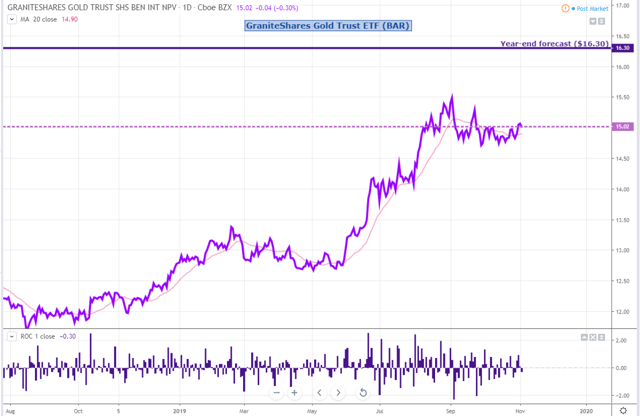

BAR Weekly: Ain't Worried About The Crowded Spec Positioning In Gold

BAR has remained resilient since the Fed pushed the "easing pause" button on October 30.

This is principally because the market was not convinced that this rate cut would be the last. Our "buy on the dips" strategy was therefore not deployed.

Although we contend that gold's spec positioning looks stretched on the long side, there are other offsetting buying forces in the gold market, which should push BAR higher.

We therefore maintain our bullish outlook for BAR, having a year-end target at $16.30 per share.

Thesis

Welcome to Orchid's Gold Weekly report. We discuss gold prices through the lenses of the GraniteShares Gold Trust ETF (BAR).

BAR has picked up in recent days, boosting our conviction that the sell-off of 3% in September was temporary.

Contrary to our initial expectations, the hawkish surprise from the Fed (by signalling that the October rate cut was likely to be the last in this easing cycle) has not pushed BAR lower. This is mainly because the market is not convinced that this rate cut would be the last. As a result, we did not have a chance to implement our "buy on the dips" strategy, which we suggested in our previous weekly note.

Although we contend that gold's spec positioning looks stretched on the long side (removing a buying force from the market while potential adding a selling force to the market), we expect gold spot prices to remain resilient thanks to other offsetting buying forces stemming from ETF investors, institutions, and central banks given the fragile macro backdrop.

We therefore maintain our year-end target of $16.30 per share for BAR.

Source: Trading View, Orchid Research

About BAR

BAR is directly impacted by the vagaries of gold spot prices because the Funds physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.1749%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.1749% while IAU and GLD have an expense ratio of 0.25% and 0.40%, respectively.

Macro

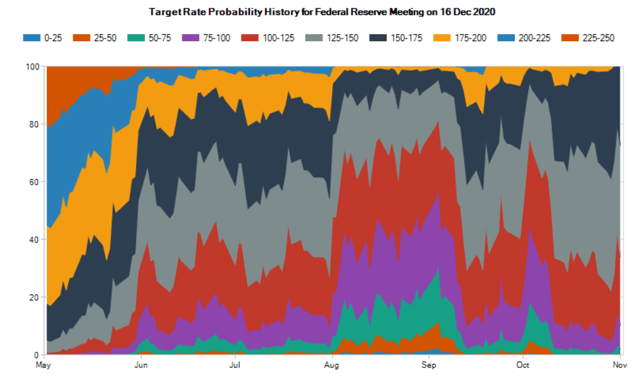

On October 30, the Fed delivered a 25-bp cut in the target for the federal funds rate, which is now at 1.50%-1.75%, in line with market expectations.

However, Fed Chair Powell signaled a pause in easing after these third consecutive rate cuts, sending some hawkish vibrations to the financial markets.

Interestingly, the market appears to have overlooked the hawkish forward guidance, with the Fed funds futures continuing to price in a rate of 1.25% by the end of 2020.

Source: CME

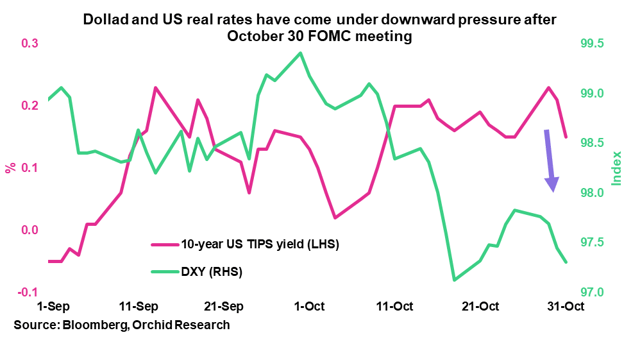

As a result, the dollar and US real rates have weakened (instead of strengthened), which has been conducive to stronger monetary demand for gold.

Source: Bloomberg, Orchid Research

We agree with the current market pricing in the sense in which the Fed will need to act more aggressively to tackle the slowdown in economic growth. This hawkish forward guidance makes financial conditions vulnerable to an abrupt tightening, which could in turn accelerate the deterioration in US economic conditions.

In all likelihood, this fragile macro environment is positive for gold, which should therefore lend support to BAR.

For more details about our Fed outlook, please refer to our recent note, published on November 5, with a focus on GLDM.

