Bad Apple

In light of Trump's tariff threat on Apple, Michael Ballanger of GGM Advisory Inc. shares his thoughts. Ballanger also takes a look at gold and silver and shares one of his favorite junior developers.

In light of Trump's tariff threat on Apple, Michael Ballanger of GGM Advisory Inc. shares his thoughts. Ballanger also takes a look at gold and silver and shares one of his favorite junior developers.

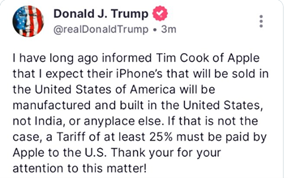

One of the most dynamic rallies in stock market history came to an abrupt end last week in exactly the same way it started words from the mouth of U.S. President Donald J. Trump.

Stocks were advancing nicely in May and looked very much like they had overcome the lingering shadow of tariffs, DOGE, the Middle East, and Ukraine as the S&P 500 came within 2.91% of its record high of 6,147.43 registered back on February 19.

Stocks were advancing nicely in May and looked very much like they had overcome the lingering shadow of tariffs, DOGE, the Middle East, and Ukraine as the S&P 500 came within 2.91% of its record high of 6,147.43 registered back on February 19.

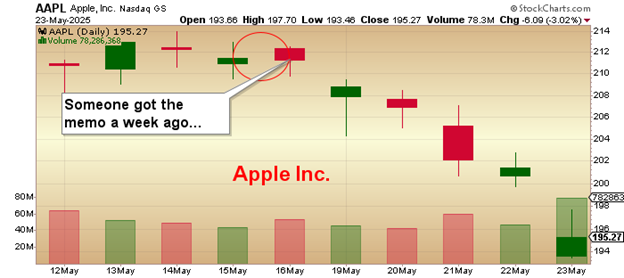

The QQQ:US the retail trader's proxy for the technology sector and "Mag Seven" leadership came within 3.4% of its high of $540.81, also registered in the February advance. Alas, on Thursday, the U.S. President uttered the words shown above, sending a large and very threatening cannonball across the bows of the USS Apple (Apple Inc. (AAPL:NASDAQ)), sending stocks careening lower as the "tariff tantrums" returned with a vengeance.

One of the gurus of the fintwit world, Sven Hendrick, tweeted out a beauty: "I am old enough to remember when there was free market capitalism." in a damning response to the White House edict.

I empathize with the Northman Trader because I, too, recall the days when none of us could even tell you the name of the Federal Reserve Chairman, let alone have a sitting president make remarks about a publicly-traded company.

However, here in 2025, the stock market's behavior has become a litmus test of sorts for economic performance and managerial excellence. It matters not how one measures the standard of living of the average citizen; all that matters is that the "Q's" are hitting new highs and that Nvidia Corp. (NVDA:NASDAQ) "beats their number."

Political leadership is not gauged by the effectiveness of legislation, budget balancing, or the ability to secure peace at home and abroad; it is gauged by the faces of the CNBC anchors, where smiles mean the bull has arrived and frowns mourn the bear.

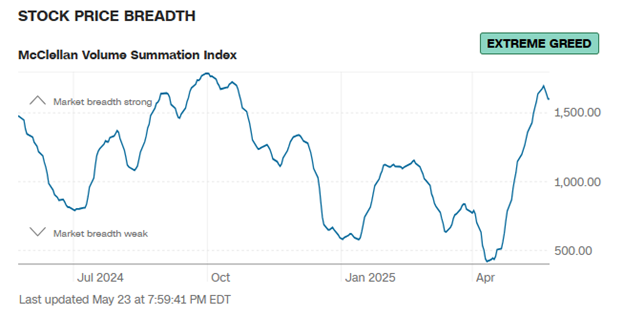

With the CNN Greed-Fear index registering a giddy 64 as of the Friday bell, the U.S. market for common stocks is still heartily overbought and in fact overrun with the one emotion that signals trend reversals the terminus of the advance and that emotion is .

In fact, in looking at the McLelland Summation index (which measures market momentum), it is flashing not just greed but and just as we saw these indicators flash right at the April 7 low, they are now flashing as stocks have been well ensconced in a momentum-driven rally with "PILE ON" as the operative order.

