As insider stocks hit all-time highs, keep an eye on the HII

On Tuesday and Wednesday, the INK Canadian Insider (CIN) Index closed at new all-time highs. Despite this strong show of success, the mainstream media would have you believe there is a lack of opportunity in the Canadian market. We saw the same media sentiment back in February when Maclean's ran a story labeling the Canadian market the worst in the developed world. They blamed a lack of technology stocks.

While more technology stocks would be nice, Maclean's was wrong. As a member of the Canadian Insider community, I think you will agree with me that opportunity always exists if you know where to look.

If there is a problem, it is not a lack of technology stocks but rather that the media is heading in the wrong direction. They follow the S&P/TSX Composite Index which is dominated by big cap stocks. As result, whether it is in mining, or marijuana, they fail to spot under-the-radar trends in smaller stocks ahead of time.

At INK, we have chosen a different path.

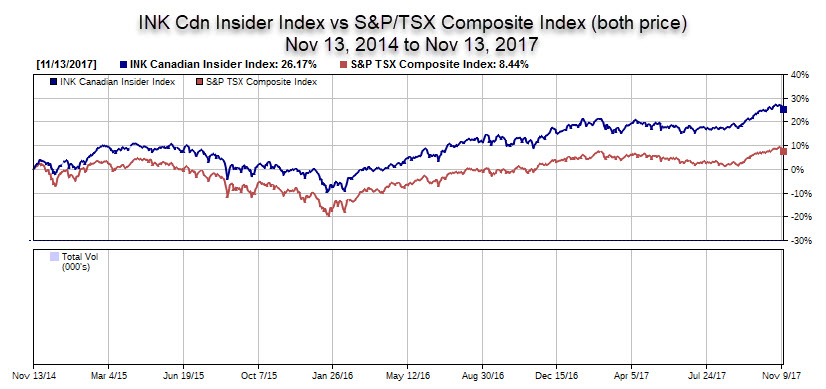

Our path follows the insiders. Just over three years ago, we launched the INK Canadian Insider (CIN) Index. It tracks the 50 top-ranked value and growth stocks on the TSX preferred by insiders. In the chart below, you can see how this mid-cap-oriented Index (blue) outperformed the S&P/TSX Composite Index (red), by more than 5% annually in its first three years.

Just as insider commitment is an important element of your approach to investing, it also forms the foundation of the INK CIN Index. For the Index, we determine the amount of insider commitment at each company by the amount of stock insiders are buying and holding in their own firms.

At INK, we have worked for years to bring insider data to investors for free via the Canadian Insider website. One way we can keep the site free is through the commercial success of the INK CIN Index. We currently license it for use in the Horizons Cdn Insider Index ETF (HII). So far, so good in terms of performance. The ETF has done very well, earning a 2017 Fundata Fundgrade A+ award. In April, it was a 5-star Morningstar ETF.

With our success continuing to grow, we are eager to get the word out about the Index and the HII. So, I am asking for your help to follow the Index and spread the word about the HII ETF. You can follow the Index in real time on the Canadian Insider website and click on this link from HorizonsETFs to get more information about the HII.

HorizonsETFs has sponsored the Canadian Insider site this month which is helping us in our mission to keep it free for our community. In appreciation, we have decided to remove the requirement for Basic Subscribers to receive electronic commercial communications. If you want to opt out, we explain below how to unsubscribe.

Thank you for using Canadian Insider and I wish you every success in this late-cycle rally which we believe is unfolding in Canadian stocks.

Sincerely,

Ted DixonCEO INK Research

Thanks to a sponsorship with HorizonsETFs, you can unsubscribe by withdrawing your consent at anytime by unchecking the agree box for communications on your edit profile page (after logging in). Access to the website and filing alerts will not be impacted.