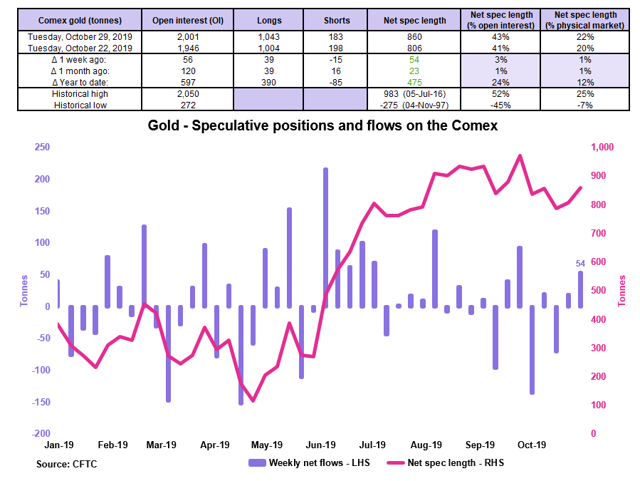

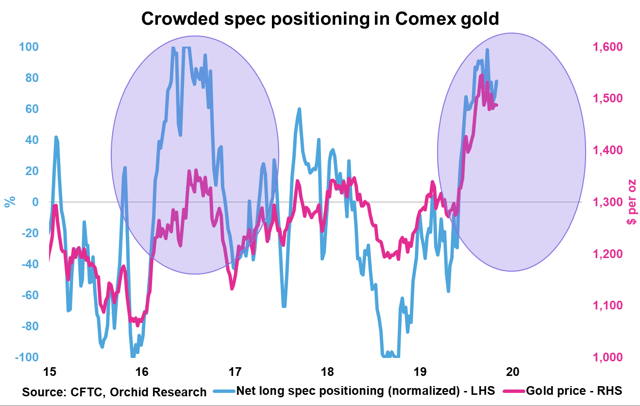

Speculative positioning

Source: CFTC, Orchid Research

Speculators lifted their net long position in Comex gold by 54 tonnes over October 22-29, representing around 3% of OI.

The net spec length in Comex gold has increased noticeably by 475 tonnes since the start of the year, the equivalent of 24% of OI or 12% of annual physical consumption.

Across the precious metals complex, gold's spec positioning is the most stretched on the long side when we analyze the current net spec length relative to its historical high in terms of OI.

We illustrate the crowdedness of the spec positioning in Comex gold in the chart below, which shows the net long speculative position in Comex gold held by non-commercials, which is "min-max" normalized using a 5-year trailing range. This normalized net spec length can move from -100% (specs have never been this short over the past five years) to +100% (specs have never been this long over the past five years).

Source: CFTC, Orchid Research

As the chart shows, the net spec length is at +80%, which could signal a possible top in Comex gold spot prices. All else equal, this chart makes us cautious on our outlook for gold.

Implications for BAR: In all likelihood, there is limited room for additional speculative buying in favor of Comex gold, which could cap the upside for gold spot prices and therefore BAR.

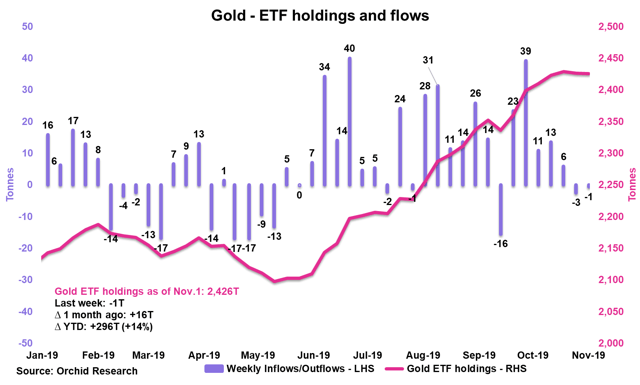

Investment positioning

Source: Orchid Research

ETF investors were on the sidelines last week (October 25-November 1), unwilling to build long exposure to the yellow metal in the face of the raging bull market in equities. The S&P 500 (SPY) hit an all-time high last Friday, prompting some investors to believe that the risk-on mood will continue for longer.

That said, we believe that the low VIX environment suggests renewed investor complacency. Investors seem to be overlooking downside risks to the economic outlook, including the ongoing US-China trade dispute (despite a possible "cosmetic" US-China partial trade deal being signed by year-end), the de-anchoring of US inflation expectations, and the recession in the manufacturing sector.

We argue that investor fears over US (and global) growth will re-emerge sooner rather than later, which could in turn trigger a sharp sell-off in global equities like in December last year.

In this respect, we believe that gold ETF inflows are more likely than gold ETF outflows in the coming months.

Implications for BAR: The current macro fragility calls for caution, which should elicit some ETF inflows into gold in the months ahead. This is positive for the gold spot price and thus BAR.

Closing thoughts

Because the market has refused to take seriously the forward guidance delivered by the Fed at its latest meeting, the macro environment for gold has remained stable, which has prevented us from implementing our "buy on the dips" strategy, highlighted in our previous weekly note.

While we concur that gold's spec positioning looks stretched on the long side (removing a potential support to gold prices), we expect the yellow metal to remain resilient thanks to the presence of other buying forces stemming from ETF investors, institutions, and central banks given the fragile macro backdrop and lingering uncertainty.

We therefore maintain our year-end target of $16.30 per share for BAR.

Did you like this?

Click the "Follow" button at the top of the article to receive notifications.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Orchid Research and get email alerts