As much as I was patting myself squarely on the back for calling the lows back in early April, I replaced my hedges and shorts far too early, thinking erroneously that the Trump Team cared not a whit about stocks and that Main Street was the chosen demographic to be coddled and coaxed and catered to as opposed to the fat cats on Wall Street.

However, all it took was an implosion in the credit markets that shook the hedge fund community to its very foundation to prompt President Trump to yank his tariff war, giving the stock and bond markets a wonderful opportunity to rebound. Such a rebound has enabled the chosen few on the inside of Trump's brain to sell that which they had forgotten to sell back in March, thus getting very liquid (and very short Apple) before he applied the proverbial slicer to Apple Inc. (AAPL:NASDAQ).

Notwithstanding that the markets were sorely overbought leading up the AAPL slice-and-dice job, it never ceases to amaze me how engrained is the belief by this new generation of traders and investors that no matter what is ailing the domestic economy, stocks will always be rescued by either the Fed, the Treasury, or Wall Street. Seasoned pro traders with luminous track records have been net sellers of this rally all the way up, while the fuzzy-cheeked kiddies with their first $1,000 account have been big buyers of every dip that has appeared in the past decade.

It has been such a dominating recent performance by this retail throng of wild-eyed maniacal kiddie traders that the last leg of the advance of the April lows had to be short-covering by the wailing and whining professionals investors.

Alas, despite the declines on Thursday and Friday, there is strong support just beneath the weekly closing levels as there is a convergence zone of the 20-day, the 100-day, and 200-day moving averages below which there is the 50-day m.a. all serving as a floor for stock prices, at least in the near term.

Mind you, if they get taken out, then my longstanding thesis of a secular top having been formed last February finds at the very least the possibility of rebirth as markets revisit the April 7 lows.

For now, I will refrain from adding to my hedges until there is compelling evidence that this magical "stick save" advance, completely and totally contrived by the White House in order to rescue the imploding bond market (which, by the way, is in full force in Japan), has reversed. The convergence zone is at around $573 for the SPY:US, with the next level of support being the 50-dma at $566.60.

One thing is for certain: the technical picture is anything but a classic B-wave advance. The prototype "sucker rally" as Joe Granville used to call it was not what I just watched since April 7. It contained the immortal Zweig Breadth Thrust ("ZBT"), a technical indicator used in the stock market to identify a rapid shift in market participation, indicating potential bullish momentum.

It measures the percentage of advancing stocks against the total number of stocks traded, and a ZBT signal occurs when this percentage rises rapidly from below 40% to above 61.5% within a 10-day period. These types of advances in breadth are not normally associated with bear market rallies because breadth is usually eroding during sucker rallies but since the April lows, there has been nothing even vaguely close to such erosion.

Could it be that the Papa Bear I have been expecting needed to lure in the maximum number of unsuspecting hors d'oeuvres before beginning his feast?

Possibly so, but I need more evidence before I classify that stellar "no more tariffs" rally as anything close to "sucker."

Gold (and Silver)

I consider the April top above $3,500 as an intermediate top for June gold futures and the $317.63 level as the same for the GLD:US.

The only occurrence that will alter my view is a two-day close above $3,509.90 basis June futures and a close above $317.63 for the GLD:US.

In the meantime, I have been completely shut out of the rally off the April lows because not only have stocks enjoyed a 25% rebound, but gold is now 14% off the April 7 lows, with the HUI:US now up 28% off the April lows.

However, the initial rebound off the "Liberation Day" lows was nearly 33% by mid-April, with the second advance falling a tad short in mid-May. If this advance stalls below the mid-May peak, then it spells "bearish divergence" with three descending peaks in the gold miners to coincide with a possible triple-top in gold itself.

