Chinese-backed Mirador mine inEcuador opened in 2019.

Most of the metalproduced under these off-take agreements will NEVER come to the market anyplaceother than in China. Those metals that do, can have their supply shut down anytime the Chinese want.

In Brazil, Chinesebanks and investment groups have committed $15 billion of a $20b China-BrazilFund, launched in 2016 to finance infrastructure projects.

The Madein China 2025 initiative, which aims tomake China’s copper industry more efficient, is expected to grow Chinese copperdemand by an additional 232,000 tonnes by 2025. This isn’t counting the needfor more copper for railways, electric vehicles, car motors and powertransformers.

China’s Belt and RoadInitiative (BRI) is a $900 billion program to open channels between China andits neighbors, mostly through infrastructure investments.

China long ago put alock on much of Africa’svast resources.

China’splans

China’s terrible airand water pollution, accumulated from several years of break-neck industrialgrowth, has been cited in numerous edicts from Beijing to shut down polluting, oftenunregulated mines, and to clean up smog-belching factories.

Arguably though,China’s environmentalism has been driven by necessity. The one thing theChinese Communist Party (CCP) cannot abide is an insurrection, mounted bypeasants or poor factory workers, who could rise up against the government dueto sicknesses and deaths from widespread pollution. So with one hand Chinatries to fix the environment, and with the other it buys coal from North Koreaand builds new coal-fired power plants.

Currently, a majorshift is taking place regarding the environment at the highest levels of theCCP. It began last month when President Xi Jinping pledged to make the countrycarbon-neutral by 2060, and has continued to a revised Five Year Plan.

Al Jazeera doesa good job of explaining why this is such a big deal:

BeforeSeptember, few expected China to promise more ambitious curbs on climate-warminggreenhouse gases over the next five years, with policy documents signallingBeijing’s intent to make energy security and the economy its top priorities. Itwas also expected to go on a new coal-fired power construction spree, butgovernment scholars have been forced to revise their old drafts.

“Rightnow, every level of government is busy working on the 14th Five-Year Plan,”said Kevin Lo, associate director at the David C. Lam Institute for East-WestStudies in Hong Kong, who studies China’s environmental policies.

“Theunderstanding is that there is no time to waste if China is to achieve carbonneutrality by 2060.”

Reaching thecarbon-reduction goals in China’s 14th Five Year Plan, 2021-25, mayinvolve setting an absolute emissions cap for the first time ever. On MondayChinese policymakers gathered at a plenum to figure out how to meet PresidentXi’s radical new climate targets, made real after Xi told the United Nationsthat China will offset all its emissions within 40 years.

Al Jazeera quotes oneenergy expert who says thatChina would need to stop building all new coal-fired power plants. TheDevelopment Research Center, a Cabinet think-tank, predicts that meeting thetargets will involve doubling wind and solar capacity to around 500 gigawattsby 2025.

Meanwhile China has rolled out a ‘new infrastructure plan’ that is bigon local ore beneficiation, and has a focus on high-tech infrastructure.

In its latest report, Fitch Solutions discusses how the plan will boostproduction of “high-end metals” as opposed to primary metals like iron ore.

Working with existing industrial policies like Made in China 2025 andthe China Standards 2035 plan, Fitch says the new infrastructure plan signalsChina’s ambitious long-term strategy to becoming a global leader in high-techindustries.

Included among new infrastructure projects, are 5G networks, datacenters, artificial intelligence (AI), ultra-high-voltage (UHV) technology, EVcharging stations and high-speed rail.

According to Fitch, the plan will require lighter, more advanced metals,compared to say, normal steel products like rebar, giving high-end copper,aluminum and steel a strong boost going forward. Close to a million tonnes ofhigh-end aluminum and 32Mt of specialty steel are needed in 2020 alone, theconsultancy anticipates, with the figures rising in 2021 and 2022 as moreprojects are rolled out. Key demand drivers are UHV power cables, urban masstransit and 5G network base stations.

According to theInternational Copper Association (ICA), copper consumption in China is expectedto increase by 232,000 tonnes annually up to 2025, due to the installation ofhigher-efficiency industrial motors and distribution transformers, theelectrification of new railways, and new energy vehicles (NEVs) for industrialuse.

Newcopper contract

From these plans, it isabundantly clear that China, which is already breaking records for copperimports, is going to be bringing in more red metal. Potentially A LOT more.

No coincidence,therefore, that a new international copper contract is being launched Nov. 19,on the Shanghai International Energy Exchange. (INE) Unlike the existing coppercontract, which trades on the Shanghai Futures Exchange (ShFE), the new derivative will, according toClyde Russell’s above-cited column, be open to trade by foreigners andshould offer a much easier path to get exposure to China’s copper market.

