Atlanta Fed Says US Economy Suddenly On Verge Of Contraction

At a time when the Wall Street banks are scratching their heads for credible explanations why they are keeping (or raising) their year-end S&P targets at a time when economic growth is in freefall and inflation is soaring (read: stagflation), an unexpected source of honesty has emerged - the Atlanta Fed, which now sees the US on the verge of contraction.

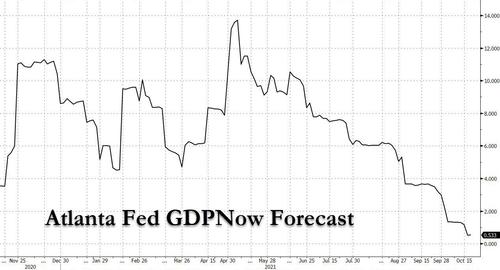

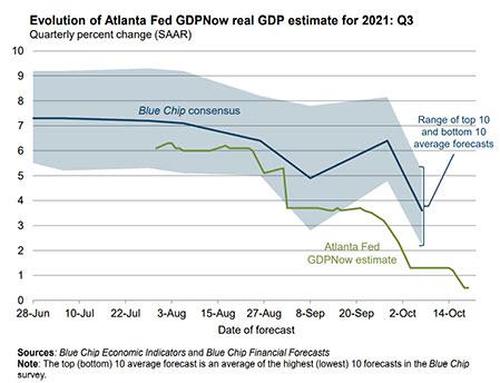

In its latest GDPNow forecast published moments ago, the Atlanta Fed slashed its estimate for real GDP growth in the third quarter of 2021 to just 0.5%, down from 1.2% on October 15, from 6% about two months ago, and down from 14% back in May.

Remarkably, the GDPNow tracker is about to turn negative even as the average "blue chip" Wall Street baank has a Q3 GDP forecast of just below 4%.

The collapse in the Atlanta Fed tracker has correlated almost tick for tick with Citi's US macro surprise index which has also plunged in recent months...

... which in turn is the inverse of Citi's inflation surprise index:

According to the Atlanta Fed economists, after recent releases from the US Census Bureau and the Federal Reserve Board of Governors, "the nowcasts of third-quarter real personal consumption expenditures growth and third-quarter real gross private domestic investment growth decreased from 0.9 percent and 10.6 percent, respectively, to 0.4 percent and 8.4 percent, respectively."

In short, everything is slowing and it is the consumer - that 70% driver of GDP growth - that may be about to hit reverse.

Realizing that it would be taken to task for its euphoric Q3 GDP estimate, over the weekend (when the Atlanta Fed forecast was still 1.2%) Goldman published a research report titled "How Fast Is Growth Slowing? Q3 GDP Tracking Update" in which it said that the bank is assessing "key areas" where its own forecast diverges from that of the Atlanta Fed. This is what it said:

We view the risks around our 3 1/4 % Q3 GDP forecast as balanced. In our view, GDPNow appears too pessimistic on net trade and investment. On the former, we suspect the Atlanta Fed's model does not fully capture the drag on net imports from supply chain bottlenecks and port congestion. On the latter, capex and construction indicators generally remain robust. Consensus on the other hand may not embed enough of a consumption drag from the Delta variant, given the September pullback in some virus-sensitive services categories.

Goldman then reminds clients that while Q3 GDP may be the low-point of 2021 (the bank's forecast is at 3.25%), it is "confident" that Q4 will be higher and the quarters of 2022 higher still:

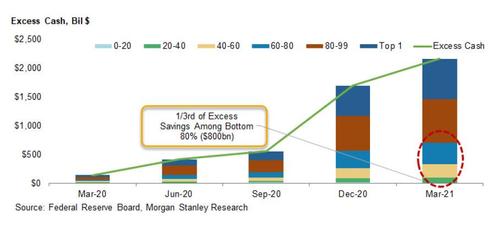

Of course, as we explained before, Goldman will be wrong again, and the bank will have to slash its own GDP forecasts as there won't be nearly as strong a bounce as the bank expects for the simple reason that it is estimating that the biggest surge in consumption in Q4 and onward will come from the spending of excess savings.

The reason this won't happen is shown in this chart from Morgan Stanley, according to which only a third of the $2 trillion in excess savings has gone to the bottom 80%.

Translation: the bottom 80% has long ago spent its "excess savings" and only the top 20% has any residual money left from the trillions in covid stimulus. Unfortunately for Goldman's thesis, this "top 20%" has a far lower likelihood of spending its money.As a result the roughly 2-3% boost to Q4 2021 and Q1 2022 GDP that Goldman expects will kick in thanks to excess savings won't happen, and the bank will soon be slashing its GDP forecasts even more aggressively.