Barrick Gold: Sell The Rally?

Barrick Gold has rallied 37% off of its lows in the past month.

While 2019 earnings estimates are an improvement from 2018 levels, they are still below 2017 levels.

The stock likely needs a pullback and higher low to allow its moving averages to play catch-up before moving higher.

Barrick Gold (ABX) has seen a powerful move off of the lows since September, which has accelerated after its acquisition of RandGold Resources (GOLD) just recently. Barrick has positioned itself as the world's largest gold miner which has got investors excited and bidding up the shares, but a breather for the stock seems needed after what's been a relentless rally over the past 30 trading days. While it's quite possible the stock has put in its bottom after its powerful push higher on strong volume, I have a hard time seeing the stock getting much past the $13.40 level without a pullback first. If I was trading the stock I would be taking partial profits into the $13.00 area, and looking to add back on a dip or into a new setup. The reward to risk at the $13.00 area is no longer anywhere near as favorable as it was a few weeks ago for those bottom-fishing the stock.

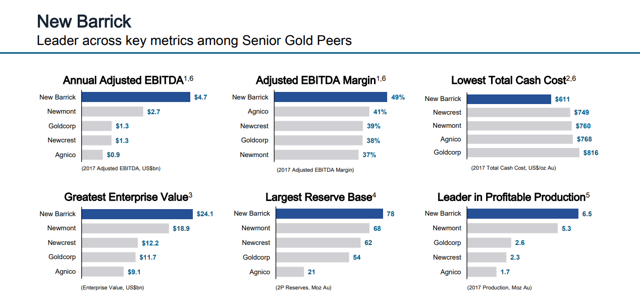

The RandGold Resources acquisition is clearly a plus for Barrick and the market is responding accordingly. The stock has been bid up on large volume since the news was released, and based on the stock's advance, this buying power looks to be accumulation. Based on the merger, not only will Barrick hold the title for the largest gold reserve base among the majors, and the largest annual production profile, it will also have the lowest total cash cost of its peers by a wide margin. This should be a positive for earnings growth and cash-flow over the long-run, and in the bigger picture this has likely helped to bottom out the stock at the $9.50 level.

(Source: Barrick Gold Presentation)

(Source: Barrick Gold Presentation)

It's certainly nice to see the world's largest gold miner enjoying a relentless run off the lows for those in the gold sector, but it's possible this run is getting a over-heated short-term. There is absolutely no debating that the acquisition of RandGold Resources at a very reasonable price was a good move for the company, but I believe that traders chasing the stock at the $13.00 area up here might be better served to be patient and look to purchase the stock on a dip if a higher low is put in.

The issue I see is that the stock has soared 37% in less than 25 trading days, and is now trading up into the top of its descending channel which has been in place for nearly two years now.

Not only has the stock gotten ahead of itself a little on the weekly chart as it runs into formidable resistance, it's also running hot above its key daily moving averages and this rally has not allowed them to play catch-up. The 50-day moving average for the stock currently sits at $10.70 which is 20% below current prices, and this moving average is only gaining ground at a pace of $0.04 per day. This means that even in a month's time, we would only expect the 50-day moving average to have moved up to the $11.70 level. I believe the most likely path for the stock would be for it to pull back from these levels where the 50-day moving average might end up catching the stock and make a higher low. A depiction of what this might look like is drawn in below the current chart.

The good news for investors in the stock with a longer-term horizon is that it's starting to look more likely that the lows are in at $9.50. The stock is back above its 40-week moving average, and two weekly closes above this level ($12.36) would show commitment to this move and suggest the worst is over for Barrick. The other piece of good news is that that the stock is clearly seeing a change of character as it's up six weeks in a row for the time being, and this is the first six-week winning streak the stock has been able to string together since Q2 2016. (assuming we close Friday above $12.47). This is a positive sign for the bulls if they are able to build on this rally, and it strengthens the prevalent thesis that the stock might have bottomed out at $9.50.

While there's no question that this merger is good news for Barrick and the company has now positioned itself as the top gold major with the technicals starting to turn around, the stock is getting a little ahead of itself short-term. I believe the most likely path for the stock is an 8% or larger pullback to at least the $11.70 to $12.00 level where it might find some support at the 50-day moving average. This is providing traders with an opportunity to lock in some profits and look to buy back the stock lower.

I am not long Barrick Gold currently, but if I was I would be using this opportunity to sell a portion of my position into the $13.00 area, and would be looking to buy back that portion of the position on a dip under the right conditions. This would place the position at zero risk for bottom-fishers who picked up the stock under $11.50 as they would net a 10% profit on their shares, and could use a break-even stop on the remainder of their shares under $11.50. While it's entirely possible the stock continues to run up here and push above the $13.00 level, I believe any further gains from here above $13.40 have a better shot of being retraced. For those with a longer-term view on Barrick, they are going to want to see the stock hold its 50-day moving average on any pullbacks. If the stock truly has bottomed, I see no reason for any pullbacks to exceed the 15% threshold as this would show it's back to its usual character. The 50-day moving average currently sits at $10.70, but should be at $11.00 by the end of this week.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Taylor Dart and get email alerts