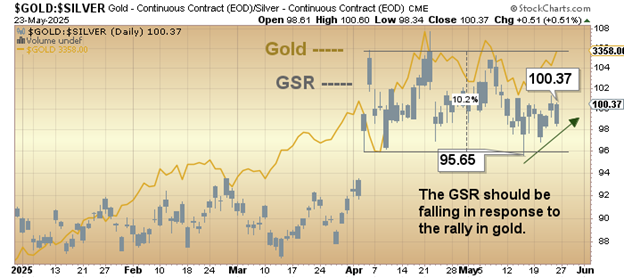

Also of concern to me is the action in silver. If April 7 marked the resumption of the golden bull, silver should be outperforming gold, as should the miners. Thus far, the gold-to-silver ratio ("GSR") is rising, and that is a non-confirming divergence to conditions resembling a bona fide gold bull.

The initial rally in mid-April in gold saw the GSR hit 107, and while it did experience a decent drop by mid-May, this week's gold advance was accompanied by a rising GSR, and that is called a "negative divergence" and is bearish.

All my mining industry buddies are laughing and giggling and booing and hissing my cautious view but they forget that while I am near-term cautious, I have not sold one share of my favorite junior developer, Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB).

Getchell announced a $3 million funding with a $1.2 million lead order from none other than Myrmikan Capital's Dan Oliver.

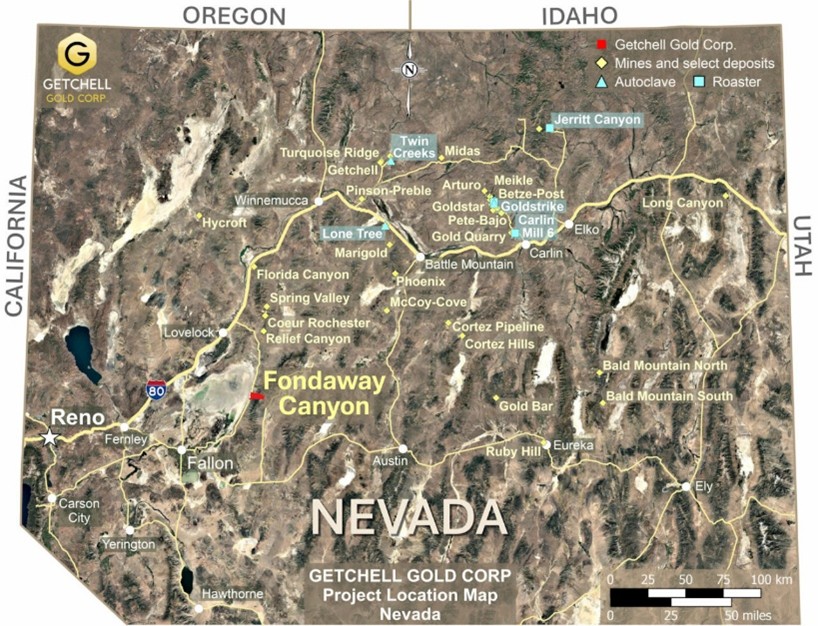

This marks the first showing of institutional support for GTCH/GGLDF since 2019, when the company first entered into an earn-in arrangement on their now 100%-owned Fondaway Canyon project in Nevada.

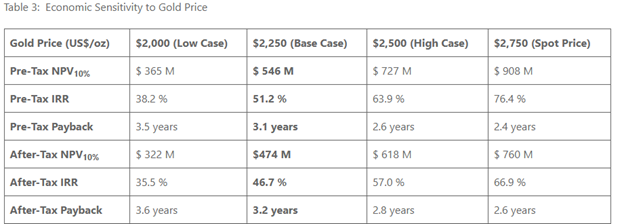

The offering is massively oversubscribed thanks largely to Myrmikan and I, for one, heartily applaud the endorsement of Mr. Oliver because I have been pulling my hair out by the roots trying in vain to understand why the institutional investors ignored the exceedingly "robust" PEA which came in at a $546 million pre-tax net present value discounted at 10% ("NPV10%") and a 51.2% pre-tax internal rate of return ("IRR"), $474 million after-tax NPV10% and a 46.7% after-tax IRR all using at a gold price of $2,250/troy ounce ("oz").

