Bank Options Pop as Financial Shares Slump

The banking sector is taking a hit after this morning's yield curve inversion

The banking sector is taking a hit after this morning's yield curve inversion

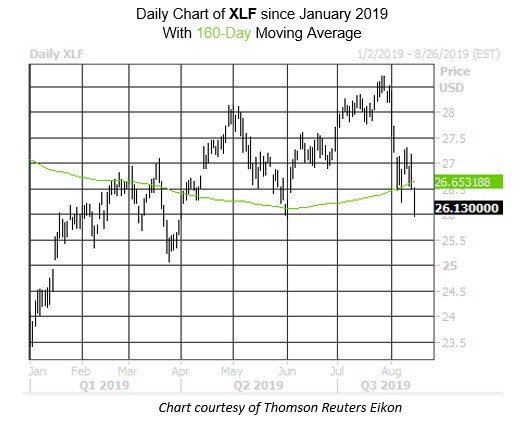

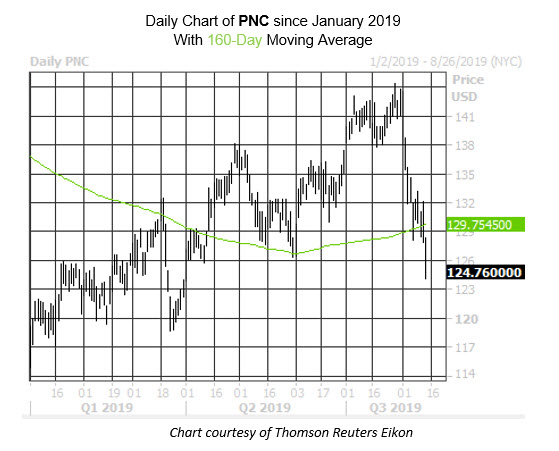

Wall Street has been rocked today by news of an inverted yield curve. The banking sector is getting hit the hardest, as evidenced in the price action in the Financial Select Sector SPDR Fund (XLF), which is down 3.2% at $26.13, breaching support at its 160-day moving average, which contained a pullback in late May. Bank stock PNC Financial Services Group Inc (NYSE:PNC) is also staring at stiff losses, falling below a key trendline of its own.

More broadly, the technical picture for banks has already been dour, with the sector currently perched near the bottom of an internal scorecard compiled by Schaeffer's Senior Quantitative Rocky White. Heading into today, only 8% of the 45 stocks we track under the "banks" umbrella were above their 80-day moving average, and less than half of the covering analysts maintained a "buy" or better opinion, down from a year ago.

It looks like some options traders today are betting on more headwinds for the banking sector, too. XLF has seen around 143,000 put options change hands so far -- double the average intraday put volume and five times the number of calls traded. Most active is the August 26 put, where it's possible new positions are being purchased.

However, today's bearish trend is nothing new for the financial fund. Over the past two weeks, traders on the International Securities Exchange (ISE), Cboe Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX) have bought to open 2.07 XLF puts for every call.

Drilling down on PNC, the bank stock is down 2.1% to trade at $128.03. This has taken the security below its 160-day moving average, which has cushioned the shares since mid-April.

While PNC options volume pares in comparison to XLF trading today, puts are running at a quicker-than-usual clip, and are outpacing calls by a nearly 3-to-1 ratio. Speculators may be liquidating their now in-the-money September 125 puts -- the most active PNC option -- while others may be buying to open the November 100 put. PNC stock hasn't traded in double-digit territory since November 2016, so some of this put buying could be protective.