Barrick Gold Is An Emerging Cash Cow

Q1 results illustrated how my long-term bullish thesis on Barrick is beginning to play out.

Debt paydown, gold price appreciation, and improving operational proficiency lead to credit rating upgrades, higher earnings, and an improved free cash flow to earnings ratio.

The company is finally moving past the Acacia and Pascua-Lama quagmires and is poised to pour its large and growing cash pile into growth and shareholder returns.

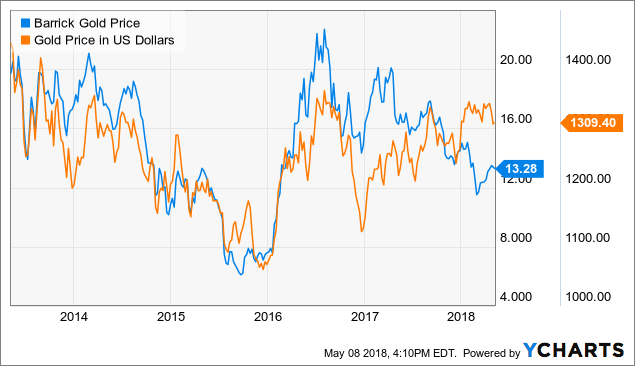

Barrick Gold's (ABX) Q1 results, while not sparkling, clearly illustrate how my high conviction long-term bullish thesis on the company is playing out. When I initiated my bullish thesis on ABX, it was trading in the single digits and its back was to the wall as its bloated debt burden and a crashing gold price put it under significant pressure. Management then took the courageous step of training their focus on cutting portfolio fat (i.e., non-core assets) and throwing everything they had into attacking the debt burden while simultaneously upgrading the company's core operations through investments in digitization and joint ventures. I was bullish on the company because I believed that their product - gold - would appreciate with time due to numerous macroeconomic and geopolitical factors and believed that their high-quality core assets were undervalued. Once management paid down debt and improved operational efficiency, the rising price of gold and strong production from high-quality core assets would turn Barrick into a cash cow.

Fast forward a few years to the present and we see that management's laser-like focus has borne tremendous fruit: Barrick remains one of the world's largest miners while also boasting a fortress balance sheet and one of the most efficient operations in the industry. Meanwhile, the share price has rode market sentiment waves up and down but stands considerably higher today at ~$13.5. More importantly, gold has consistently appreciated in recent years and Barrick is beginning to print a high volume of free cash flow each quarter.

ABX data by YCharts

This past quarter, a symbolic recognition of management's fiscal discipline in recent years was made by both primary credit rating agencies: both Standard and Poor's and Moody's upgraded ABX's credit rating. This positions the company well for accessing capital markets should it need for financing growth projects and helps insulate them from potential increased costs from rising interest rates.

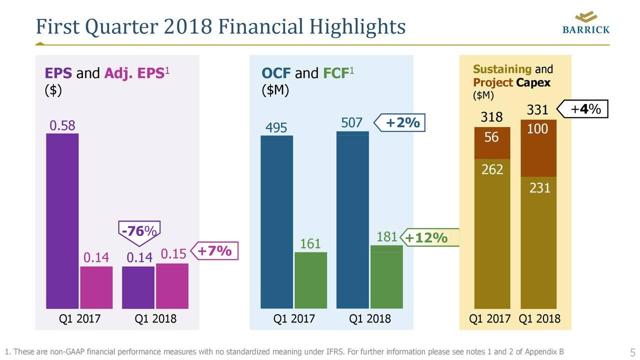

Furthermore, there were signs in the report that operations continue to get more efficient. Though CapEx was higher Y/Y, less money was spent on sustaining CapEx while growth-oriented project CapEx was up significantly. Furthermore, though gold production was down significantly Y/Y, adj. EPS and free cash flow were both up due to the rising price of gold (as my thesis predicted). Even more impressive was the free cash flow growth outpaced adj. EPS growth by five hundred basis points, indicating the decreased capital intensity of their operations and improved cash generation ability. These positive trends in CapEx and free cash flow should only improve moving forward as the drain from the Acacia Mining and Pascua-Lama quagmires should be over soon as per the company's announcement.

Progress on all of these fronts led management to make an important, long-awaited announcement signifying their arrival as a cash cow: no more capital would be shifted from income generation to debt repayment. While the company still has ambitious goals for paying down debt this year, they only plan to do so on terms that are friendly to shareholders and also are not desperate enough to reallocate capital from sales of productive assets to pay it off. From now on, management plans to reallocate all disposition funds either directly to shareholders or back into growth-oriented spending.

With free cash flow growing and a cash pile in excess of $2B, ABX is looking increasingly poised to either hike shareholder capital returns or significantly increase growth projects. My projection is that sometime over the next year, they will hike the quarterly dividend by 33% from 3 cents/share to 4 cents/share and/or initiate a buyback program (especially if the share price remains stuck in the low teens), given that gold is staying stubbornly above $1,300 an ounce despite a strengthening dollar, cooling tensions in Korea and acquisition targets remaining richly priced.

The challenges facing the company's continued progress as a cash cow are the threat of interest rates rising faster than inflation and cooling geopolitical tensions reducing international demand for gold. I don't believe either of these will bear significant long-term drag on gold because the Federal Reserve has already left wiggle room for inflation to move a little bit above their long-term target and the election year will put significant pressure on the Fed to not allow interest rates to rise too quickly. Furthermore, geopolitical concerns appear poised to resurface over the Iran-U.S. nuclear agreement, U.S. trade negotiations with China, Canada, Mexico, Japan, and the E.U., and what will likely be an interesting attempt to reach some sort of resolution to the Korean conflict. Meanwhile, central banks continue to inflate their fiat currencies and governments continue to run up massive deficits, both tailwinds for hard, traditional money commodities such as gold.

Investor Takeaway

The long-term bull thesis remains intact and on track, so Barrick Gold remains a high conviction buy for me and I recommend selling $15 one month Covered Calls to generate additional income from the shares while still leaving over 10% upside for short-term appreciation.

Disclosure: I am/we are long ABX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Samuel Smith and get email alerts