Barrick Gold Reports Low Gold Production For The First Quarter 2018

Barrick Reports Preliminary First Quarter Production Results last week.

Gold Production for the first-quarter 2018 is disappointing even so it is still within guidance. Preliminary first-quarter production of 1.05 million ounces of gold, and 85 million pounds of copper.

I recommend accumulating the stock on any weakness, especially at or under $12.50.

Source: Barrick Gold

Investment Thesis

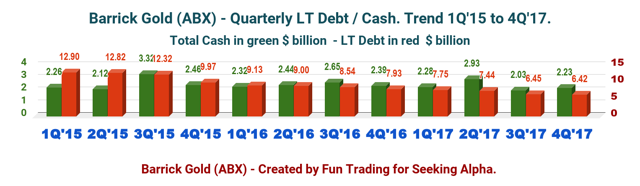

Barrick Gold (ABX) is one of the largest gold producers in the world. The stock price has suffered from a gold price slump and high debt on its balance sheet which reaches over $12.75 billion in 4Q'14, and despite an impressive comeback in 2016, the stock price has been sliding down since then.

However, while the company held one of the highest Debt/Equity ratio among its peers, Barrick Gold management was undoubtedly aware of its debt issue. The company has made significant strides to cut its long-term debt to $6.42 billion as of December 31, 2017, and expects to reduce it further to $5 billion at the end of this year.

This critical goal combined to a constant free cash flow encourages me to continue to support Barrick Gold as a long-term investor's opportunity and I recommend accumulating the stock on any weakness, especially at or under $12.50.

To reduce debt to $5 billion this year will be costly and challenging. Catherine P. Raw, CFO, said in the conference call:

We exceeded our 2017 debt repayments target achieving a total debt reduction of $1.51 billion. Our goal remains to reduce out total debt to around $5 billion by the end of this year. However, with our bonds now trading at between 119%, 125% premium to par, we will only take those actions where the risk/reward tradeoff makes sense.

ABX data by YCharts

ABX data by YCharts

Note: The debt reduction has been driven mainly by selling the company's non-core assets to optimize its balance sheet.

Kelvin Dushnisky - Barrick Gold CEO said in the conference call:

Our first priority was to maximize free cash flow. In 2017, our operations generated over $2 billion of operating cash flow and nearly $670 million of free cash flow. This allowed us to increase reinvestment in the future of our business during the year.

Friday news and commentary

Barrick Reports Preliminary First Quarter Production Results

Barrick Gold today announced the preliminary first-quarter production of 1.05 million ounces of gold, and 85 million pounds of copper, and preliminary first-quarter sales of 1.07 million ounces of gold, and 85 million pounds of copper. The average market price for gold in the first quarter was $1,329 per ounce, while the average market price for copper was $3.16 per pound.

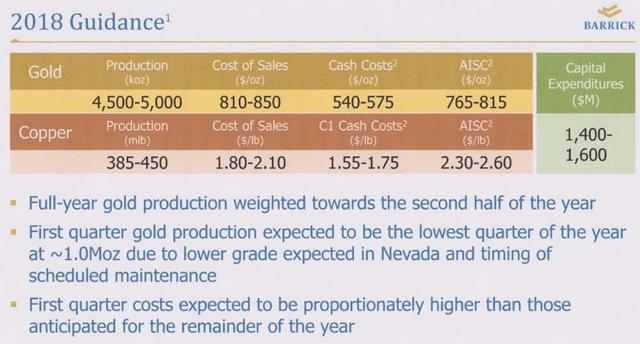

Courtesy: ABX presentation.

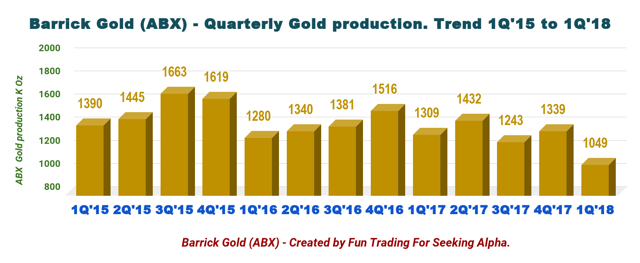

1 - Gold Production for the first-quarter 2018 is quite disappointing albeit it is still within guidance as indicated above in the last 4Q'18 presentation.

Production of gold is down 19.9% from a year ago, and down 21.6% sequentially. The gold output is a multi-year low as we can see in the chart below. I am not sure how the market will interpret the next results? Some sell off could be logically expected.

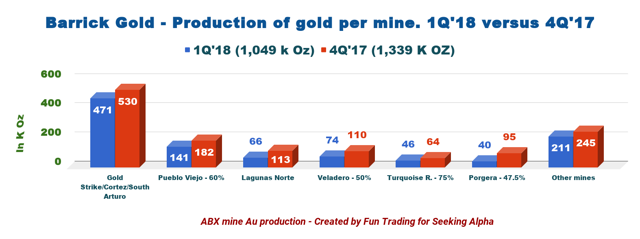

After comparing the preceding quarter to the first-quarter 2018, on a per mine basis, we can conclude that the gold production is significantly lower this quarter for every single mine. It is not particularly about one mine, but generalized to all producing mines as the graph below is showing.

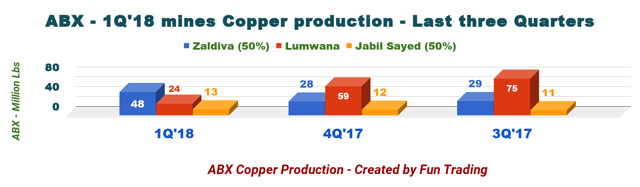

Copper production is different with Zaldivar doing well but Lumwana going down significantly.

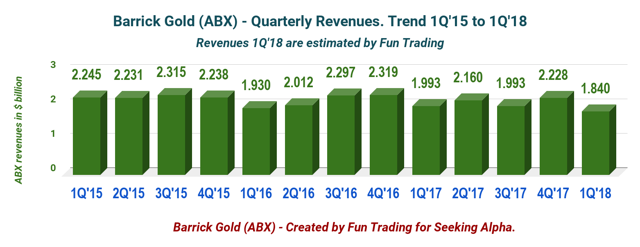

2 - Revenues estimated for the 1Q'18 will be approximately $1.840 billion in my opinion, which will be a record low revenues. The problem is that free cash flow will be meager to none in 1Q'18.

2 - Revenues estimated for the 1Q'18 will be approximately $1.840 billion in my opinion, which will be a record low revenues. The problem is that free cash flow will be meager to none in 1Q'18.

I estimate that revenues will be down 8% from a year ago approximately down 18% sequentially.

I estimate that revenues will be down 8% from a year ago approximately down 18% sequentially.

Technical analysis

ABX is forming a simple descending channel pattern which is bullish long-term if the line resistance can be successfully crossed (buy/sell flag) at around $13.15. In my opinion, it could be prudent to take some profit off the table above $13.25 due to the risk attached to the next results.

The next earnings results will not be stellar even if the company warned in February of weak 1Q'18 results; it is likely that ABX experiences some sell off at that time due to record low revenues and almost no free cash flow.

In the worst case scenario, I believe ABX may re-test $11.80 as first support (buy flag) and may whether bounce back later or continue its weakening pattern below $11, depending mostly on the future gold price which is quite stable now around $1,350 per ounce.

Important note: Do not forget to follow me on ABX and other gold stocks. Thank you for your support. More importantly, do not forget to click "like this article" in a sign of support and appreciation.

Disclosure: I am/we are long ABX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade the stock regularly as well.

Follow Fun Trading and get email alerts