Barrick Gold: It's Time To Reload

Barrick Gold has been having a bit of a post-merger sell-off since the deal closed on January 1.

There are too many positives when it comes to the company, the most important being that the continued debt reduction will result in a further re-rating of the stock.

While we don't know Q4 financial figures yet, I think it's safe to assume that net debt declined even further.

The recent sell-off (post-merger completion) was expected, and I consider this a great opportunity to buy this still-discounted producer.

A few months ago, October 19, 2018, to be exact, I discussed Barrick Gold (GOLD) and the remarkable progress it had made on reducing debt, as well as how the merger with Randgold was creating the first real super company in the gold space.

As I stated in that article:

If one is bullish on gold, I don't see why you wouldn't want to own ABX. Although maybe wait until the stock cools down a bit as it has been charging higher over the last month.

The merger is complete, and the ticker has now changed to GOLD - as Barrick retained Randgold's apropos stock symbol - but the message is still the same: If one is bullish on the precious metal, I don't see why you wouldn't want to own GOLD.

Now there is the added benefit of a stock price that has cooled.

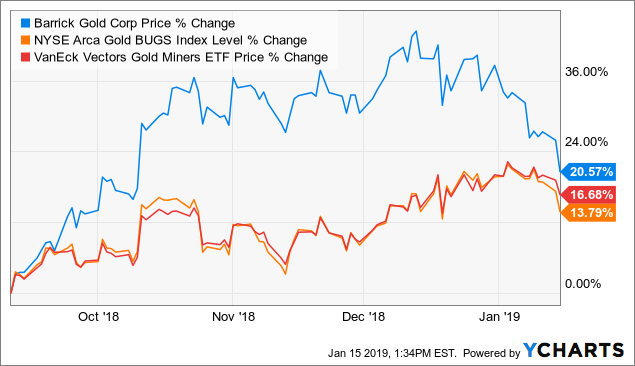

GOLD ran hard from its September 2018 lows and is still outperforming the sector during that time. However, since October of last year, it has been mostly trending sideways as the rest of the sector tries to catch up.

GOLD data by YCharts

GOLD data by YCharts

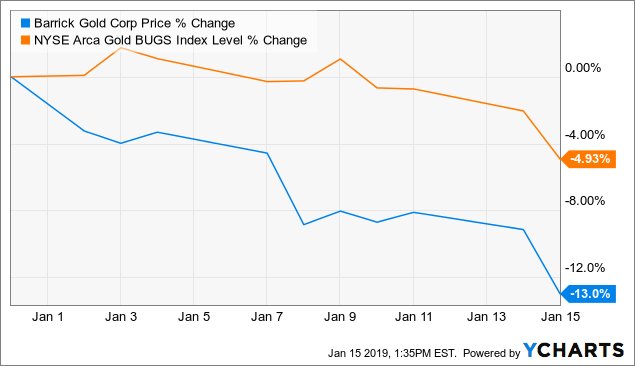

Since the start of the year, GOLD has declined by 13%, while the HUI Gold Index is down about 5 percent. This is no surprise, as you could be certain there was going to be selling once the merger was complete given the very strong run in both Barrick and Randgold stock prices leading up to the closing of this transaction.

GOLD data by YCharts

GOLD data by YCharts

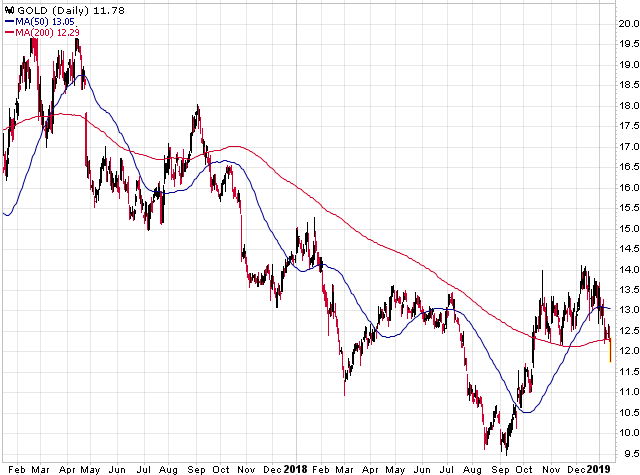

GOLD was finding support at the 200-day, which is a logical technical level that a low would form on the current chart. That level is now failing to hold, but I like the chances of a recovery, and the entry point is much better than it was months ago.

