Baozun: Making A Fortune In The Gold Rush

Baozun will share the fast growth of China's e-commerce market as the leading service and technology provider.

Baozun's past growth numbers and future outlook are both strong.

Baozun's valuation is relatively cheap compared to its benchmark in the States.

Baozun's (NASDAQ:BZUN) share price is largely undervalued and presents a good entry opportunity for investors.

Baozun: The (Biggest) Beneficiary of China's E-Commerce Growth

Believe it or not, China is poised to become the world's top retail market in 2019, displacing the US. According to eMarketer, e-commerce is a major driver of China's retail economy, with sales growing more than 30% in 2019 to reach $1.989 trillion. That means 35.3% of China's retail sales occur online, by far the highest rate in the world.

When we talk about China's e-commerce market, people typically end up thinking about the big names in their heads such as Alibaba (NYSE:BABA), JD.com (NASDAQ:JD). That's understandable, as BABA and JD together take about 75% of China's e-commerce market. But when it comes to investing in the market, we would suggest Baozun as a better target.

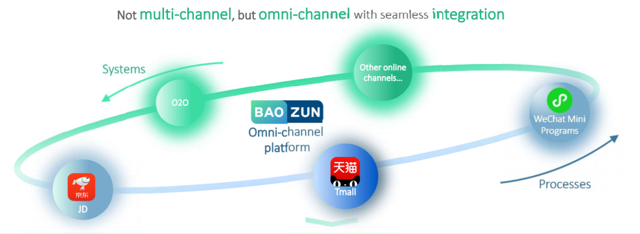

BZUN provides cutting-edge omni-channel solutions, integrated retail operating support system, big data-driven analytics, and highly targeted digital marketing services to their brand partners to make better business decisions and improve operating efficiency. The company is by far the industry leader in this market, with hardly any competition from outside. BABA was once considered a threat, but it now integrates Baozun's services into its Tmall and Taobao marketplaces to help vendors quickly set up shops. In fact, not just BABA, other major e-commerce companies in China also cooperate with BZUN:

Source: BZUN's Q1 Presentation

Shining Growth Numbers With Cheap Valuation

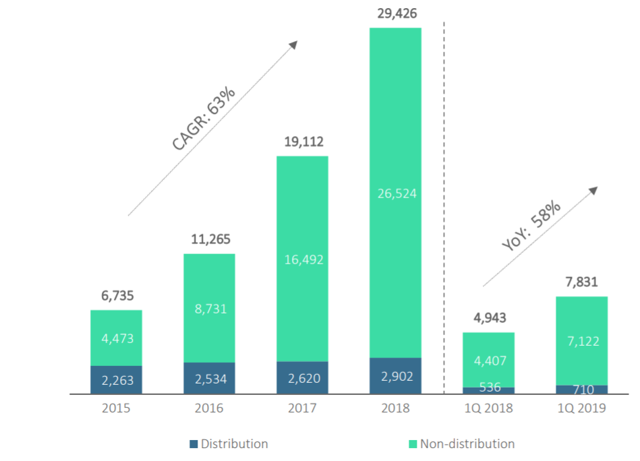

Ever since it went public, BZUN has been delivering shining growth results. One of the major metrics we look at is the GMV (Gross Merchandise Volume, or the value of everything that is sold) through the platform. BZUN's GMV has been growing at CAGR of 63% in the past few years. Even in the slowing economy, BZUN delivered 58% YoY growth of GMV in 2019 Q1:

Source: BZUN's GMV, 2019 Q1 ER

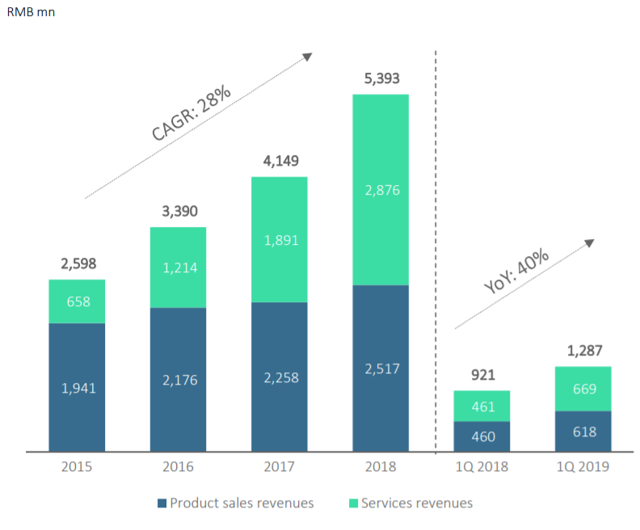

In Q1 2019, BZUN's total net revenues grew by 39.7% YoY to RMB1,286.8M, while services revenue grew by 45% YoY to RMB669.2M. Over the years, we have seen nearly 30% CAGR in net revenue growth:

