B2Gold: FY 2018 Review And FY 2019 Outlook

An analysis of BTG's FY 2018 performance reveals that FY 2018 outperformed FY 2017 in terms of production and costs.

I expect that BTG would perform even better during FY 2019.

I have discussed the reasons for such an expectation.

A technical price chart indicates that a reasonable target price in the medium term could lie between $3.00 and $3.50.

Therefore, BTG is a bargain at the current price levels.

Thesis

B2Gold (NYSEMKT:BTG) is a mid-tier Canadian gold miner that has seen the first full year of production (in 2018) from its recently acquired flagship asset, namely the FM (read: Fekola Mine).

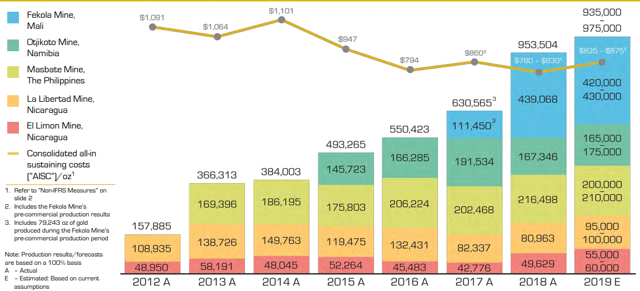

Figure-1 (Source: Company website)

Figure-1 (Source: Company website)

In this article, I have analyzed the Q4 and FY 2018 performance of BTG together with the outlook for FY 2019 and have also discussed a recent operational update on the FM that significantly enhances the production potential of the company, going forward. In my view, the increased production potential, together with the recent upside in gold prices, should enable BTG to witness price appreciation during FY 2019.

Q4 and FY 2018 review

Q4 2018: BTG delivered a mild Q4 2018 in terms of revenues and earnings. Unfortunately, both these metrics remained below expectations. Q4 revenues of ~$272 MM missed expectation by ~$2.36 MM. Similarly, Non-GAAP EPS stood at $0.01 and missed expectations by $0.01. In terms of operational performance, gold production witnessed a decline Y/Y; from ~240.7 Koz (read: a thousand ounces) in Q4 2017 to ~231 Koz in Q4 2018. Likewise, cash costs and AISC (read: All-in-Sustaining-Costs) also witnessed a Y/Y increase during Q4 2018. Nevertheless, when considered for the full fiscal year 2018, BTG delivered stronger performance on a Y/Y basis, as elaborated below.

FY 2018: During FY 2018, the gold production stood at ~ 953.5 Koz and significantly exceeded the FY 2017 production of ~630.5 Koz. Similarly, the company witnessed an improvement in both CoC (read: Cash Operating Costs) and AISC. COC decreased from $542/oz (in 2017) to $495/oz (in 2018). Similarly, AISC also decreased from $860/oz (in 2017) to $758/oz (in 2018).

FY 2019 outlook

Even though FY 2018 has been an impressive year compared with FY 2017; I believe that FY 2019 would be an even stronger year for a variety of reasons. Let's get into the details.

As shown in Figure-2, BTG's FY 2018 production stood at ~953 Koz. In 2019, BTG expects to produce between ~935 and 975 Koz of gold. The midpoint value of this range is ~955 Koz, and we can see that BTG's overall production during FY 2019 would exceed FY 2018 even if the annual production nears the midpoint value of the guidance range.

Figure-2 (Source: B2Gold Investor Highlights)

The chart also shows that BTG's FM will remain to be the most significant contributor to annual production. During 2019, FM is expected to produce between 420 and 430 Koz, which would be slightly lower than FY 2018 production Y/Y, even if we assume that FM would deliver production near the higher end of the guidance range. However, it's likely that FM tops the FY 2019 production guidance since BTG has planned expansion of the mine that will further improve the production potential, going forward.

On that note, it should be considered that BTG recently announced its plan to proceed with the expansion of the FM, based on a positive PEA (read: Preliminary Economic Assessment) that evaluates the 'Life-of-Mine' options for expanded mining operations. At present, the FM processing mill has a capacity to process up to 6 Mtpa (read: Million tons per annum) of ore. The planned expansion would require ~$50 MM in CAPEX and would enhance the processing capacity by ~1.5 Mtpa, to ~7.5 Mtpa. This should enable the company to increase the Fekola gold production, going forward.

