As recession risk looms, Kaiser sees gold more likely to hit $3,500 than $500

In his latest broadcast, John Kaiser from Kaiser Research Online makes the case that gold can breakout to $3,500. Speaking to Jim Goddard, the resource analyst suggests fundamental, technical and financial self preservation factors may come together to push gold higher.

Kaiser suggests that there is a growing concern that the trade war has been pushed too far, and points to the inverted yield curve, a development that is not stock market friendly.

The bond market is saying that interest rates have go down, not because we want the stock market to go up, but because we are heading in to a recession, a downturn and you are going to have stimulate the economy and all of this is building a sense that this big stock market boom is coming to an end.

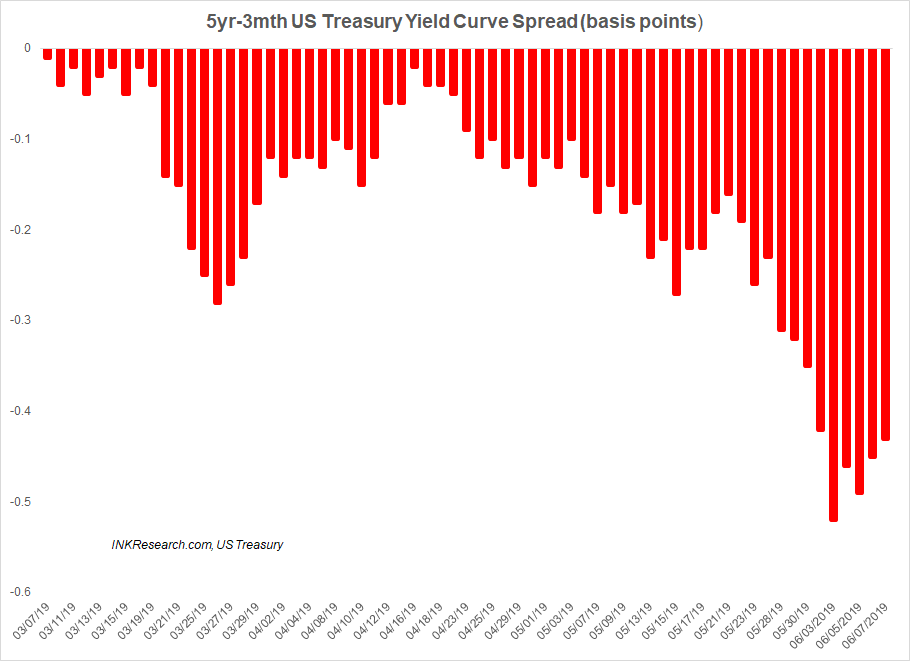

We would note that the 5-year minus the 3-month part of the yield curve has now been inverted for 3 months with the difference between the two yields being negative. As we pointed out in our May 22nd US report and in my May 23rd broadcast, according to work by Campbell Harvey of Duke University a recession is likely if the yield on the 5-year Treasury bond remains below the 3-month T-bill yield for one quarter. While the curve has yet to stay inverted for a full calendar quarter, the trend does not suggest a reversal into positive territory anytime soon.

The 5-year minus 3-month yield curve spread has been negative for three months (click for larger)

Kaiser throws back to 1980 when the United States had its superpower status in question due to Iran, an aggressive Soviet Union and rising inflation. At the time, gold ran up to $850 and the global gold above ground inventory stock was worth 25% of global GDP.

However, he points out a big difference between today and 40 years ago:

Today the gold stock has only doubled from what it was in 1980 thanks to all the mining done...but the global economy is 10 times equivalent.

He suggests that if the world once again starts to get concerned the United States will no longer be playing the role of a superpower keeping everything together, the gold price could soar to catch up to global GDP:

The equivalent 25% of the existing gold stock as a percentage value of global GDP, the equivalent price to $850 in 1980 is [now] $3,500.

In contrast, Kaiser suggests that for the gold price today to be equivalent to what it was in 1999 when the world was enjoying the post Berlin Wall peace dividend is only $500. He then asks the question:

In which direction is gold more likely to go? $3,500 or towards $500?

Mr. Kaiser suggests $3,500 is more likely, a move that would not require inflation but instead requires extreme anxiety about the level of uncertainty ahead, which could even include the question of property title.

Perhaps Mr. Kaiser has been following the fallout from the Vancouver property bubble where the provincial government has been actively pursuing policies to moderate prices via new taxes and public property registries.

Already, Mr. Kaiser suggests that we may be seeing some deep physical buying by the wealthy elite, but admits it is hard to tell whether this is really happening. That said, technically he suggests that if the gold price makes it to $1,400, it will start to gain attention from more investors.

Earlier in the broadcast, Mr. Kaiser provides an update on Verde AgriTech (NPK)'s Cerrado Verde Project in Brazil which he suggests is at a critical stage. The potassium-rich deposit is now fully permitted and in production so the company has a full planting season ahead to demonstrate the viability of the company's business. In the next segment he assesses the status of InZinc Mining (IZN) and in third segment he provides an update on the Midas Gold (Rainy; MAX) Stibnite Gold Project in Idaho which is expected to include antimony as a by product. According to Kaiser, China is the biggest producer of antimony and is needed in some key industrial applications.

This post first appeared on INKResearch.com.