(Source: StockCharts.com)

It's time to take advantage of this sell-off, as I don't believe it will last. There are too many positives when it comes to GOLD:

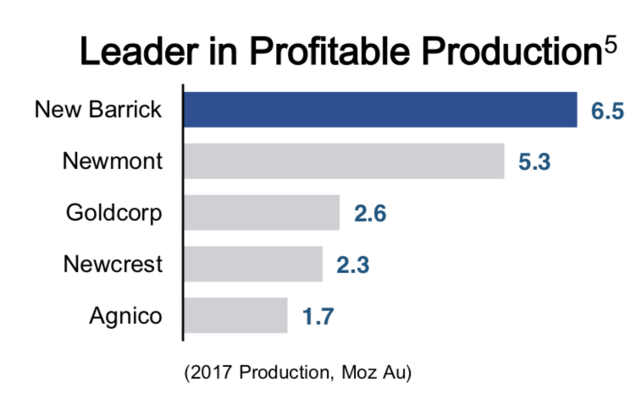

1) It is the largest gold producer in the world, at least for the time being given the GG/NEM news.

(Source: Barrick Gold)

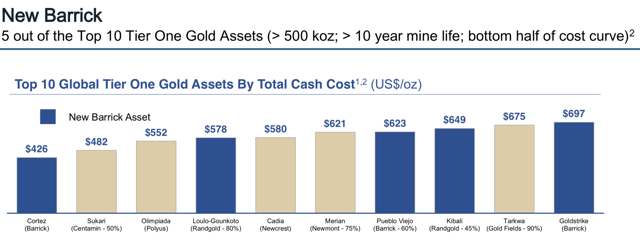

2) Barrick owns some of the best gold mines on the planet, including 5 out of the top 10 tier one gold assets.

(Source: Barrick Gold)

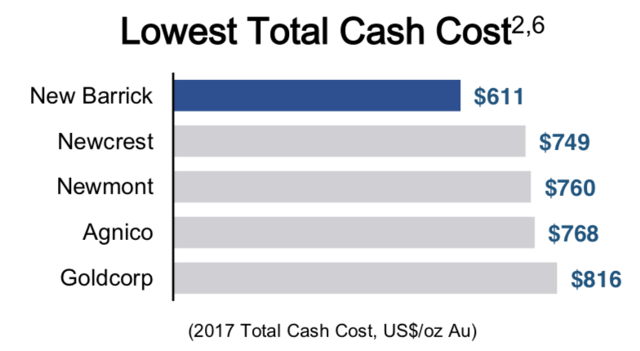

3) It's in the first quartile of the cash cost curve.

(Source: Barrick Gold)

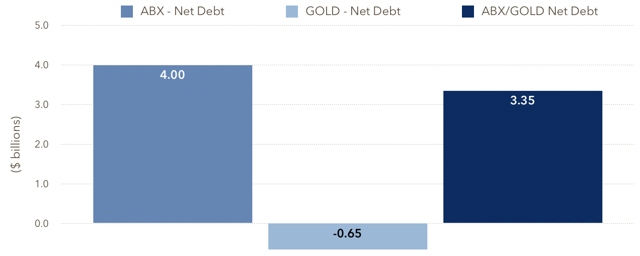

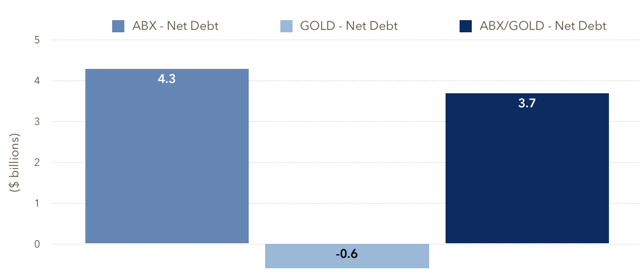

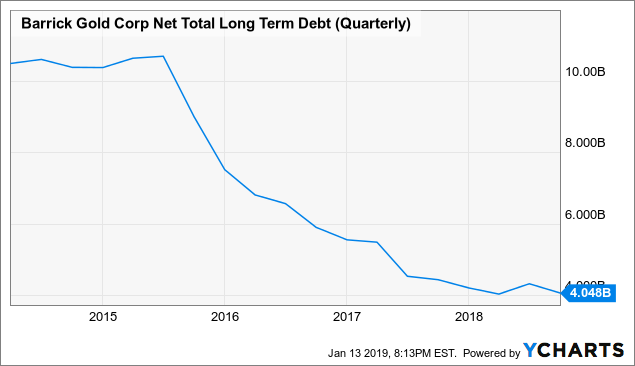

4) And most important is that the continued debt reduction will result in a further re-rating of the stock. At the end of Q3 2018, Barrick's net debt position was just over $4 billion. Back in 2013, its net debt was over $13 billion.