Similarly, BTG's other significant producing assets namely Otjikoto and Masbate, are expected to ramp up their Y/Y gold production in FY 2019. On a different note, BTG's other two producing mines namely La Libertad and El Limon are also expected to increase their FY 2019 production, Y/Y. However, since these two mines are located in Nicaragua that's currently facing political instability, I believe there is a higher risk associated with the mining operations of these two mines. But then again, the overall mining picture of BTG looks solid with suitable upside in production potential.

Nevertheless, BTG is expected to witness an increase in its cost metrics. During 2018, the average AISC stood at ~$758/oz, and that was actually lower than the budgeted AISC of ~$920/oz. During FY 2019, BTG expects the average AISC to be within the range of $835-875/oz. On the surface, this might appear to deteriorate BTG's mining profile. However, I believe otherwise. In my view, even if BTG sees an increase in AISC during FY 2019, the impact of such higher 'per ounce' cost will be partially offset by a significant improvement in gold prices. As shown in Figure-3, having previously suffered from depressed prices for a long time, gold has finally regained strength, and this positive momentum is likely to continue for some time. For BTG, this should result in a favourable impact on revenues.

Figure-3 (Source: Infomine)

BTG's technical picture

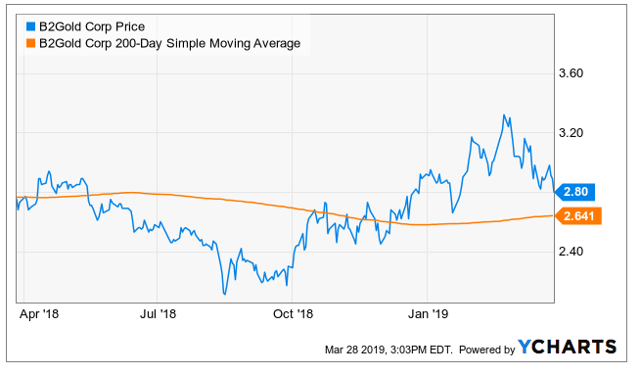

Having considered the mining dynamics of the company, let's analyze its technical picture to see if BTG is a buy at current levels. BTG's 52-week range lies between $2.10 and $3.35. At the time of writing, BTG last traded at $2.79, slightly above the median value (~$2.72) of the 52-week range. Moreover, the stock price is also trading marginally higher than the 200-day SMA (read: Simple Moving Average) of ~$2.64, which suggests that the share price has some room for correction (Figure-4).

Figure-4 (Source: YCharts)

On the other hand, a closer look at BTG's technical price chart (Figure-5) reveals the potential upside in share price. Based on an extension of the trend lines connecting the resistance and support levels, we can say that BTG's share price has a target range between $3 and $3.5.

Figure-5 (Source: Finviz)

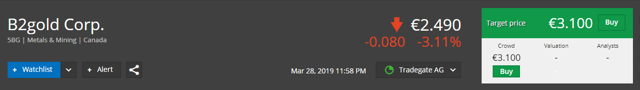

This expectation is confirmed by the recommendation of analysts (Figure-6), which indicates that the stock is a 'buy' with a target price of $3.48 (?,?3.1 x $1.12/?,?1).

Figure-6 (Source: Sharewise)

Conclusion

In the preceding discussion, we have seen that BTG's FY 2018 was stronger than FY 2017 as the company significantly improved its production and lowered its costs. The increase in production was principally attributable to the first full year of output from the FM. During 2019, BTG expects higher production Y/Y, and this expectation would be supported by the planned expansion of the Fekola mill. Even though the AISC during FY 2019 is expected to be higher than FY 2018, the recent improvement in gold prices would offset the impact of higher costs.

Finally, a technical price chart indicates that the stock is a buy at current levels and promises suitable upside in the medium term. This indication is reaffirmed by the recommendation of analysts who have called for a target price of ~$3.48.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Aitezaz Khan and get email alerts