Barrick unveils early results of plan to buy back $1.15bn of its own debt

Co-President Kelvin Dushnisky (right) took over as president of the company in August, as the world's largest gold producer restructured management to boost efficiencies. (Image: Screenshot of a Barrick video, via YouTube)

Canadian Barrick Gold (TSX, NYSE:ABX) announced Tuesday early results of its plan to buy back up to $1.15 billion of its own debt, as the Toronto-based miner continues to deleverage in the face of plunging bullion prices.

The offer, which expires on Dec. 30, follows on the heels of an earlier cash tender offer in October, which saw Barrick buying back $834 million of its own debt.

The company, which began the year with an over $13 billion debt, has vowed to reduce the hefty figure by $3 billion before the end of 2015.

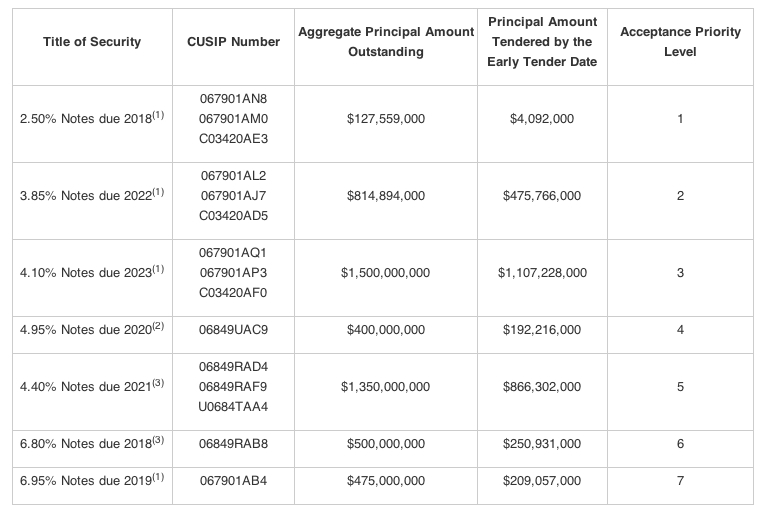

In a statement Tuesday, the miner outlined the aggregate principal amount of notes validly tendered and not validly withdrawn on the early tender date for each series of notes, as shown in the following table:

(1) Barrick is the applicable Offeror for the 2.50% Notes due 2018, the 3.85% Notes due 2022, the 4.10% Notes due 2023 and the 6.95% Notes due 2019.?EUR?(2) Barrick (PD) Australia Finance Pty Ltd is the applicable Offeror for the 4.95% Notes due 2020.?EUR?(3) Barrick North America Finance LLC is the applicable Offeror for the 4.40% Notes due 2021 and the 6.80% Notes due 2018.

Barrick noted that the total consideration or the tender offer consideration, as applicable, for each series per $1,000 principal amount of notes will be determined at 2:00 p.m., New York City time.

The giant gold miner, the world's largest by total output, has also been driving down its production costs and selling assets as it grapples with prices that have slid from $1,300 an ounce in January to near its recent bottom, at $1,062.20 on Tuesday morning.

The precious metal prices could fall even further, depending on the US Federal Reserve's decision on interest rates, which will come at the end of a two-day meeting starting today.