ShFE is mostly gearedtowards Chinese traders. The hope, states Russell, is that the new copperfutures contract will replicate the success of the INE’s oil futuresderivative, which has allowed for the delivery of several Middle Eastern crudegrade to various Chinese ports, and gives traders exposure to prices at boththe loading and delivery points.

TheBiden factor

China is by far themost important player in the copper market, but there are other areas thatshould be looked into when forecasting supply and demand. Two of the biggestunknowns right now, are how soon the global economy can be resurrected fromcovid-19; and whether Joe Biden, a tax and spend Democrat who has promised a $2trillion clean energy plan, will beat Trump in the Nov. 3 election that iscoming up fast.

Biden has signaled hewill embrace central concepts of the “New Green Deal” - a program firstespoused by New York Senator, and Democratic wing-nut, imo, AlexandriaOcasio-Cortez - including spending $1.7trillion over 10 years to achieve 100% clean energy and net-zero emissions by2050.

(“AOC” will reportedlyserve on a panel helping Biden to developclimate policy.)

Dubbed “CleanEnergy Revolution”, Biden’s climate plan callsfor installation of 500,000 electric vehicle charging stations by 2030, andwould provide $400 billion for R&D in clean technology.

Key to Biden’s $1.3trillion infrastructure improvement plan, is a $50 billion investment in repairsto roads and bridges; $10 billion for transit construction in poor areas of thecountry; a doubling of BUILD and INFRA grants, and more funding for the US ArmyCorps of Engineers.

The plan alsoincludes investments in high-speed rail, public transit, bicycling, schoolconstruction, expansion of rural broadband, and replacement of pipes and otherwater infrastructure.

The Biden campaignhas reportedlytold US miners it supports boosting production of metals used to make EVS, solar panels and other materials crucial to his climate plan.Biden also supports bipartisan efforts to build a domestic supply chain forlithium, copper, rare earths and other strategic materials the US currentlyimports from China and other countries.

If Biden snatches thepresidency from Trump, and the Democrats manage to sweep both Houses ofCongress, there will almost certainly be huge investments in clean energy andthe raw materials it requires, including copper. If Trump wins, it will be businessas usual, ie., continued support of the oil and gas industry, and limitedfederal money put towards renewable energy/ electrification.

Covidwildcard

Whoever is installedin the White House in January, they will face the daunting challenge of pullingthe US out from under the 1,000-pound gorilla sitting on its chest: covid-19.

Can we expect aneconomic recovery? The way things are going in the US, which still leads theworld in cases and deaths, it doesn’t look good.

The $2.2 trillionstimulus package agreed to by Trump and Nancy Pelosi was chopped down by SenateRepublicans to a half a billion. That lesser package was recently rejected bySenate Democrats.

Globally there is norecovery. The IMF estimates the world economy will contract by 4.4% this year.

Countries that liftedlockdowns, and aren’t in a second wave, are facing a long period of modestexpansion, meaning it will likely take many months, if not years, for theglobal economy to bounce back to pre-pandemic levels.

While hopes arepinned on a new vaccine, or vaccines, there are voices warning that even if asuccessful immunization system is introduced, it won’t be an instant economicpanacea. “In terms of actually getting back to pre-Covid or trend growth, itcould take more than a year,” said Chris Chapman, a portfolio manager in chargeof $660 billion, quotedthis week by Bloomberg.

For copper, thatmeans the heavy lifting will have to be done by China, currently the onlycountry nearly fully recovered from the virus.

Tightmined copper supply

However, there is onelight at the end of a dark covid-19 tunnel, and that is tight mined coppersupply.

According to theInternational Copper Study Group (ICSG), the refined copper market is likely toregister a deficit this year of 52,000 tonnes – against a 280,000t surplus thegroup forecast this time last year. The reason, we know, is an unexpected pushfor copper imports from China; and the fact that global copper production hasbeen upended by the coronavirus. The ICSG predicts copper mine production willfall 1.5% this year, the second consecutive year of lower output.

Longer-term, coppersupply is almost certain to be squeezed.

As wehave reported, without new capitalinvestments, Commodities Research Unit (CRU) predicts mine production will dropfrom the current 20 million tonnes to below 12Mt by 2034, leading to a supplyshortfall of more than 15Mt. Over 200 copper mines are expected to run out ofore before 2035, with not enough new mines in the pipeline to take their place.

For copper producers,a bullish signal right now comes from Freeport McMoRan. The US-based copperminer every year negotiates the following year’s benchmark deal for the copperindustry at an exclusive Park Lane hotel during London Metal Exchange Week.

A tight copper marketin 2020 allowed Freeport to strike deals that offered the lowest smelterprocessing fees in nearly a decade. This year, the miner is expecting to reachsimilarly favorable terms, reportedlybecause the pandemic is stoking marketuncertainty and keeping mine supply tight, a central pillar in copper’s reboundto a two-year high above $7,000 a ton last week.