The offering is massively oversubscribed thanks largely to Myrmikan and I, for one, heartily applaud the endorsement of Mr. Oliver because I have been pulling my hair out by the roots trying in vain to understand why the institutional investors ignored the exceedingly "robust" PEA which came in at a $546 million pre-tax net present value discounted at 10% ("NPV10%") and a 51.2% pre-tax internal rate of return ("IRR"), $474 million after-tax NPV10% and a 46.7% after-tax IRR all using at a gold price of $2,250/troy ounce ("oz").

With initial capital costs estimated at $226.5 million (including a 20% contingency), and with a short pre-tax payback of 3.1 years, I was still awake at three in the morning, fussing and fuming over what on this earth I could be missing.

Well, now I know that I have missed nothing and that the dozens of companies out there with analyst coverage that have IRR's a fraction of Getchell's and CAPEX numbers ten times Getchell's are simply ill-fated oversights.

So, simply because I am near-term cautious on chasing gold, which I continue to hold albeit hedged in a very minor way, does not mean that I have abandoned my longer-range forecast of $10,000 per ounce plus. Remember, when I launched the GGMA back in 2020, I did an analysis of what it would take to collateralize the U.S. national debt (ex-entitlements), then US$24 trillion with 10% coverage by gold. Here is what I wrote:

"Using the above spreadsheet as an illustration, take the total U.S. (debt at $24 trillion) and divide by the 286,802,112 ounces currently held in the U.S. treasury, and you arrive at $83,680 per ounce. It would take that gold price level to provide total coverage of total U.S. debt (a gold-to-debt-ratio" of 1:1). If the standard banking benchmark for real estate loans is a minimum of 10%, then a gold price of $8,368 provides 10% coverage of total debt. It is not exactly a gold "standard", but it is certainly a debt "governor" and it avoids the need for cataclysmic debt reduction by way of asset sales or stifling tax rates and fiscal extremism."

Now, consider this: the national debt of the U.S. of A. is now nearly $37 trillion, up 54% in five short years. Using the same formula, 10% coverage of the national debt has grown to require a gold price of $12,900 per troy ounce and that is before entitlements which means that it has to increase by 3.84 times the current price of $3,357 to serve as "adequate collateral."

So, in summary, I am cautious on gold over the near term because everyone and their shoeshine boy have jumped on the golden bandwagon this year, and that is not the ideal set-up for speculating in gold futures or call options on Newmont Corp. (NEM:NYSE).

I prefer the junior developers with huge upside sensitivity to gold like Getchell whose pre-tax NPV10% grows from US$546 at $2,250 gold million to US$908 million at $2,750 gold.

At today's prices, one has to wonder whether a billion dollar NPV might attract more than a few interested majors.

In my perfect little world, the month of June lives up to its reputation as a seasonally weak month for the metals, and I get my much-needed correction to sub-$3k gold.

As it happens, silver declines but at a far slower pace and amplitude, taking the GSR down below 90. By mid-summer, with speculative fervor dampened by seasonality and sideways price action, the metals turn led by silver and the HUI:US marking the resumption of the bull market and the phase of the bull market that is historically the most manic phase where line-ups around bullion dealers and the penny dreadfuls are the talk of the town at country clubs, bars, and internet cafes.

As I said, in my "perfect little world". . .

Buckle Up

This week, I will be eager to see if the major averages can shrug off the "Sell AAPL!" call by the President and resume their march to new highs and a possible double top.

I will also be closely monitoring the action in the copper market, where it sported a nearly 4% move on the day. As much as we all love gold, the one metal with the more powerful fundamental case is copper. The expansion and modernization of electrical grids the world over are underway, and that demands more and more copper. I expect news from Fitzroy Minerals Inc.'s (FTZ:TSX.V; FTZFF:OTCQB) Buen Retiro Copper Project as well as updates on the big new copper-molybdenum discovery at Caballos.

As long as we can avoid tariffs on the other members of the MAG SEVEN, things should remains calm but with DJT in the White House and Elon Musk's "X" as the message delivery system, that would be an extremely high expectation at any time. Buckle up.

Sign up for our FREE newsletter

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: None. My company has purchased stocks mentioned in this article for my management clients: None. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involve