GOLD Net Total Long Term Debt (Quarterly) data by YCharts

GOLD Net Total Long Term Debt (Quarterly) data by YCharts

Randgold had $650 million of net cash at the end of the third quarter of last year, meaning net debt for the two combined was $3.35 billion as of Q3 2018. This is a $350 million improvement quarter over quarter compared to Q2 2018.

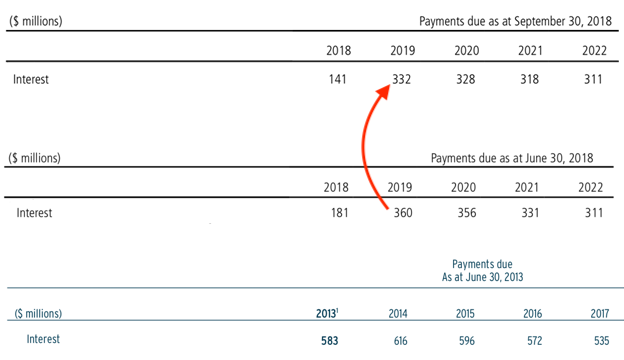

As of Q3 2018:

As of Q2 2018:

(Source: SomaBull)

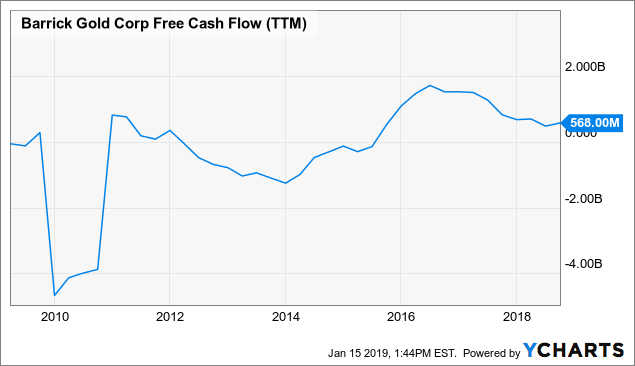

While we don't know the Q4 financial figures yet, I think it's safe to assume that net debt declined even further. This company is capable of generating over $1 billion (depending on capex needs) of free cash flow per year at current gold prices.

When net debt gets to the zero mark, which is likely just a few years away (maybe less if it sells some more assets), then this stock will command a premium in the market. Right now, it's still trading at a discount, but the re-rating is in progress.

This debt reduction kills two birds with one stone, as lower debt means lower interest payments. Back in 2013, Barrick was paying $600 million in interest per year. Now, it's around $300 million, and that annual burden continues to be reduced. In July 2018, the company repaid $629 million of the 4.4% notes due in 2021. This resulted in a savings of $28 million per year in interest, or just over $80 million over the four years left on the notes.

(Source: Barrick Gold)

Barrick struggled with a high debt load several years ago, but it was clear the company would be able to pay this down. Now debt isn't a concern, as it's being rapidly extinguished.

5) Barrick is now generating more free cash flow than it was when the gold price was far higher and the company owned many more assets. That just shows you how its focus has shifted from "growth at any cost" to "shedding non-core mines, paying down debt, and generating strong free cash flow."

GOLD Free Cash Flow (TTM) data by YCharts

GOLD Free Cash Flow (TTM) data by YCharts

In Summary

Barrick is the best gold company on the planet, as it owns a slew of world class assets, is one of the lowest-cost producers, debt/interest continue to decline and it is generating strong free cash flow even in today's low gold price environment. This is why the shares are being re-rated, and I expect that trend to continue.

The recent sell-off (post-merger) was expected, and I consider this a great opportunity to rebuy - or acquire more shares of - this still discounted producer.

Join The Gold Edge for Comprehensive Coverage of The Sector

Become a member of The Gold Edge and receive some of the most comprehensive and in-depth analysis of the gold sector.

***Prices for a monthly subscription will be going up at the end of January 2019. Join now to lock in a lower monthly subscription rate.***

Here are just some subscriber articles that have been posted just over the last few weeks:

Newmont Buys/Steals GoldcorpPretium Resources: Another Decline In Grade At BrucejackSector UpdateClick here to join The Gold Edge!

Disclosure: I am/we are long GOLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow SomaBull and get email alerts