“Wedefinitely see a continuing deficit of concentrate in the market,” said [SeniorVice President of Marketing and Sales Javier] Targhetta, referring to the minedores extracted by Freeport and other producers. “I’d look at a small numberplus or minus,” compared with the current benchmark, he said.

Meanwhile JP Morgan,which also attended London Metal Exchange Week, commentedthat,

“After a week full ofvirtual meetings, our bullish view on copper first established in April andreaffirmed in August hasn’t changed,” analysts from the investment bank said ina note. They forecast copper prices will reach $7,500 a tonne ($3.40/lb) in thesecond quarter of 2021.

“While there weresome disagreements around the price targets during our calls, we concluded thatthis constructive view on copper seems to be consensus by now.”

Technicalanalysis bullish

Still skeptical thatcopper is doing so well during a pandemic? For the non-believers, we turn tothe charts. A recent Blomberg Intelligence report titled ‘Futures Focus – FirmingCommodity Price Foundation’, bravely takes on crude oil, gold, copper andgrains.

The sections on copperand gold are particularly uplifting.

“The metals sector isa top contender for sustained leadership as evidenced by one-year curves –copper backwardation and gold contango indicate demand exceeding supply,”writes BI commodity strategist Mike McGlone.

According to McGlone,despite LME copper at $7,000 a ton ($3.17/lb) facing resistance on Oct. 21, anew bull market above $7,000 is sustainable, “although plenty of wood may needto be chopped.”

His analysis alsoshows a bullish divergence for copper versus the stock market:

Theadvancing copper price toward the end of October, despite a declining stockmarket, indicates a bullish inflection point for the metal, in our view. Copperis sustaining above $3-a-pound resistance for the longest period in about twoyears and may be turning this level into support. Our graphic depicts the metaladvancing to its highest price since 2018, compared with the CME E-Mini Nasdaq100 Stock Index future struggling to sustain above 12,000 resistance. Thisdivergence indicates a solidifying copper foundation for recovery.

Conclusion

Resource nationalismis the tendency of people and governments to assert control, for strategic andeconomic reasons, over their natural resources. Traditionally, developingcountries have seen the benefits of foreign companies coming in to extracttheir natural resource endowment, in the form of jobs and higher wages fortheir often-impoverished citizens, and government revenues through taxes,royalties or dividends.

There can also beindirect benefits such as knowledge and technology transfers. Foreign investmentsoften involve infrastructure spending, sometimes on a massive scale, likeelectricity, water supplies, roads, railways, bridges and ports. The Chinesehave used this model very effectively in Africa, where they have set up miningoperations but also built schools, roads, water infrastructure, etc.

China leads the worldin the manufacture of electric vehicles and charging stations, far exceedingsecond-place USA. China has the most installed solar capacity, wind power, andhydrogen production. And as we discovered during the pandemic, China is alsothe world’s major producer of ventilators, respirators and other personalprotective equipment front line health workers are in desperate need of, andsome have died from the lack of. Let’s hope the coronavirus is the final nailin the coffin for China’s dominance of the global supply chain.

The bottom line?China cannot continue to supply us, in Canada and the United States, witheverything. The time has come, and Trump is right about this, to get seriousabout re-making global supply chains that cut China out of the loop.

The problem withcopper is there is so much demand for it, and not enough new mines being builtto expand the supply - not only for traditional uses, like copper wiring andpiping, but in clean energy applications such as electric vehicles, trains and5G. Are the 20 million tonnes of copper mined globally going to be enough tomeet the massive amount of metal required by major planned infrastructure andclean energy investments, in not just China and the United States, but othercountries as well?

Getting enough copperis also challenged by climate change, evidenced by water shortages currentlyexperienced in top producer Chile; the fact that China is vacuuming up all theexcess supply, and stockpiling it; and the open question as to whether coppermines that have either been taken offline by the pandemic, or had their outputcut, will ever return to normal production and staffing levels? Is full mineproduction, globally, even possible during a pandemic? If not, expect coppersupply to continue lagging demand for the foreseeable future.

China is both a helpand a hindrance to the copper market. A help obviously by buying so much copperthat it is elevating the price; but a threat in that China with all itsambitious planning will demand so much copper that it puts the squeeze oneveryone else, including us here in Canada and the US.

We haven’t locked upthe world’s resources. China has. In a world of finite metals, many of whichare getting scarcer, this puts us in a very vulnerable position. Where are wegoing to get the minerals we need?

China is increasingits buying of deposits that will result in offtake agreements, meaning thismetal is effectively off limits to the market. And they’re solidifyingalliances with the countries they need to supply them with raw materials,through their Belt and Road Initiative.

Those countries withcopper deposits are in future more likely to hang onto them than previously,when the copper supply-demand imbalance was less obvious.

I believe thesechallenges to supply will exacerbate the tightness in the copper market, andwill eventually prove that resource nationalism is something we are reallygoing to have to monitor in our investments.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle,USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2020 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2019 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.