Source: BZUN's Net Revenue, 2019 Q1 ER

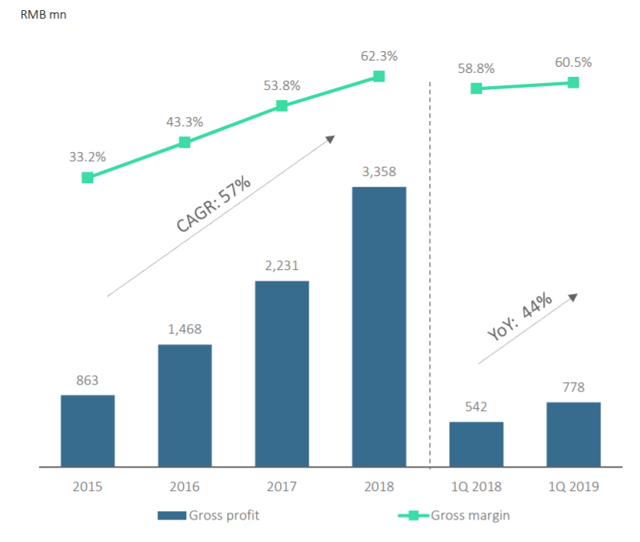

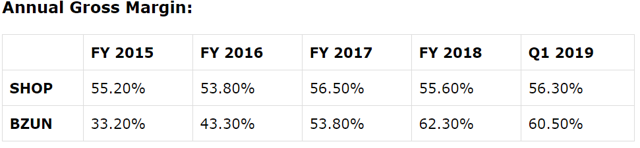

More importantly, we have witnessed BZUN's profit margin improvement along with the revenue growth:

Source: BZUN's Profit Margin, 2019 Q1 ER

A simple comparison with BZUN's benchmarking company in the U.S., Shopify (NYSE: SHOP), shows the improvement and achievement of BZUN along the way:

Source: Investing Hobo

The improvement of BZUN's profitability comes from their strategy shift, from a "distribution" model, where it takes possession of merchants' products and helps them fulfill orders, to a "non-distribution" one, where vendors sell and ship their products directly to customers.

This strategy, along with its robust revenue growth, helped BZUN stay consistently profitable. Its adjusted net income rose 30% annually in 2018 as its reported net income increased 29%. Moreover, analysts expect BZUN's top- and bottom-line growth to accelerate with 34% revenue growth and 67% earnings growth this year - which are stellar growth rates for a stock which trades at just 25 times forward earnings.

BZUN will release Q2 earnings on Aug 11th. For Q2 outlook, we are quite optimistic for BZUN's numbers. Judging from the sales numbers from the "6.18" shopping festival, China's Q2 e-commerce market will deliver a pretty result overall:

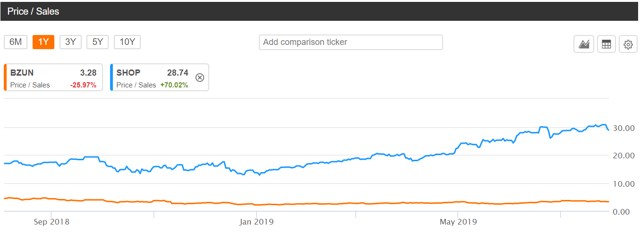

JD.com (NASDAQ: JD) saw 201.5 billion yuan ($31.53 billion) worth of orders to close the campaign, a year-on-year increase of 26.57 percent; Pinduoduo (NASDAQ: PDD), reported its order volume surpassed 1.1 billion during this year's spree, with the GMV surging 300 percent from last year; Suning said its order volume jumped by 133 percent year-on-year during June 1 to 18; Juhuasuan, Alibaba's group buying branch which serves as an entrance to online retail platform Tmall, recorded 86 percent growth in transactions year-on-year;When it comes to valuation, a natural comparison is with SHOP, who has recorded tremendous upside return YTD:

Source: Google Finance

So apparently, the market buys the business model and the potential of (even U.S.) e-commerce. With SHOP trading at nearly 30x price/sales and BZUN at only 3.3x, we think BZUN is largely undervalued:

Source: Seeking Alpha

The potential reason for the mis-matching in valuation of the two may include, which also represents the risk factors of our long recommendation:

Concern of all China related risk factors, including trade war, currency, economy slowdown, regulation, etc. We don't think this is a factor that will reduce BZUN's valuation by so much. Most macro outlook we have seen so far put China's potential growth ahead of the U.S. The concern that BZUN will lose to SHOP once the latter decides to enter the big market with huge potential. We wouldn't worry too much about that, at least for now. The governance issue in China still sets a high bar for international players to enter (not necessarily a good thing in the long run, but good for BZUN at current stage), take Facebook and Google for example.Conclusion

Overall we feel BZUN is largely undervalued. The future growth of China's e-commerce sector will boost BZUN's financials and its share price as well.

Disclosure: I am/we are long BZUN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Aiden Wang and get email alerts